At a time when international energy companies rushed to exit Russia after the outbreak of the Ukrainian war, the American company SLB began to acquire contracts for services and equipment from these companies and established its presence in Moscow.

The company – which is based in the US state of Texas and abandoned the name (Schlumberger) months ago – was not satisfied with that, but rather recorded a strong performance in the third quarter of last year (2022), amid expectations that it will announce record results for the fourth quarter, according to what was said. Viewed by the specialized energy platform.

The adoption by the world’s largest oil field companies of strong plans in Russia during the current year (2023) – including the development of the “Sakhalin 3” natural gas production project – sparked controversy over its position on the sanctions imposed on Moscow since its invasion of Kyiv last February, according to a report. Published by Reuters.

SLB in Russia

The third quarter of last year (2022) witnessed a strong performance for SLB (formerly Schlumberger) in Russia; Inventories grew by 25% from the previous quarter (Q2 of the same year).

While the company’s expectations indicate that the growth of the inventories of its projects in Russia will record record results during the fourth quarter of the year.

The company’s performance in Russia, during the same quarter, outperformed growth results in Asia by 12% and the Middle East and North Africa by 11%.

Known as the world’s largest oilfield company, the company is one of the contractors for the huge and controversial Sakhalin 1 project in Russia; As it witnessed a stumbling block with the exit of the American company, Exxon Mobil, which manages it, but it is currently about to reach its full production capacity again.

The company has extensive plans to develop its business in Moscow during the current year (2023), including plans to raise the production of the “Sakhalin 3” project concerned with the production of natural gas.

Russian projects accounted for 6% of the company’s revenues during the first three quarters of last year (2022), equivalent to $1.21 billion, up from a share of 5% of total revenues prior to the outbreak of the war.

Sanctions charges

As several energy companies abandoned operations in Moscow to comply with the sanctions and others put projects on hold, SLB has boosted its staff base in Russia by about 70 in joint ventures with Gazprom and Rosneft.

Experts did not decide the company’s position on the sanctions, referring to the fact that the sanctions did not include an obligation for the Russian energy sector to reduce oil production.

Mercury executive director Peter Kosek, former official of the US Office of Foreign Assets Control, confirmed that Russia’s energy sector does not fall under the scope of comprehensive sanctions, noting that companies can operate subject to the restrictions on financial transactions contained in the sanctions.

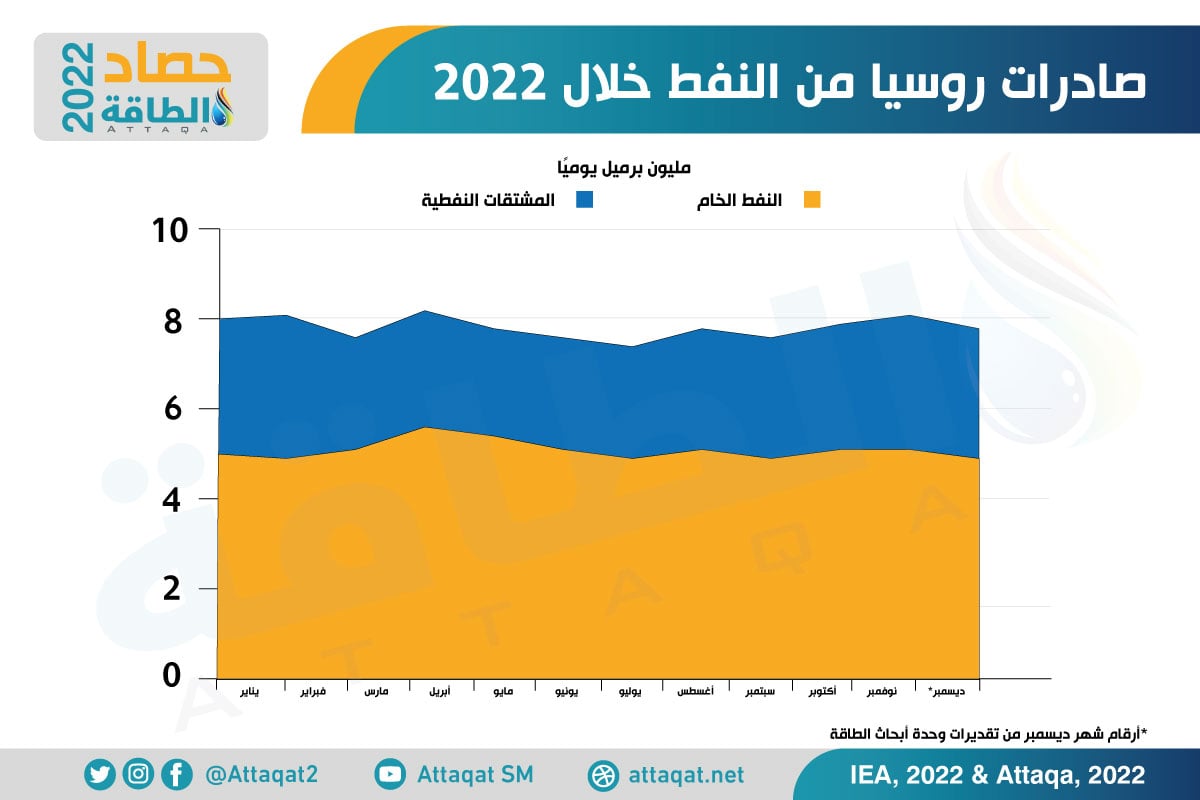

The chart below – prepared by the specialized energy platform – reveals the volume of Russian exports of oil and its derivatives, during the past year (2022), according to the data of the International Energy Agency:

On the other hand, Ukraine views the continuation of SLB’s business in Russia as support for the war against it, and a spokesman for the Kyiv embassy in Washington DC confirmed that commercial cooperation with Moscow is “financing the war and contributing to the killing of civilians and the destruction of cities.”

