Stocks of oil derivatives in Morocco are one of the most important issues that concern the government, in light of its dependence mainly on importing fuel from abroad.

Despite the strenuous efforts to secure fuel for the local market, fuel stocks are facing severe shortages compared to the levels required by law.

In this context, the Minister of Energy Transition and Sustainable Development, Leila Benali, revealed that the country’s stocks of oil derivatives are sufficient for only 31 days.

The law stipulates the need to provide a minimum stock of petroleum materials sufficient for 60 days. However, actors in the fuel distribution market usually fail to secure this for many reasons, most notably the poor infrastructure and the lack of the necessary liquidity.

Storage potential in Morocco

Benali said, in response to a written question from the House of Representatives, that the existing storage capacities in Morocco are not being exploited to a large extent.

And she explained that stocks of oil derivatives amount to 1.2 million cubic meters, or about 31 days of national consumption, according to the data seen by the specialized energy platform.

And she stressed that the availability of stocks of oil derivatives is linked to the presence of storage capacities in the country to contain it, pointing out that Morocco has storage capacities of liquid petroleum materials amounting to 1899 million cubic meters, 94% of which are related to ports, and 582 thousand cubic meters for liquefied oil gas, 89%. Some of them are connected to the ports.

Fuel prices in Morocco

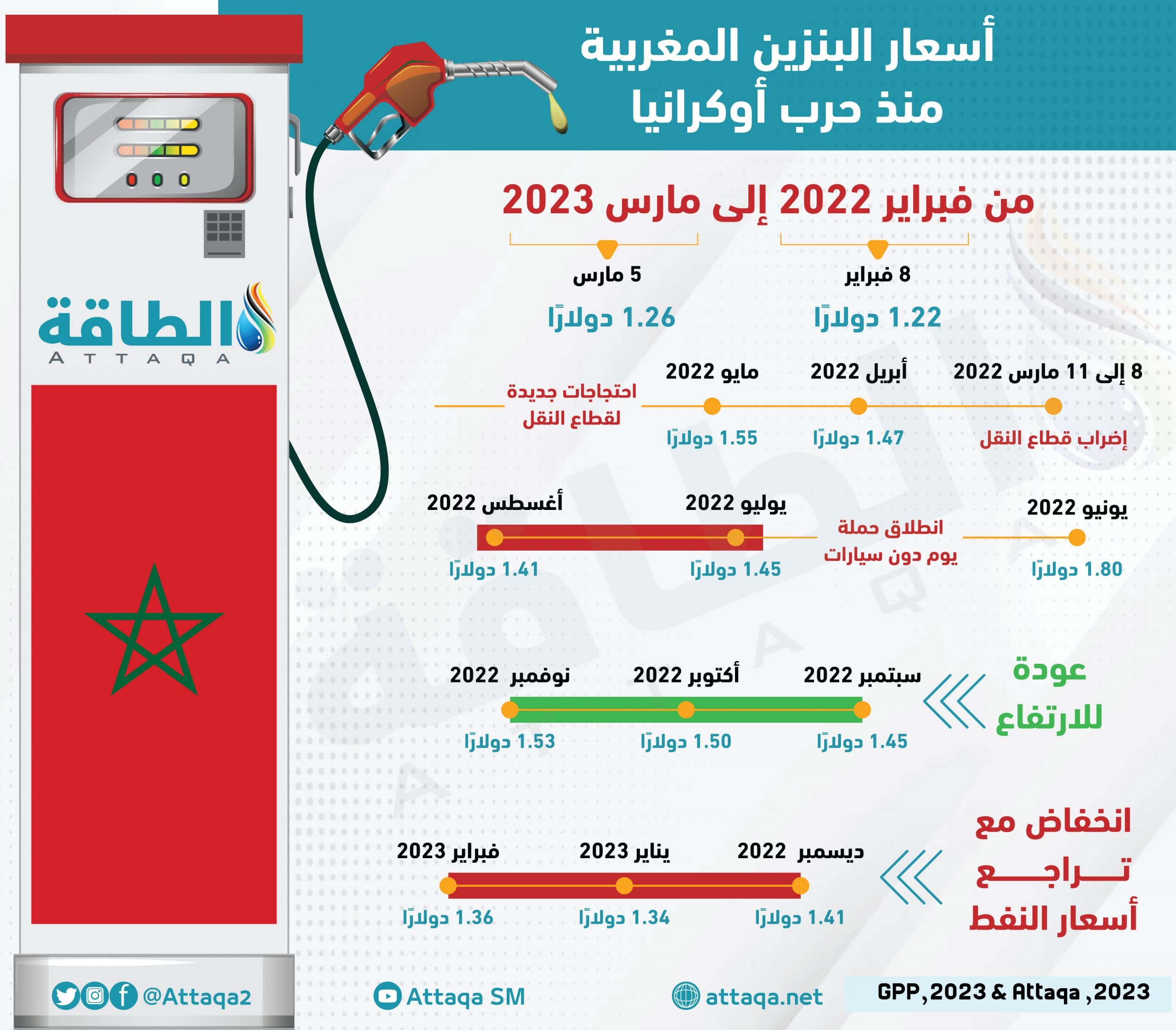

Stocks of oil derivatives in Morocco play a role in fuel prices in the country, which witnessed a turbulent year in 2022, in conjunction with the rise in global oil prices.

Leila Benali stressed that while stocks of oil derivatives do not exceed 31 days of national consumption, storage capacities in Morocco are able to guarantee 81 days of consumption of premium gasoline, 67 days of gas-diesel and 102 days of jet fuel. And 64 days of fuel – fuel oil -.

Morocco has storage capabilities to ensure the supply of the national market for 41 days of consumption for butane gas and 42 days for propane gas.

And the fuel markets in Morocco had received several shocks in 2022 with the rise in oil prices and the suspension of Algerian gas exports, which prompted the Rabat government to take several decisions to raise fuel prices to face the large increase in the energy bill, which angered the citizens.

The rise in fuel prices in Morocco to record levels, on more than one occasion, led to popular protests, some of which called on the government to reduce, and others chose the boycott weapon to put pressure on gas stations and the government to respond to the subsidy demand, according to information seen by the specialized energy platform.

