Russia’s invasion of Ukraine, and the embargo on Russian energy exports, provided a good opportunity for Turkey to import cheap Russian oil; Moscow sold oil at a huge discount to some Asian countries and Turkey. To reduce the impact of sanctions on its oil exports.

In the past 4 decades, Russia has played an important role in Turkish energy security, and it was the largest supplier of natural gas to Turkey, until last year.

It should be noted that the volume of trade exchange between Turkey and Russia has flourished since this spring, when Turkish companies were not prevented from trading with their Russian counterparts, and these companies worked to fill the vacuum created by European companies leaving Russia after the start of the Ukraine war.

Energy played an important role in increasing the volume of trade exchange between the two countries.

Turkey’s purchases of Russian oil

Data released last summer showed that Turkey’s main refiner “Topras” and Azerbaijan’s SOCAR refinery in the Turkish city of Izmir significantly increased their purchases of Russian Urals and Siberian light oil this year.

This comes as Turkey reduces its purchases of oil from the North Sea, Iraq and West Africa.

In the past few years, as a result of the high price of Russian crude, the Star refinery has increased its purchases of Iraqi oil and the Norwegian Johan Sverdrup field, which is close to the Russian Urals oil in terms of quality.

Although Turkey imported cheap Russian oil in the past months; Some Turkish energy experts believe that the increase in importing cheap Russian crude has not affected the price of gasoline in Turkey, and final consumers in Turkey are still buying gasoline at a high price.

Fluctuations in natural gas and oil prices

The fluctuations in natural gas and oil prices, which began with the imbalance between supply and demand after the pandemic and continued after the Russian invasion of Ukraine, remain.

These fluctuations directly affect Turkey, which is one of the largest energy importers in the region, and the pricing of Russian crude began at a discount of 25-30% of its value, after Western countries imposed a series of sanctions on it.

Turkey remains the largest buyer of Russian Urals oil in the Mediterranean; As it bought 15% of the exported shipments from Russian ports last November.

In November 2022, total shipments of Urals oil from Russian ports for the month were 7.5 million tons, excluding quantities from Kazakhstan, according to Reuters calculations based on estimates by Anglo-American Refinitiv and trader data.

Russian oil is still selling at a discount of $23 a barrel, and the price of a barrel of Urals Light crude has fallen to less than $60; India and Turkey make a big profit from it.

In November, deliveries to Turkey accounted for about 1,125 tons of all offshore Urals oil exports, according to a Reuters tally.

Imports of oil and its derivatives

Crude imports, which constitute the largest component of Turkey’s total oil imports, increased by 4.96% and amounted to 2 million 984 thousand and 449 tons, according to the latest report issued by the Turkish Energy Market Regulatory Authority (EMRA) in September.

During this period, Turkey imported other oil derivatives, and aviation fuel, marine fuel, gasoline, fuel oil, and other products represented the remaining part of the imports.

Thus, total imports increased by 9.16% in September, compared to the same month of the previous year, and amounted to 4,348,338 tons.

The highest import of crude oil and oil derivatives came from Russia with 2 million and 41 thousand tons, while Iraq came with 1 million and 76 thousand tons, followed by Kazakhstan with 262 thousand and 293 tons.

Gasoline sales in Turkey increased by 2.95% in September, compared to the same month of the previous year, to 307 thousand tons, and diesel sales decreased by 9.44% to 2 million 189 thousand and 885 tons.

Total sales of petroleum derivatives decreased by 6.98%, to record 2,642,196 tons.

On the other hand, total imports of oil and petroleum products increased by 5.6% in August, compared to the same month of the previous year, to reach 4,338,242 tons.

The import of crude oil, which constitutes the largest component of Turkey’s total oil imports, accounted for 3% of imports, rising to 2 million 942 thousand and 495 tons, according to the “oil market sector report” issued by the Turkish Energy Market Regulatory Authority for the month of August.

