Energy platform editing advisor, energy economics expert Dr. Anas Al-Hajji, said that there are those who hope that oil prices will rise in the current year (2023) above the $100 level.

Al-Hajji explained, during an episode of the program “Energy humanitiesHe presented it on Twitter under the title “Oil Markets Outlook for 2023,” that a report published by “Substack” on energy market expectations for the current year said that the first half of the year is completely different from its second half.

Dr. Anas Al-Hajji added: “All expectations see that the oil market is weak during the first half of (2023), but there is great optimism in the second half, and there are many reasons for this view, some of which differ from one company to another, but there are general reasons.”

And he continued: “Among these general reasons, the global economic situation – especially in Europe – is very bad, because of everything that happened. Inflation is still a big problem, and the dollar is still high – despite the recent decline – compared to other currencies.”

He added, “The problem is that most developing countries – based on the advice of developed countries, the World Bank and the IMF – have lifted subsidies on fuel, and therefore fuel prices are still very high in these countries, due to the collapse of their currencies, and not because of the rise in oil prices.”

Falling oil prices and demand

The energy platform editorial advisor said that oil prices have witnessed a noticeable decline in recent times, but talking about this point must first start with talking about oil markets and the global demand for crude oil.

He explained that the first result of expectations is that the year 2023 may be the exact opposite of 2022, as it is expected to be a quiet year, compared to what happened in the past year. The first half of this year will be weak, while the second half will witness – according to expectations – an improvement in prices. oil and its demand.

And he continued: “The second result is that compared to 2022, the market will be quiet in 2023. With regard to the demand for oil, there are several bodies and companies that issue forecasts permanently, the most important of these organizations are the International Energy Agency, OPEC, large banks, and large consulting houses.”

