With economists still predicting a slowdown and recession in some regions of the world, including the United States and Europe, the Middle East and North Africa region is one of the few regions in the world that is expected to witness moderate to strong growth.

These prospects should enhance the confidence of regional investors and provide a strong foundation for the chemical and petrochemical industry in the region to increase production and continue to invest in new projects and innovations.

Regional industry leaders can also seize this opportunity to make decisive and bold decisions to advance their growth and sustainability program through 2023 and beyond.

Economic and social impact

The GCC countries have performed strongly on several fronts over the past two years.

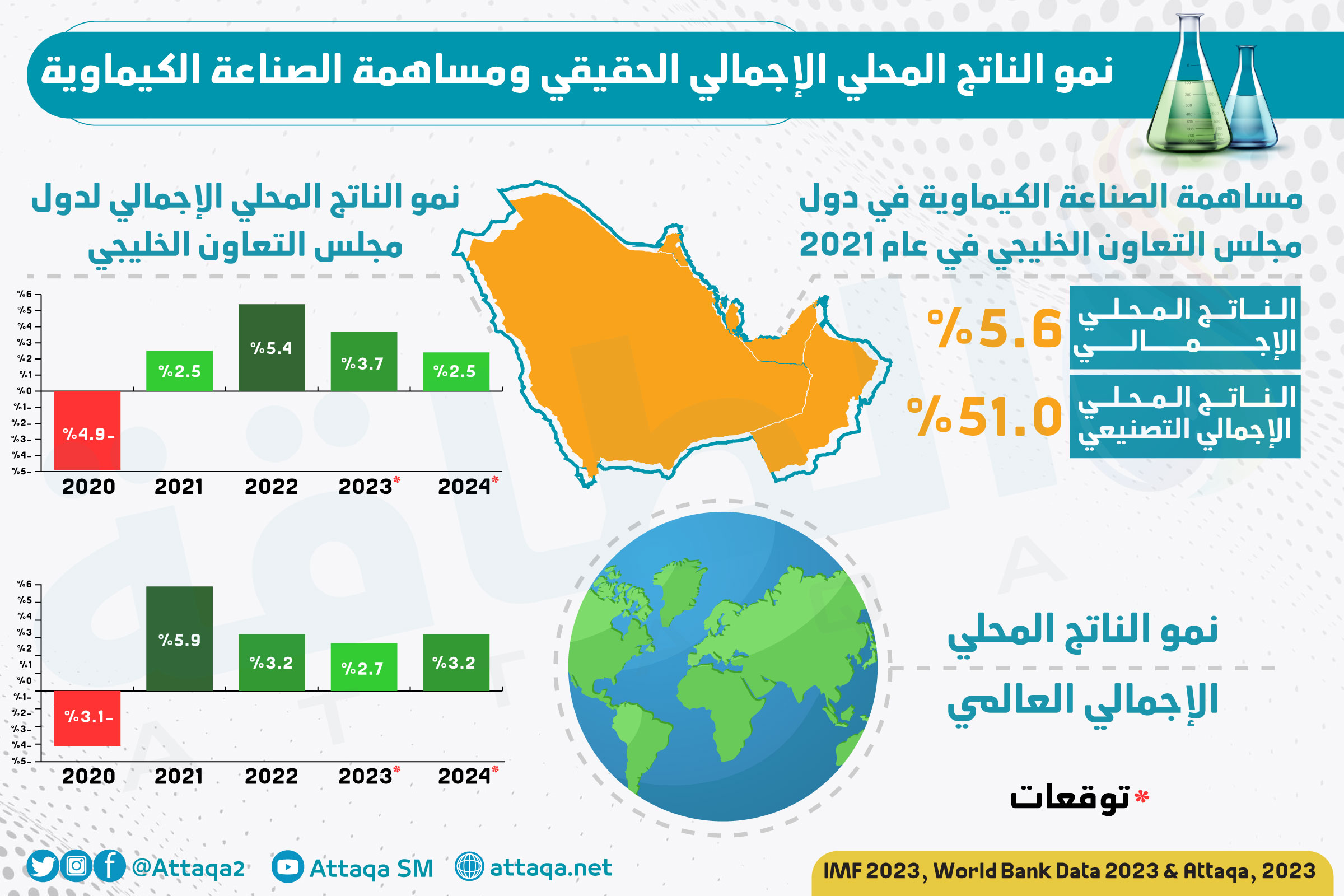

According to the International Monetary Fund, the real GDP of the GCC countries grew by 2.5% and 5.4% in 2021 and 2022, respectively.

