The International Monetary Fund (IMF) expressed a negative view regarding the expectations of global oil prices, suggesting that they will decrease by more than 24% during the current year (2023), with the deterioration of global economic growth prospects.

According to the World Economic Outlook 2023 report, issued by the Monetary Fund today, Tuesday (April 11, 2023), it is expected that the average price of oil (Brent crude) will reach $73.13 per barrel in 2023, compared to $96.36 in the previous year (2022).

Brent crude futures are currently trading around $85 a barrel, as monitored by the Energy Research Unit.

Oil price forecasts in the coming years

Next year (2024), the International Monetary Fund expects oil prices to continue to drop to an average of $68.90 per barrel, representing a decline of 5.8%, compared to the forecast for 2023.

Crude prices are expected to continue declining over the next few years until they average $65.4 per barrel in 2026.

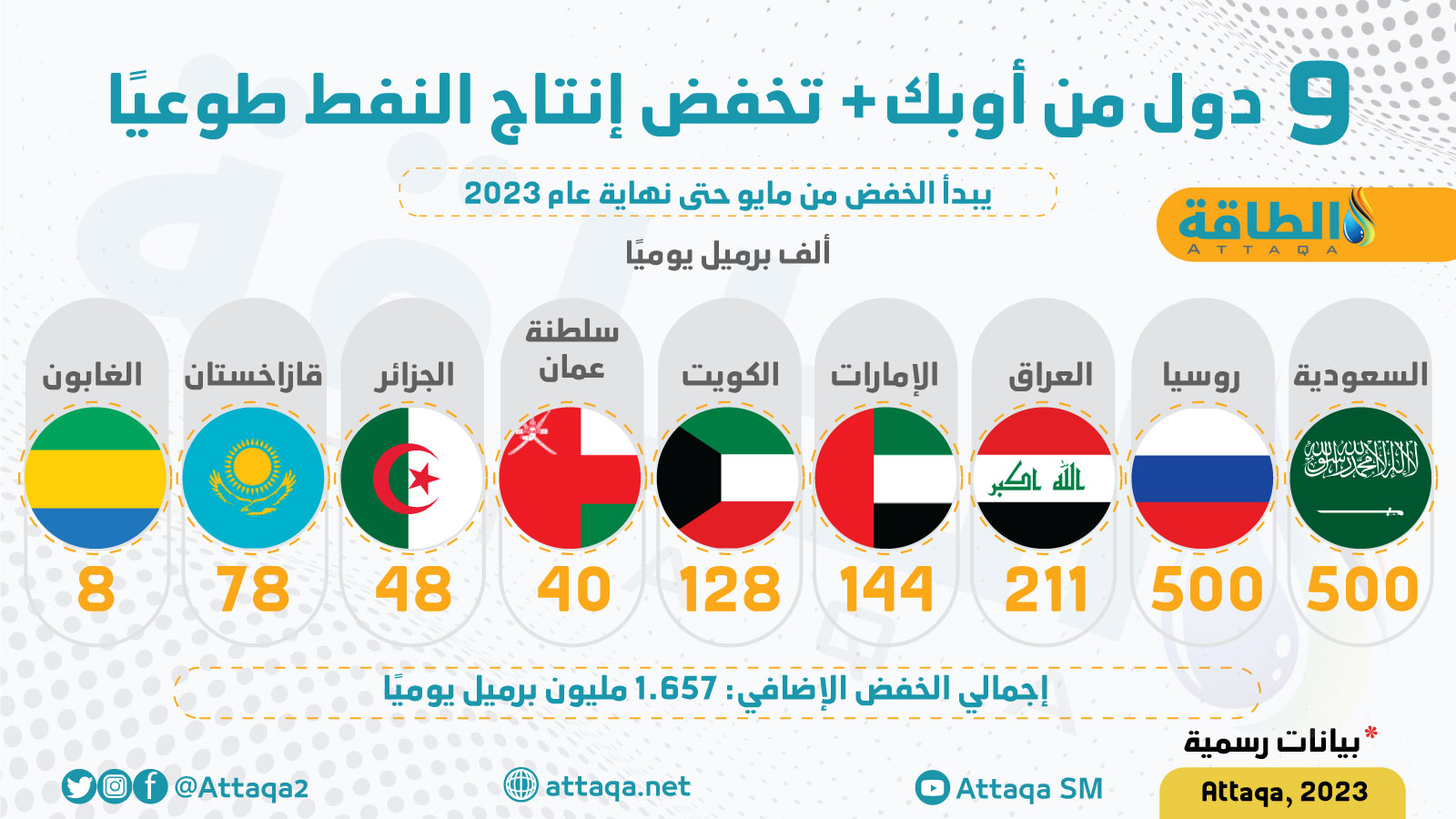

For his part, Pierre-Olivier Gorinchas, Director of Research at the Monetary Fund, said that oil price expectations by the IMF do not take into account the impact of voluntary oil production cuts, approved by the OPEC+ countries, with a total of 1.66 million barrels per day, starting from next May until May. end of 2023.

The following infographic monitors voluntary production cuts by 9 countries from the OPEC + alliance:

The IMF indicated that oil prices fell by about 15.7% during the period from August 2022 to February 2023, with the repercussions of slowing global economic growth on crude consumption.

China witnessed the first annual decline in oil demand during the current century, amid repeated closures related to the Corona epidemic, according to the report.

And raised the high global inflation and continuous rate hikes from central banks great concerns about weak demand for oil.

On the supply side, the IMF pointed to the implications of the uncertainty resulting from Western sanctions against Russian oil exports on the outlook for global market balances.

The European Union imposed a ban on Russian crude starting from December 5, 2022, and also on Russian oil derivatives, starting from February 5, 2023.

Negative view of the global economy

The International Monetary Fund forecasts a drop in oil prices, as a result of negative prospects for global economic growth, after a series of interest rate hikes to curb inflation.

The IMF lowered its forecast for the growth of the global economy by 0.1% during the current and next years, to reach 2.8% and 3%, respectively.

It is not currently expected that the global economy will return in the medium term to the growth rates that preceded the Corona epidemic, according to the report, whose details were followed by the Energy Research Unit.

The global economic growth rate is likely to reach around 3%, which is the lowest medium-term estimate disclosed by the IMF since 1990.

The International Monetary Fund said, in its report: “The weak outlook reflects the aggressive monetary policy stances needed to bring down inflation, the repercussions of the recent deterioration in financial conditions, and the ongoing war in Ukraine.”

related topics..

Also read..

Leave a Reply