The largest US refineries are preparing to return to normal activity after the wave of severe storms that disrupted their production subsided over the past weeks, but other refineries are still suffering, prompting Canadian crude to search for new buyers in Asia.

The Port Arthur refinery in Texas is preparing to announce the regularity of its production cycle naturally, after its success in restoring its normal activity, on Wednesday, January 25, 2023, according to Reuters.

Port Arthur is the largest US refinery, with a refining capacity of approximately 626,000 barrels per day through Motiva Enterprises.

Motiva belongs to Aramco

Motiva Enterprises is one of the largest oil refining companies in the United States (it is owned by giant Saudi Aramco), and is headquartered in Houston, Texas.

Motiva Enterprises hasn’t released data that it’s back to full normalcy yet, according to the specialist energy platform.

The production of this refinery was subjected to severe disruptions due to a new wave of storms on Tuesday, January 24, 2023.

The return of the charging pumps in the jet kerosene hydrotreatment unit (2) was monitored, to work with a capacity of 19.2 thousand barrels per day, equivalent to nearly half of the production capacity of 42 thousand barrels per day, according to Reuters.

Return lubricant unit

On Wednesday morning, January 25, 2023, the lubricant production unit returned to operation, after being put out of service earlier due to severe storms.

Lubricating oils are called other names, such as lubricants used to reduce friction rates between the surfaces of bodies connected to each other in the engines of cars, trucks, ships, and others.

US oil refining margins rose – according to the “Crick Spread Scale” – to their highest levels in 3 months, due to the disruption of US refineries from production during the past days.

Refining margins record $42.4

US oil refining margins on the index recorded around $42.41 a barrel on a stormy Tuesday, January 24, 2023, which is the highest level since October 2022.

It is not usual for refining margins to rise to this level during the month of January of each year, due to the decrease in movement and travel due to the cold weather.

The average US oil refining margins during the month of January and over the past 5 years were approximately $15.56, according to data issued by the specialized company Refinitiv Eikon.

The recorded data on average refining margins for January 2023 means that they are almost twice as high, compared to their average in 2018, according to the calculations of the specialized energy platform.

Gasoline prices are above $3 a gallon

The “Crack Spread” measure is commonly used to measure the difference between the price of crude oil and the sale of final oil derivatives to the public, and it is a well-known measure among refining and futures trading companies.

Average gasoline prices in Texas rose to $3.07 a gallon on the same day, up 44 cents from their average for December 2022.

Average gasoline prices in Oklahoma rose to $3.31 a gallon, up 45 cents, according to AAAA Automotive data.

Gasoline refining margins in Europe rose, during January 2022, to their highest levels since 2016, driven by increased US demand due to refinery outages in the United States, according to the Argos website, which specializes in analyzing energy markets.

European gasoline refining margins rose to $15.7 per barrel of North Sea crude, according to what was monitored by the specialized energy platform on January 16, 2023.

High refining margins in Europe

The average refining margins in Europe, during the first 3 weeks of January 2023, were nearly $13 a barrel, which is the highest seasonal average recorded in January since 2016, which is always referred to in comparison, as it recorded $14.3. per barrel.

The Elliott blizzard increased US gasoline imports to 600,000 barrels per day in December 2022, compared to 546,000 barrels per day in November.

It is scheduled that the European and American ban on Russian diesel shipments transported by sea will enter into force, starting from Sunday, February 5, 2023, and European refineries will enter the periodic maintenance season during the spring, which is likely to continue high refining margins in Europe.

The decision to ban will lead to a decrease in the supply of naphtha, which is mainly used in the gasoline refining mix, according to the specialized energy platform.

Close the diesel refining unit

A diesel production unit at the Northeast refinery, Louisiana, of BPF Energy, was closed after a fire on Saturday, January 21, 2023; This could delay production for at least a month for maintenance work.

The Pemex refinery in Deer Park, Texas, was also suspended until Wednesday, January 25 (2023), due to a lack of external steam supplies following Tuesday’s storms.

The capacity of this refinery is approximately 312 thousand barrels per day, and it is currently working to repair a leak in the liquid cracking unit that produces 70 thousand barrels per day, which led to a reduction in its production capacity, according to Reuters.

Breakdown of a petrol refining unit

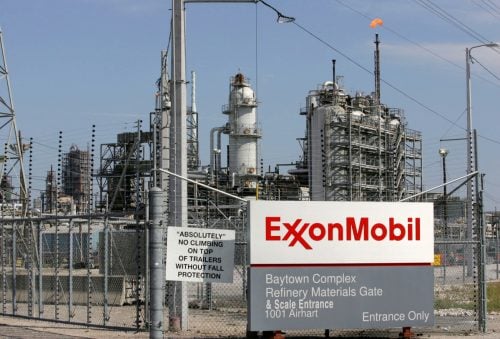

The American Exxon Mobil Corporation announced – also – on Monday, January 23 (2023), its readiness to start the planned periodic maintenance work for several units in the “Baytown” complex for the petrochemical industry in Texas.

The American company confirmed – in an updated statement – that the Baytown petrochemical complex will return to work normally on Wednesday (January 25 (2023), with the exception of the gasoline-producing cracker, and some smaller units that are out of work for planned repairs before the storms.

The Baytown refinery has a capacity of approximately 560.5 thousand barrels per day, and ExxonMobil plans to ramp up production of gasoline and diesel from its Beaumont refinery units in Texas in the coming days to make up for the shortfall, according to a statement reported by Reuters.

The current US refinery maintenance season is expected to be longer than usual, as several refineries on the US Gulf Coast are still operating below their refining capacity since Winter Storm Elliott.

Elliott storm caused a decrease in the daily refining capacity in the United States by 1.5 million barrels per day during the month of December 2022.

Sencor Refinery is offline

The Suncor refinery in Commerce City, Colorado, has been offline since the December 2022 storm until now, according to the specialist energy platform.

In addition, some companies delayed plans for some repairs during the past two years due to the Corona pandemic, which is likely to double the volume of repair and maintenance work in refineries during the current maintenance season.

And the intensification of maintenance will affect fuel supply pressures in the United States, amid expectations of a decrease in inventories, which is likely to continue the rise in gasoline and diesel prices.

Gasoline stocks in the United States are currently 10% lower than normal, and diesel stocks are down 20%, narrowing the margin of error for refinery maintenance plans and durations, according to US analyst Rob Thumel.

Saxo Bank’s Head of Commodities Sector Ole Hansen also expects greater risks to fuel supplies in the US with the ban on seaborne Russian diesel imports taking effect on February 5, 2023.

Hansen fears an increase in European demand for refined oil derivatives in the United States after the ban on imports of Russian diesel, which may put more pressure on the US refinery sector.

Hansen expects that the emerging refining center in the Middle East will contribute to compensating part of the Russian diesel, but it is unlikely that the shortfall will be fully covered for at least a few months.

Canadian oil escape to Asia

On the other hand, the disruption of American refineries led to the flight of Canadian crude oil to Asia, according to the movements of Canadian shipments monitored by Bloomberg Agency.

Some Asian traders contracted to buy 7 million barrels of Canadian crude oil in February 2023, the most Asians have bought in nearly a year, according to data from specialist Vortexa.

Canadian crude oil was forced to search for new buyers, until the refineries in the neighboring American country return, but its return may be at different prices, which may increase cost pressures on refineries after maintenance work.

related topics..

Also read..

Leave a Reply