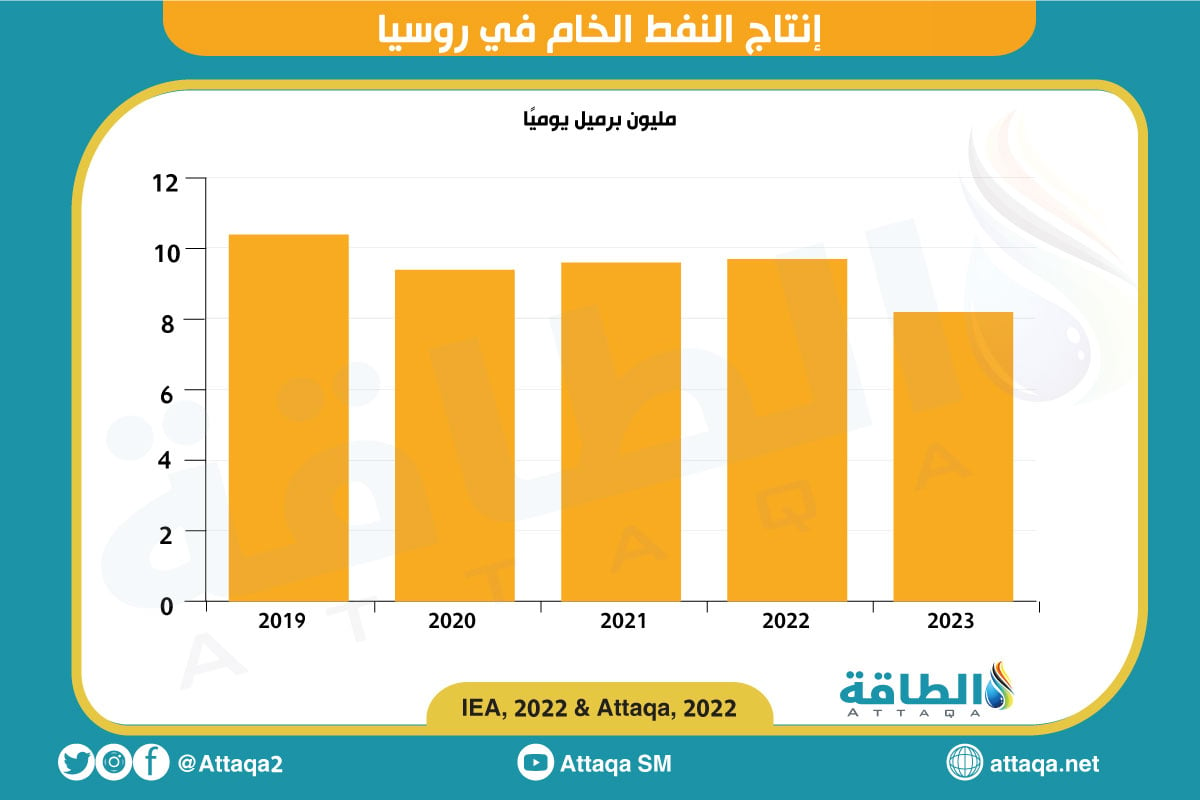

The chart below – prepared by the specialized energy platform – monitors the volume of oil production in Russia from 2019 until next year (2023), according to the expectations of the International Energy Agency:

Oil derivatives

During this period, the import of diesel products decreased by 3.53% to 1 million 28 thousand and 866 tons, and aviation fuel, marine fuel, gasoline, fuel oils and other products constituted the remaining part of the imports.

Thus, total imports increased by 5.6% in August, compared to the same month of the previous year, and amounted to 4,338,242 tons.

Although the highest import of crude oil and petroleum products was from Russia; As it reached one million and 802 thousand tons; Iraq exceeded it by one million and 99 thousand and 476 tons. It is followed by Kazakhstan, with an increase of 1161 tons.

On the other hand, gasoline sales decreased by 4.04% compared to the same month of the previous year, to 341 thousand and 427 tons, and diesel sales decreased by 5.67%, to reach 2 million 321 thousand and 871 tons, and recorded 2 million 805 thousand and 673 tons.

Moreover, the purchase of cheap Russian crude caused an increase in Turkish oil derivatives exports, in the past few months, while oil derivatives exports declined slightly by 57.6%, and Turkish jet fuel exports increased by 60.8% to 464,815 tons in August.

In the aforementioned period, marine fuel exports increased by 28.06% to reach 106 thousand 628 tons. Total exports with other products in the oil market increased by 57.6% to reach 1,229,585 tons.

In August, diesel oil production decreased by 3.99% compared to the same month in the previous year, gasoline production increased by 26.2% to 493,182 tons, and jet fuel production increased by 26.1% to 501,353 tons.

Determine the Russian oil price ceiling

In accordance with Europe’s decision to cap Russian oil prices, it seems that Turkey, like other Asian customers, will increase imports of cheap Russian oil.

Turkey can produce and export gasoline and other oil derivatives using cheap Russian oil in refineries and petrochemical facilities.

Turkey will benefit from cheap Russian crude in two ways, although the Turkish people do not benefit much from cheap Russian oil.

Despite the continued purchase of cheap Russian oil; The price of gasoline at Turkish gas stations has not decreased.

The Turkish government and interested groups will benefit from continued sanctions on Russian oil exports; It will buy Russian oil at a cheap price and sell oil derivatives.

The question here is, why will importing cheap Russian oil not reduce the price of gasoline in Turkey? It seems that the Turkish government will invest the political and geopolitical benefits of cheap Russian oil, and Russia will – in turn – interact with Turkey’s foreign policy on some regional issues.

* Dr. Omod Shoukry, Senior Advisor on Foreign Policy and Energy Geopolitics, Author of a book “US Energy Diplomacy in the Caspian Basin: Changing Trends Over the Year 2001“.

*This article represents the opinion of the author, and does not necessarily reflect the opinion of the energy platform.

Also read..

Leave a Reply