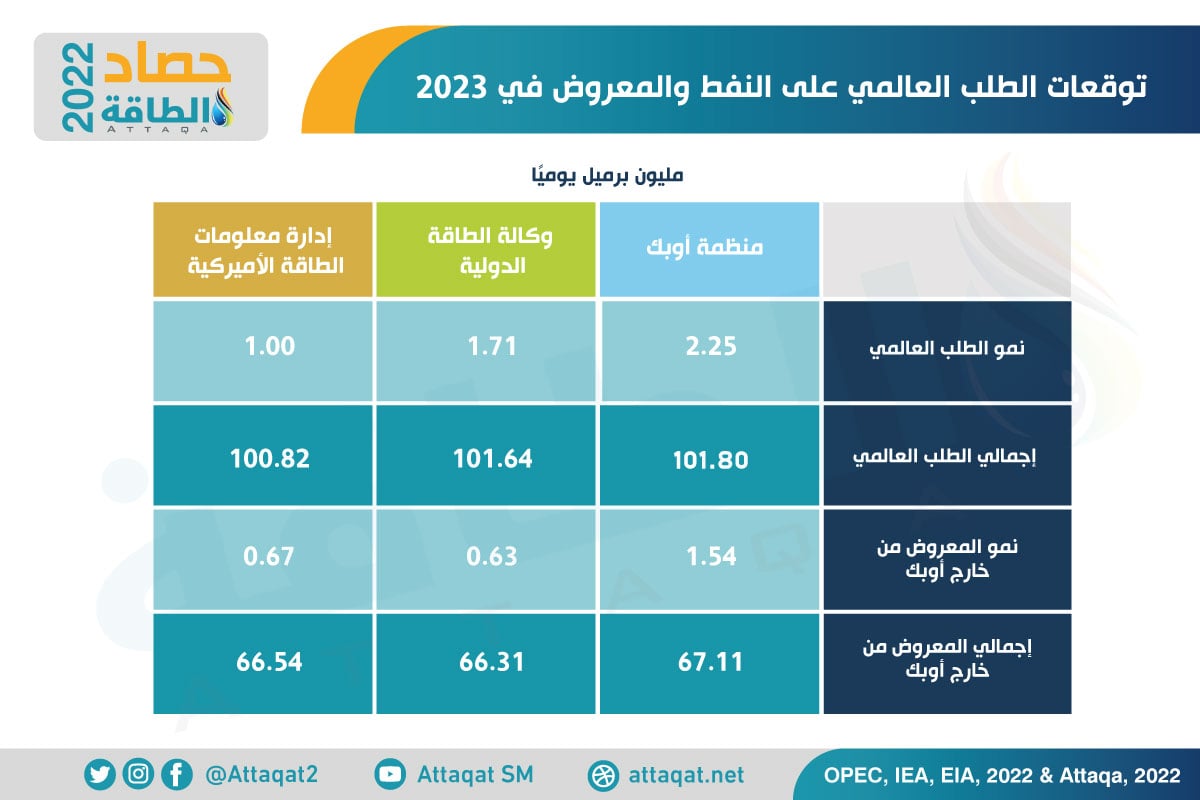

Dr. Anas Al-Hajji pointed out that the first thing that can be noticed on the expectations of international organizations, such as OPEC, the International Energy Agency and the Energy Information Administration of the US Department of Energy, is that there are significant differences between them.

He added, “When we talk about the annual average, that is, the average change or increase in oil demand in 2023 compared to 2022, we find that the average increase in oil demand in 2023 varies completely from one authority to another, from bank to bank, and from company to company.”

And he added, “OPEC believes that global oil demand will increase by 2.5 million barrels per day in 2023, and this is a very large increase, as in the normal case without a recovery, or Corona, the demand is from one million to 1.3 million barrels per day on average.”

At the same time, according to Al-Hajji, we find that the International Energy Agency is not optimistic, and believes that the increase will be 1.7 million barrels per day, which is also a large number in all cases, while the US Energy Information Administration believes that the increase will be only by one million barrels per day.

That is, the OPEC numbers are high compared to the numbers of the Energy Information Administration or vice versa, pointing out that the expectations of the company he works for are in the range of 1.38 or 1.4 million barrels per day, that is, less than OPEC and the International Energy Agency, but higher than the US Energy Information Administration.

Dr. Anas Al-Hajji stressed the need to clarify an important point when talking about expectations, which university professors and those who studied statistics realize, which is that all the aforementioned expectations have assumptions, and the general assumption is that things will continue as they are.

And he continued: “For example, at the end of 2019, we all issued our forecasts for 2020, but in 2020 developments occurred, including the issue of Corona and closures, and the demand for oil decreased dramatically, and then all expectations failed, and there are things that happen such as wars or weather changes and hurricanes, these are things.” Don’t get caught up in expectations.”

Oil prices and attracting investors

Energy economist Dr. Anas Al-Hajji said that sometimes there is a person with a fund who tries to collect money from investors and convince them that oil prices will rise above $100, and that they will achieve high profits, so he changes data and expectations to prove this.

The following infographic, prepared by the specialized energy platform, shows the expectations of global oil demand and supply during 2023:

Al-Hajji added: “Their goal is to collect investors’ money by claiming that oil prices will rise, and this is an outright lie and completely wrong expectations.”

He pointed out that in the year 2022, a person who owns an investment fund said publicly, and on the “CNBC” satellite channel, that oil prices will reach $200, and when they asked him about the reason, he said that he had information that OPEC countries do not have any surplus production capacity. Absolutely, this is an outright and unreasonable lie.

Dr. Anas stressed the need to differentiate between expectations that are not fulfilled due to matters beyond one’s control, and expectations that are either due to unfounded data, or because of erroneous assumptions that contradict reality and logic.

And it is likely that the expectations of the US Energy Information Administration, which were significantly different from the expectations of OPEC and the International Energy Agency, were so low, due to the way “Excel” works, expecting that there would be a problem in one of the cells of the program that led to these results, especially since the error Frequent in several matters related to management expectations.

He pointed out that OPEC sees a decrease in demand in the second quarter of 2023 based on the data of the previous year or the year before, in which there was a decrease due to the closures, explaining that everyone, except for the Energy Information Administration, believes that demand – and then oil prices – will start to rise from third quarter, then a big spike occurs in the fourth quarter.

Al-Hajji explained that the difference between the second quarter and the end of the fourth quarter exceeds two million barrels per day, and this affects oil prices significantly, especially since it is noted in the details that the largest increase in demand will come from China, and this is not surprising in general, but surprisingly, the increase is very limited. .

related topics..

Also read..

Leave a Reply