Over the past year (2022), Saudi Aramco was able to achieve important results, which the company’s leaders see as a giant turning point in the oil giant’s career.

Aramco’s leaders revealed, in messages carried by its sustainability report, the company’s significant contribution in new sectors, with the aim of achieving a comprehensive, stable and deep transformation in the energy sector, along with reducing emissions of the hydrocarbon sector, paving the way for achieving carbon neutrality by the middle of the century.

And Aramco announced, on March 12 (2023), achieving unprecedented records of revenues amounting to $ 161.1 billion, and free cash flows amounting to about $ 148.5 billion, according to information seen by the specialized energy platform.

A future with lower carbon emissions

The Chairman of the Board of Directors of Saudi Aramco, Yasser bin Othman Al-Rumayyan, said that the year 2022 witnessed a strong recovery in crude oil prices, in light of a state of uncertainty regarding the global economy.

Al-Rumayyan explained that the Saudi company was not affected by this ambiguity, and remained steadfast in achieving its goal of achieving energy security for its customers, in light of continuing its endeavors and plans to implement the energy transition process in a practical, stable and comprehensive manner.

The company’s chairman confirmed that the company achieved a record financial performance in 2022, which brought its net income to about $161.1 billion, which allowed it to improve its financial position list, and at the same time continue its largest capital investment programs ever.

Yasser Al-Rumayyan pointed out that the Saudi Aramco Board of Directors announced cash dividends of $19.5 billion for the fourth quarter of 2022, raising cash dividends by 4%, compared to the previous year 2021, according to statements seen by the specialized energy platform.

The leadership of Saudi Aramco believed that the rise in global crude oil prices, driven by the high volume of global demand, which had a significant impact on the company’s results, strengthens the exploration and production sector strategy, which focuses on large-scale investments in new sources of production.

According to Al-Rumayyan, this aspect includes increasing the volume of gas business, and raising the maximum sustainable production capacity of crude oil from 12 to 13 million barrels per day, as the company considers this additional production capacity important in the future global energy mix, in light of expectations of high energy demand and a deficit investments.