It is noteworthy that fuel prices in Morocco witness shifts more than once during one month, but these shifts are subject to pricing by the government, and selling prices by distribution companies; Which may create differences between the selling prices depending on the regions.

Capacity increase

Leila Benali confirmed that Morocco is implementing an ambitious policy to increase the reserve stock to secure the needs of the national market for oil derivatives.

The Ministry of Energy Transition and Sustainable Development is working to accelerate projects related to the capacities of oil derivatives stocks, and urges fuel companies to raise the level of stocks to ensure that the national market is regularly supplied in the best conditions.

Benali indicated that the Ministry of Energy is working to follow up the implementation of projects programmed by private companies to develop additional storage capacities for storing petroleum materials amounting to 540,000 cubic meters, or about 13 additional days of consumption, with an investment of approximately two billion dirhams ($190 million) during 2023. , which would make it possible to cover 44 days of consumption.

On October 13, 2022, the Ministry of Energy, in partnership with the Ministry of Equipment and Water, launched the work of the Energy Infrastructure Planning Committee, which works to plan energy flows in a balanced manner and prepare the necessary infrastructure in order to improve Morocco’s logistical competitiveness on the one hand, On the other hand, maintaining its energy security.

Leila Benali indicated that, based on the results of the study, a new system for the management of reserve stocks will be put in place, within the framework of a partnership between the public and private sectors, in order to enhance stocks of oil derivatives, according to the level required by laws, while working to distribute storage capacities in a balanced manner across all parts of Morocco.

2030 plans

Last year, Minister of Energy Transition and Sustainable Development, Leila Benali, revealed a plan to raise the level of oil derivatives stocks with investments of 5 million dirhams ($490 million).

She explained that 3 million dirhams ($290 million) will be invested by companies in the storage of liquefied natural gas and butane gas, and 2 billion dirhams to enhance the storage of gas-diesel-gasoline.

And she stressed that the ministry is working on implementing a plan to increase an additional total capacity of up to 890,000 cubic meters by 2030, in order to raise the national stockpile, to reach the legally specified level in 60 days.

The following infographic, prepared by the energy platform, reveals changes in fuel prices in Morocco during 2022:

related topics..

Also read..

Leave a Reply