While the Human Rights and Corporate Resource Center, which monitors companies’ handling of human rights issues, warned SLB (Schlumberger) of slipping into Russia’s war effort against Kyiv.

The chief researcher at the center, Ella Sky Benko, considered that the company’s continuation of its work in Russian fields makes it part of the circle of conflict between Moscow and Ukraine.

Is fining a solution?

SLB (formerly Schlumberger) usually takes it upon itself to continue its work and not pay attention to any obstacles, even if they are “international sanctions”, and its projects in Russia were not the first stop in this context.

The company had previously violated the sanctions imposed on Iran and Sudan, and paid a fine of $237.2 million to the US Department of Justice in 2015. It also paid – through its subsidiary, Cameron International – $1.4 million in 2021 under the scope of sanctions related to Ukraine also for providing services. to the Russian energy company Gazprom Neft Shelf.

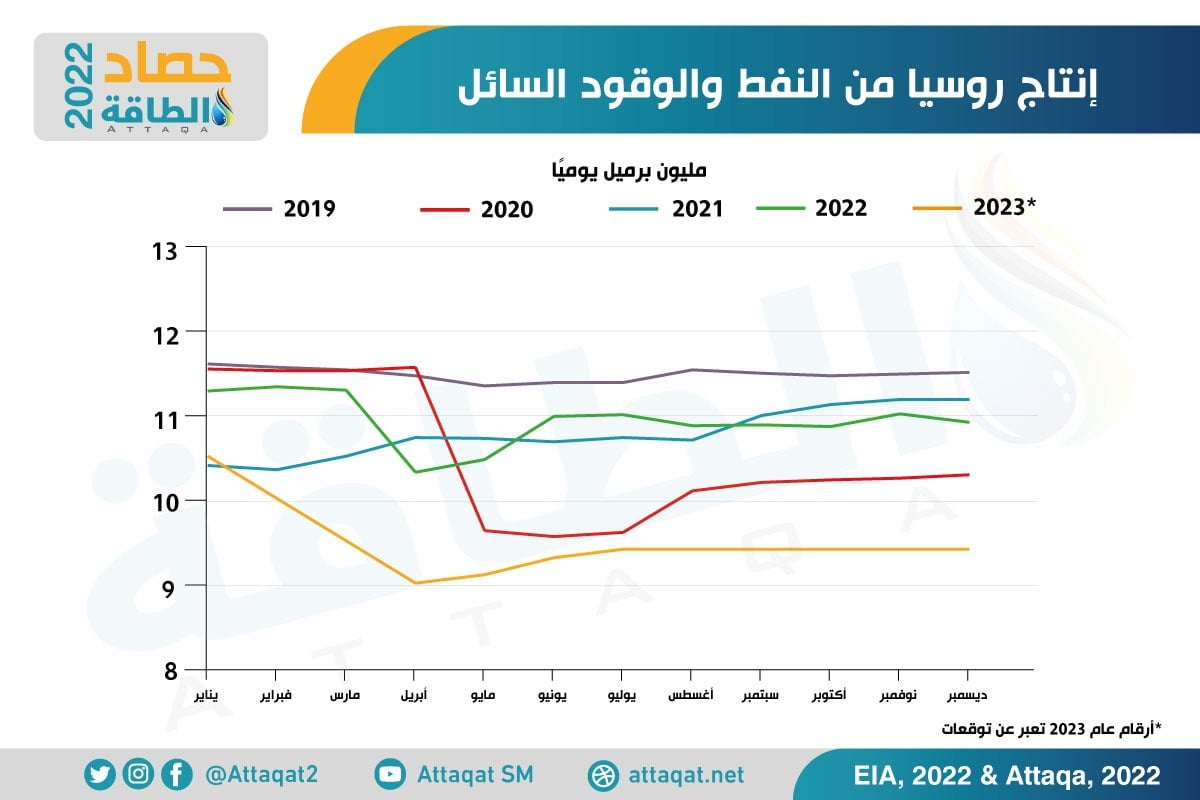

The chart below monitors the volume of Russia’s production of oil and liquid fuels during the years from 2019 until last year (2022), along with production expectations for the current year (2023), according to information from the US Energy Information Administration:

The SLB, which has its roots in Russia since 2014, has been bolstered by the exit of competitors from Moscow projects, including two Texas-based firms, Halliburton and Baker Hughes.

Halliburton said that its revenues in Moscow decreased by 6%, compared to a 45% growth in SLB revenues during the first 3 quarters of last year (2022).

The company’s activity in the Russian oil fields coincides with the recording of Moscow’s oil production, during the months from January to November last year (2022), an increase of 2.2% from the previous year (2021), in light of the increase in purchases from the markets. Asia (India, China, Pakistan) to take advantage of lower Russian oil prices.

Also read..

Leave a Reply