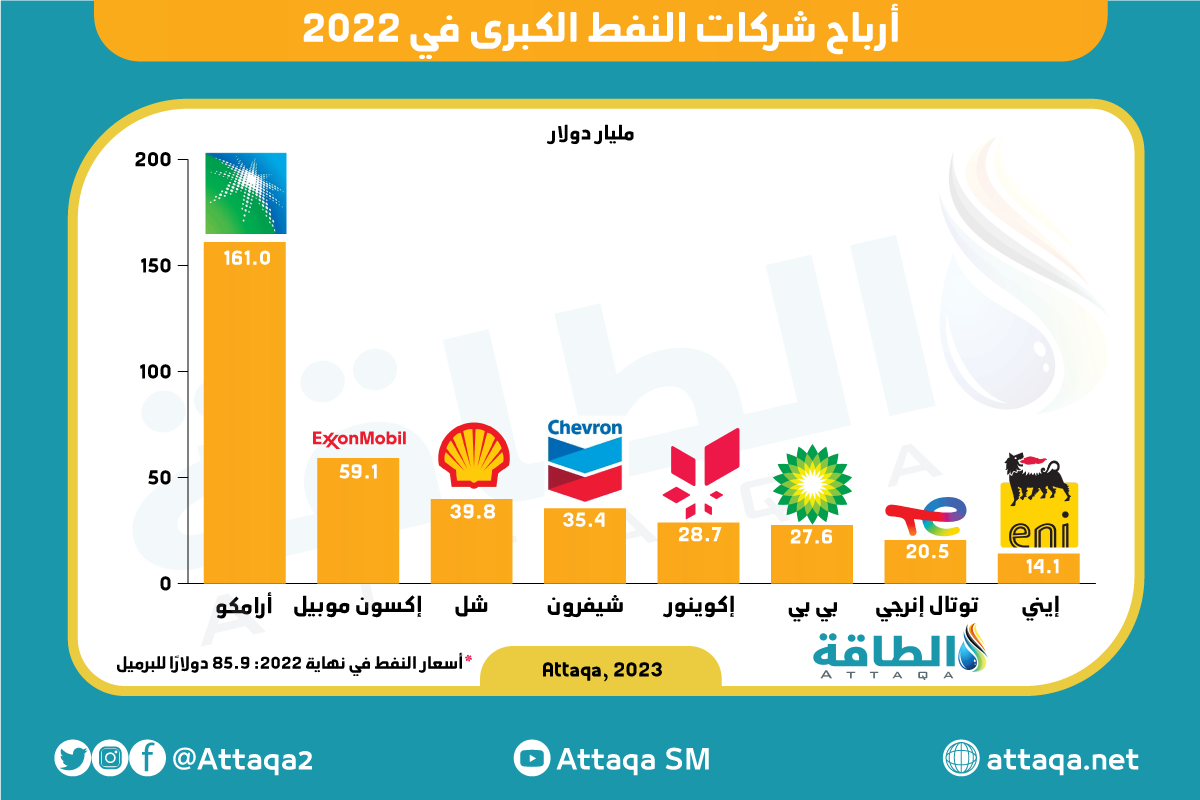

The chart below, from the specialized energy platform, shows a comparison of the profits of the major oil companies in 2022, as Aramco significantly outperforms its closest competitor.

Al-Rumayyan indicated that Saudi Aramco focuses primarily on greenhouse gas emissions, so it continues to work with the automotive industry to develop low-emission industrial fuels, as well as developing highly efficient engines, in addition to cooperating with the industrial sector to develop complementary solutions for steel and cement.

A fundamental role in the transformation of the energy sector

The President and Chief Executive Officer of Saudi Aramco, Amin Al-Nasser, said that the year 2022 was full of outstanding achievements for the company on several very important levels.

He added: “On the financial front, the company achieved the highest annual profits, thanks to the rise in global crude oil prices over the past year. On the operational front, the company began implementing the largest capital spending program in its history, driven by a growth strategy and an ambition to achieve carbon neutrality.”

The CEO of Saudi Aramco pointed out that the company – on the geographical level – continued to expand its business in the refining, chemicals and marketing sectors, by implementing strategic investments in Asia and Europe.

On the local level, according to Al-Nasser, the company has expanded its efforts aimed at strengthening its supply chain, while at the same time providing assistance to drive economic growth in the Kingdom, according to statements seen by the specialized energy platform.

And he continued: “In 2022, Saudi Aramco continued to enhance its crude oil production capabilities, including its continuous efforts to increase the maximum sustainable production capacity of crude oil by an additional one million barrels per day by 2027.”

Engineer Amin Al-Nasser expected that Aramco would be able to provide part of this additional quantity of one million barrels per day, during the year 2025, from the marine fields of Al-Marjan and Al-Bari, in the Kingdom of Saudi Arabia, stressing that the company’s management is working to prepare it strategically to play a fundamental role in achieving a transformation Practical, stable and comprehensive in the energy sector.

The President and Chief Executive Officer of the Saudi company indicated the continuation of the development work of the Jafurah unconventional gas field, of which initial production is expected to start in 2025, and to gradually increase natural gas production to two billion standard cubic feet per day, by 2030.

Long term value creation

In turn, the Executive Vice President and Chief Financial Officer of Saudi Aramco, Ziyad bin Thamer Al-Murshid, said that the company’s achievement of exceptional financial results during the past year 2022 came to overcome a state of uncertainty surrounding the global economy.

Al-Murshid explained, during a message carrying the Saudi company’s sustainability report, the company’s unprecedented financial results during the past year, which enhance its continuous ability to achieve value for its shareholders through various price cycles, in addition to providing stable energy supplies to its customers.

He pointed out that the energy market witnessed two different trends during the past year, in the first half of which an upward trend in prices appeared due to the decline in stocks of oil and refined products, in addition to geopolitical events, while the market witnessed in the second half of the year a state of weakness, due to the impact of inflation fears on the growth of demand for energy. oil.

However, the company, according to the guide, continued its policy of ensuring the strength of its financial position, its ability to generate cash, and manage indebtedness, in addition to achieving exceptional returns for shareholders, as it recorded at the end of the year ending on December 31, 2022, 161.1 billion dollars, and free cash flows of 148.5 billion. Billion dollar.

Regarding Saudi Aramco’s investments in the energy transition, the company’s chief financial officer said that it invests in key solutions related to the transformation of the energy sector, including the development of cleaner fuel technologies, low-carbon hydrogen, renewable energy sources, and carbon extraction, storage and use.

Al-Murshed stressed that these future investments are witnessing progress, as the company – through its subsidiaries such as SASREF and SABIC – obtained the world’s first independent certification for the production of blue ammonia and blue hydrogen, during the third quarter of fiscal year 2022.

