The US company ConocoPhillips is seeking to settle the Venezuelan oil sale agreement in its favor, in an attempt to recover its dues from the South American country.

The agreement, if completed, allows the American company to take over the task of transporting Venezuelan crude and selling it in the United States, according to what The Wall Street Journal reported, citing sources. Given that the two sides have not officially announced the details of the talks yet.

ConocoPhillips’ attempt indicates a second breakthrough in the oil sector in Caracas, after the US Treasury announced, in November 2022, that it would grant new powers to Chevron to resume its joint ventures with “Petroleos de Venezuela” according to specific conditions, according to what was followed by the energy platform. Niche.

ConocoPhillips agreement

The debt owed by the US company ConocoPhillips to Venezuela amounts to an estimated $10 billion, after it was forced to exit the country following the nationalization of its assets in 2007.

The American company, which is based in Houston, and the “Petroleos de Venezuela” company, owned by the Caracas government, are considering an agreement that allows the former to gradually recover its dues.

Under the prospective agreement, the American company will load, transport and sell shipments of Venezuelan oil in the United States, which is a double-benefit step. It contributes to meeting the American demand for energy on the one hand, and allows the company to obtain payments from its dues on the other hand.

This step indicates a continuation of the trend that the US Treasury Department started months ago to gradually lift the sanctions imposed on the Venezuelan oil sector since 2019, especially since Washington represented the largest oil market in Caracas prior to this date.

Venezuelan oil and sanctions

The breakthrough in the oil sector in Venezuela is expected to contribute to ending the US sanctions imposed on the sector nearly 4 years ago, and Washington’s return to relying on heavy Caracas crudes, which were the main source of operating the US Gulf Coast refineries.

The expected supplies under the ConocoPhillips and “Petroleos de Venezuela” agreement are reviving those refineries again, after they had been operating for years with “limited” supplies due to sanctions and low crude production in the South American country.

In November 2022, the US Treasury Department allowed Chevron to resume production of Venezuelan oil from its joint ventures with Petroleos de Venezuela, but that breakthrough was subject to specific conditions.

The Treasury stipulated that the Venezuelan government company not benefit from the proceeds from the sale of the crude extracted from those projects. Chevron will transport and sell it in the American market, and thus you will get the returns and financial gains alone.

Timing and production rate

American attempts to return Venezuelan oil to the scene in energy markets – whether through the permission granted to Chevron or ConocoPhillips’ attempt to recover its dues by selling crude in the US markets – come at a very critical time.

The permission granted to Chevron came just one month before the price cap imposed on seaborne Russian oil shipments goes into effect. This reduces Moscow’s crudes in the international markets, despite the increase in demand.

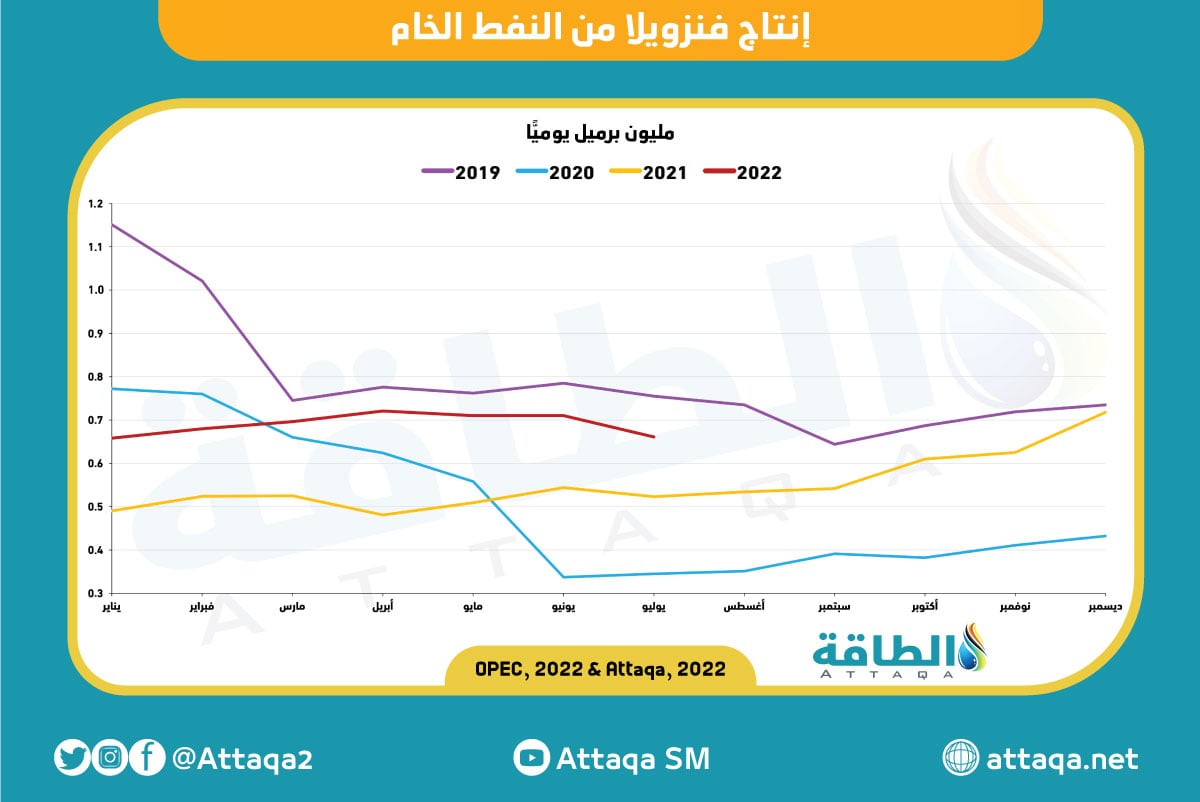

The chart below – prepared by the specialized energy platform – shows the volume of Venezuela’s crude oil production from the entry into force of US sanctions (2019) until last year (2022), according to OPEC data:

ConocoPhillips continues the same path; America seeks to compensate for the lack of Russian oil and its derivatives in the markets with alternative flows that allow it to meet domestic demand and increase refining capabilities, and it may re-export it to other markets.

On the other hand, this breakthrough may push towards saving Venezuelan oil from the rates of decline in exports that occurred in the past year (2022), as a result of the deterioration of infrastructure and the competition of Russian oil in Asian markets.

Exports of Venezuelan crudes and refined products decreased by 2.5%, with a total of nearly 617 thousand barrels per day.

Also read..

Leave a Reply