This strong recovery was largely driven by the easing of pandemic restrictions, which led to growth in oil production across the region, and positive developments in the hydrocarbon markets.

Besides, the non-oil sectors also performed well, thanks to the increase in public spending and credit growth, and the recovery of the travel and tourism sectors at the global level supported by the huge global events hosted by the region, such as Expo 2020 in the United Arab Emirates and the FIFA World Cup in Qatar.

Moreover, the geopolitical events taking place in the world, their impact on commodity markets, and the economic sanctions associated with them, also had a beneficial effect on the economy of the Gulf states. Because it provided an opportunity to increase the supply of oil and gas to the European market.

The World Bank expects Gulf economies to grow by 3.7% and 2.4% in 2023 and 2024, respectively.

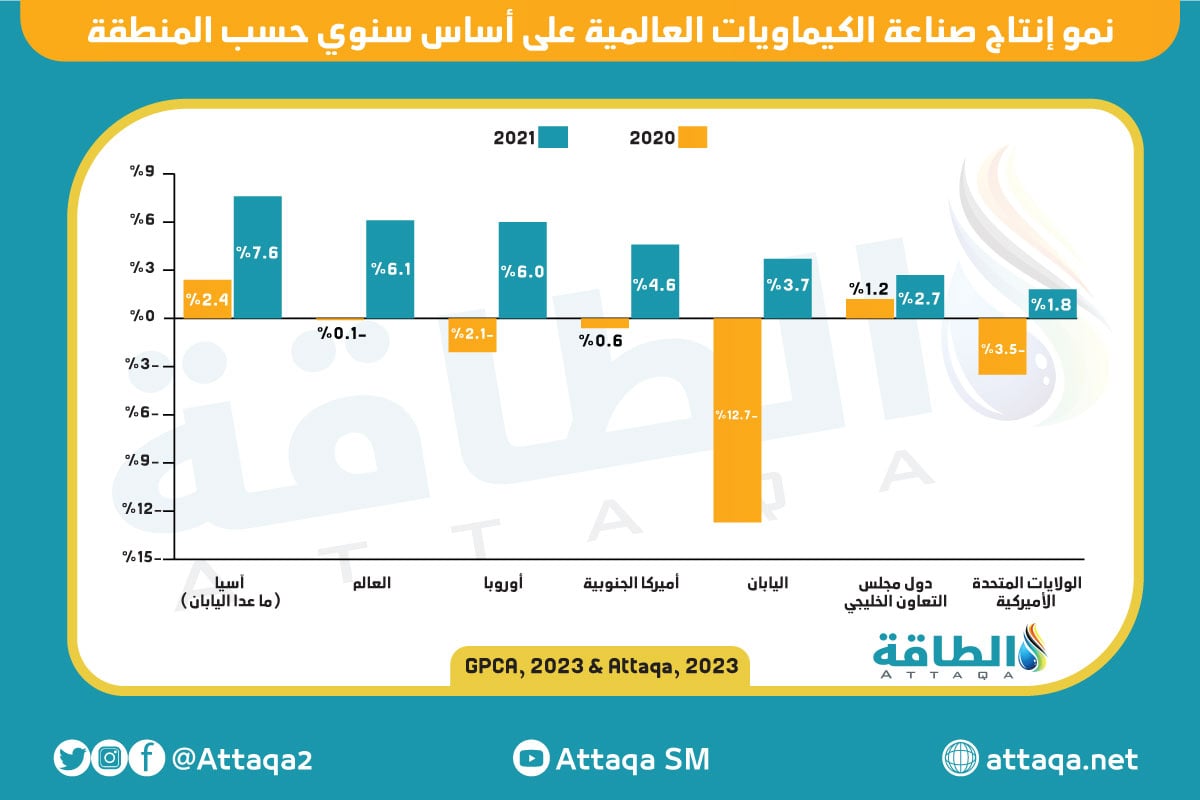

On the other hand, the International Monetary Fund expects global GDP growth to slow from 6% in 2021 and 3.2% in 2022 to 2.7% in 2023.

The economic impact of the chemicals sector in the GCC countries is very significant, making it a major industry in the region’s economy, contributing 5.6% to the GDP and 51% to the manufacturing GDP in 2021.