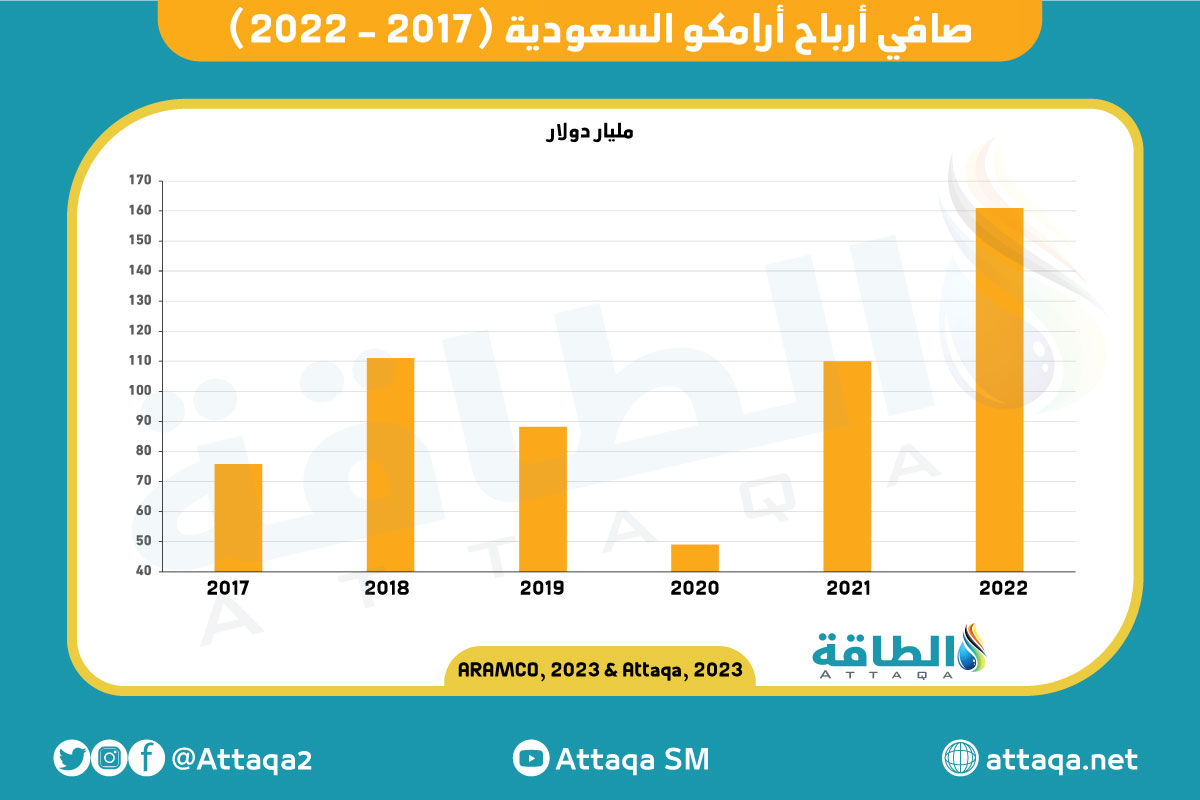

The graph below shows Aramco’s net profits from 2017 to 2022, according to the company’s data, which was monitored by the specialized energy platform.

4 strategic areas for the future

Saudi Aramco is working to consolidate its position in the future, as a source of reliable energy supplies – including oil – at reasonable prices, and at the same time adopting the reduction of carbon emissions from conventional sources, according to the data of the sustainability report, which was seen by the specialized energy platform.

In order to achieve this vision, the Saudi company focuses on 4 strategic areas within its business, namely:

Leadership in exploration and production

Saudi Aramco views the exploration and production sector as a major driver of value creation, so it aims to maintain its position as the largest oil company in the world in terms of production quantities, and one of the lowest cost oil producers.

In addition, Aramco is able, thanks to its huge base of reserves, spare production capacity, as well as operational flexibility, to respond effectively to changes in oil demand.

Downstream integration

Aramco owns a private network of local and international refineries, wholly owned and affiliated with it, to ensure greater benefits from the production of its exploration and production sector.

Thanks to this strategic integration, Aramco achieves additional value through the various stages of the hydrocarbon value chain, according to the data seen by the specialized energy platform.

Low carbon initiatives

The Saudi company aims to reduce carbon emissions associated with its business and support the global transformation in the energy sector, by developing low-emission products and solutions in the energy, chemicals and materials sectors.

Emiratisation and support for national development

The company assists in developing the energy system in Saudi Arabia, to become more diversified and sustainable, and to be able to compete globally to enhance the competitiveness of the company, in addition to supporting economic development in the Kingdom.

related topics..

Also read..

Leave a Reply