The UAE deal to buy a national fuel company affiliated with the Egyptian army is threatened with failure, especially since negotiations have almost stalled since mid-April (2023), and news has spread about the existence of financial disputes that prevent the completion of the deal.

The fuel company came at the top of the list of the 32 companies that Egypt plans to offer on the stock exchange until the end of the first quarter of 2024. As this step aims to collect billions of dollars to finance the public budget deficit, according to what was monitored by the specialized energy platform.

According to the Egyptian government’s plan, the issuance of a number of ready-made companies was scheduled to start at the end of the first quarter of 2023, led by a national fuel company, but with the start of the second quarter, no deals have been settled yet.

The possibility of canceling a national fuel company deal coincides with the retreat of Gulf companies from investment plans in Egypt, the most recent of which was the Saudi company “Extra” – which specializes in retailing household and electronic appliances – which decided to stop its expansion plans in Egypt without disclosing the reasons.

The deal is expected to be cancelled

The acquisition of a national fuel company affiliated to the Civil Service Agency of the Egyptian Ministry of Defense witnessed important developments during the month of February (2023), amid fierce Gulf competition between Saudi and Emirati companies.

ADNOC Distribution topped the list of candidates for the acquisition of “National Fuel”, especially after the entry of the Emirati company into the Egyptian market, and the acquisition of half of the fuel stations belonging to the French energy giant Total Energy.

Negotiations between Egypt and the UAE have reached an advanced stage, amid expectations that the value of the deal will exceed about $250 million, especially since the sale will be for the majority of the company’s shares.

However, informed sources revealed – in statements to the specialized energy platform – that the UAE may cancel the purchase of a national fuel company affiliated with the Egyptian army, explaining that the negotiations have been proceeding slowly since mid-April (2023).

Accordingly, the Emirati side demanded a few days ago to return to “consultation”, according to the expression of informed Egyptian sources.

The sources also indicated that the negotiations are “almost stalled” pending political movement from a “higher level”.

financial disputes

Sources familiar with the specialized energy platform have previously revealed the existence of several financial disputes between Egypt and the UAE’s ADNOC Distribution Company.

The sources said that the deal was expected to be announced in the first week of April (2023), especially after negotiations that lasted for several months, but disagreements over the evaluation of the share price of a national fuel company prevented this from being achieved, and accordingly it was decided to postpone.

According to the sources, Egypt appears open to selling the majority of the company’s shares or less than 50%, while the UAE side is willing to pay between $180 million and $220 million only.

Egypt is negotiating $350 million, and began offering the deal to Qatar Energy after ADNOC refused to distribute, but the Qatari company did not show much desire, compared to the Emirati company.

Supporting the Egyptian economy

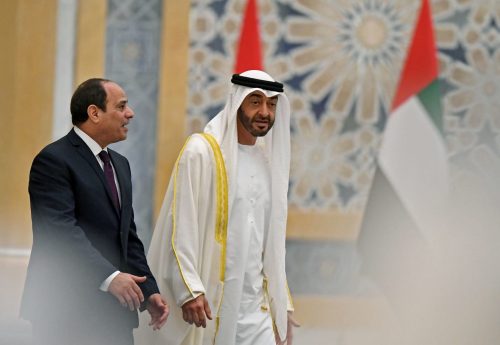

For his part, UAE President Sheikh Mohammed bin Zayed Al Nahyan, during his recent visit to Egypt and meeting President Abdel Fattah El-Sisi, on April 12, confirmed his country’s support for the Egyptian economy, according to informed sources speaking to the specialized energy platform.

The two sides discussed ways to develop cooperation mechanisms between the two countries in all fields, particularly the economic sector. Mohamed bin Zayed Al Nahyan affirmed that his country and Emirati companies will continue to invest in Egypt.

Inspite of that; “The president of the UAE did not directly address the deal to buy a national fuel company affiliated with the Egyptian army or other companies that Egypt offered for sale or investment in the stock exchange,” according to the sources asked by the energy platform.

According to the data of the Central Agency for Public Mobilization and Statistics in Egypt; The volume of Emirati investments in Egypt increased to $5.7 billion in 2021, from $1.4 billion during the fiscal year 2020-2021, an increase of 300.8%.

The value of Egyptian exports to the UAE amounted to about $1.8 billion during the first 11 months of 2022, while Emirati exports to Egypt amounted to about $2.8 billion during the same period.

Gulf investments stopped

Expectations of canceling a national fuel purchase deal come after the Saudi company “Extra” announced the cessation of its expansion plans in Egypt, after it agreed to establish a company in Egypt during December 2021.

It said the decision will have a negative impact of 38 million Saudi riyals ($10.13 million).

The Saudi company added that it had taken the decision after conducting a feasibility study on the continuation of its expansion plans in Egypt, but it did not disclose the results of the study, noting that it would later clarify any substantial developments related to this matter.

On the other hand, international investment banks continue to warn of the risks of the depreciation of the Egyptian pound to the economy, after previous cuts failed to maintain its stability against the US dollar.

The country is awaiting a first review of the Egyptian reform program with the International Monetary Fund so that it can disburse the second tranche of a $3 billion loan.

related topics..

Also read..

Leave a Reply