The economic value of the chemical industry is also evident through the creation of more than 210,000 jobs, of which 64% are employed by Gulf nationals.

output of the chemical industry

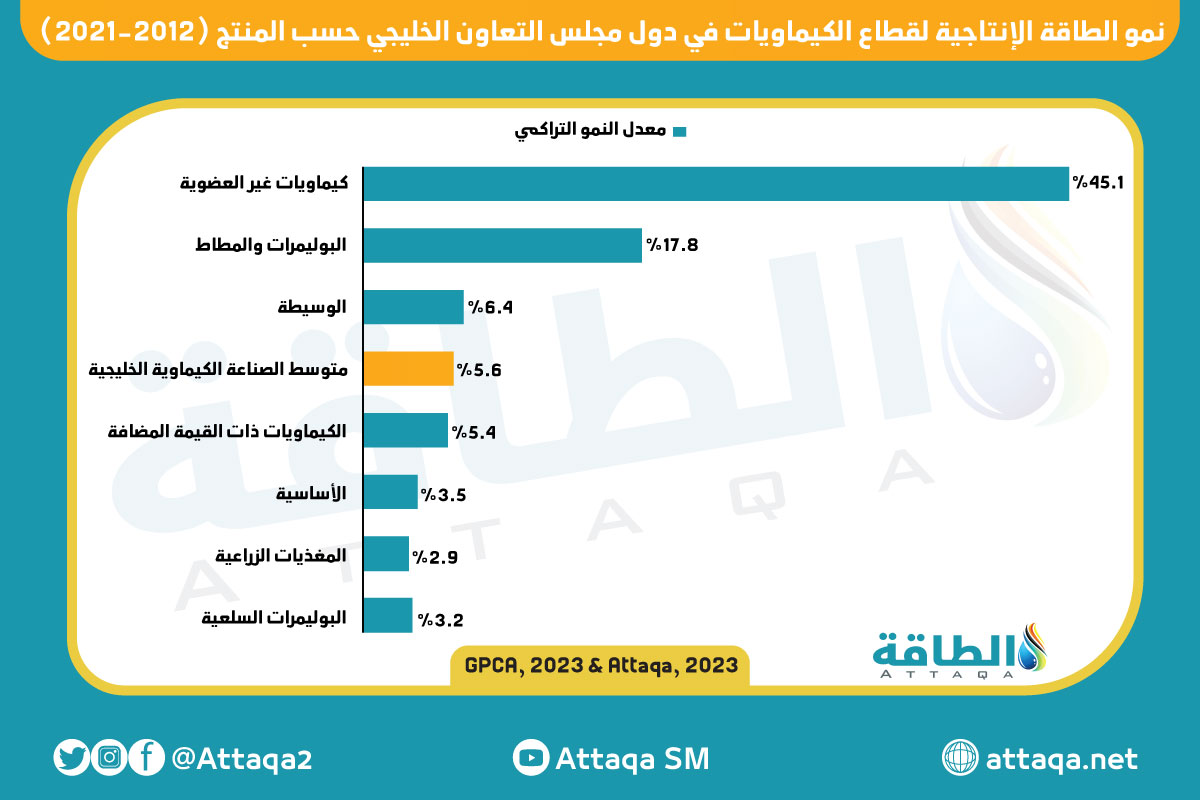

The total production of chemicals in the GCC countries grew by 2.7% in 2021, recording a production volume of 154.1 million tons, driven by the recovery of global demand for commodities, led by inorganic chemicals, high-performance polymers and rubber, which achieved an annual growth rate. Composite over 9 years, it was 45.1% and 17.8%, respectively.

Capacity growth is expected to slow slightly to 2.5% in 2023.

The regional industry occupies an important global position, and it is growing steadily, as its production capacity has doubled over the past two decades, with a market share of 6.7% of the total global petrochemical industry.

world Trade

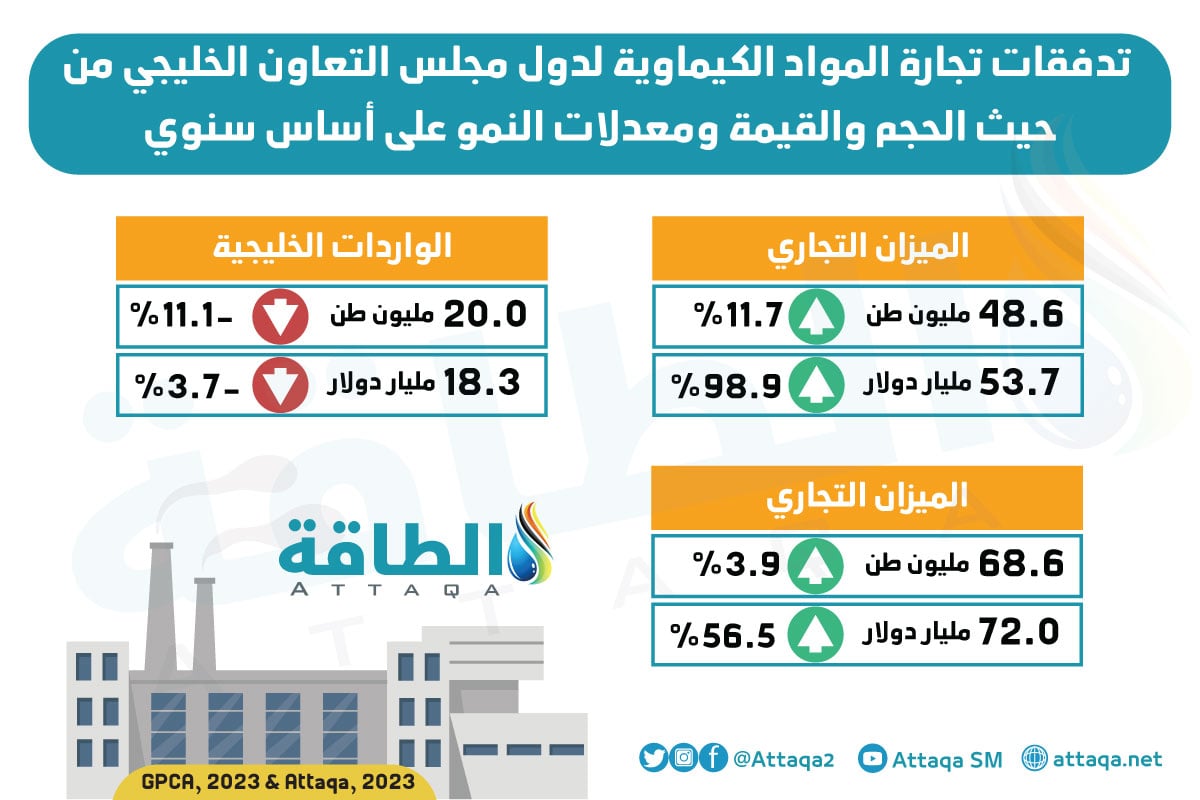

Although the chemicals industry in the GCC is export-oriented, exporting 68.8 million tons in 2021, the region imported 20 million tons, meaning a positive trade balance of 48.6 million tons, up 12% year-on-year.

China and India remain the main destinations for Gulf chemicals exports, accounting for 26% and 14%, respectively, of total chemical exports.

Global competition and cooperation are of great importance for the GCC countries to lead the sector and strengthen their trade relations, especially with global competition between countries reaching unprecedented levels and distinguished cooperation relations.

Existing GCC free trade agreements, as well as negotiations under consideration with the United Kingdom, India, South Korea, Australia, China and other major markets, play an important role in achieving this vital objective.

Revenues and investments

The regional chemical industry has surpassed pre-pandemic sales figures and recorded the highest sales value of $95.9 billion since 2013, an increase of 77.2% over sales in 2020, due to increased demand and prices of chemical products globally.

In contrast, the share of the GCC countries in global chemicals revenue rose to 2.4% in 2021, almost reaching the historical average.

Despite the significant decline in global investments, there are about $61 billion of investments planned in the Gulf region between 2021-2025.

Chemical producers in the GCC countries have continued to invest in environmentally responsible projects. Being part of the Environmental, Social and Corporate Governance Programme, particularly in Energy Efficiency and Air Pollution in 2021.

Recommendations

Given the relatively positive outlook for the region, the regional chemical industry has to make decisive and bold decisions to meet the challenges in the global market.

Since 2020, the Gulf chemical industry has shown great flexibility and a superior ability to face difficulties, no matter how severe they are.

As the economy enters 2023 on firmer foundations, senior industry leaders in the GCC must take advantage of challenges and turn them into opportunities to build a more resilient business that is able to face future challenges.

Over the next year, chemical companies will need to focus on new growth opportunities and extract more value from their existing assets.

In addition, transitioning to low-carbon economies and investing in green growth opportunities will enable the industry to meet growing global demand and enhance sustainability through carbon reduction projects and the adoption of advanced recycling technologies.

Dr. Abdelwahab Al-Sadoun, Secretary General of the Gulf Petrochemicals and Chemicals Association (GPCA)

*This article represents the opinion of the author, and does not necessarily reflect the opinion of the energy platform.

related topics..

Also read..

Leave a Reply