Diesel exports from the Middle East to Europe hit a record high in April 2023, with the old continent seeking to secure its supplies away from Russia, in implementation of the sanctions imposed on Moscow following its invasion of Ukraine and its attempt to deprive it of the tools to finance this war that has been going on since February 2022; This displaced Russia as the largest supplier and significantly changed the flow of global shipments.

Total exports amounted to about 634,000 bpd in April, up from 534,000 bpd in March, according to data published by S&P Global.

Diesel exports from the Middle East to Europe last month were the largest since at least 2016, according to data monitored by the specialized energy platform.

Diesel exports from the Middle East to Europe in April

S&P Global Commodities data showed that Belgium remained the largest destination for diesel exports from the Middle East to Europe in April, at 151,000 barrels per day.

Saudi Arabia was the largest supplier of diesel to the old continent at 331,000 barrels per day, according to data seen by the energy platform.

The Emirati port of Khorfakkan – which competes with the nearby oil trading center in Fujairah – recorded the first diesel shipment to Western Europe since July 2021 at 11,000 barrels per day in April.

This shipment also comes after the European embargo imposed on Russian oil derivatives reached its third month, as part of a series of sanctions against Moscow, in response to its war in Ukraine.

Omani diesel shipments to Western Europe jumped to 13,000 bpd in April, the most since October 2022.

Diesel exports from the Middle East to Europe declined

Despite this, diesel exports from the Middle East to Western Europe are set to slow in May 2023.

The total shipments for the month of May have so far reached only about 163,000 barrels per day, according to information monitored by the specialized energy platform.

“The route from the Middle East to Europe has been closed for most of the month,” said Heidi Grati, head of refining research in Europe and the CIS at S&P Global.

He explained that refineries are well meeting the European demand for European diesel after returning from maintenance, as well as signs of slowing domestic demand, and inflated inventories in the regions of Amsterdam, Rotterdam and Antwerp.

“As a result, more diesel fuel in the Middle East has moved east and south instead,” Gratti added.

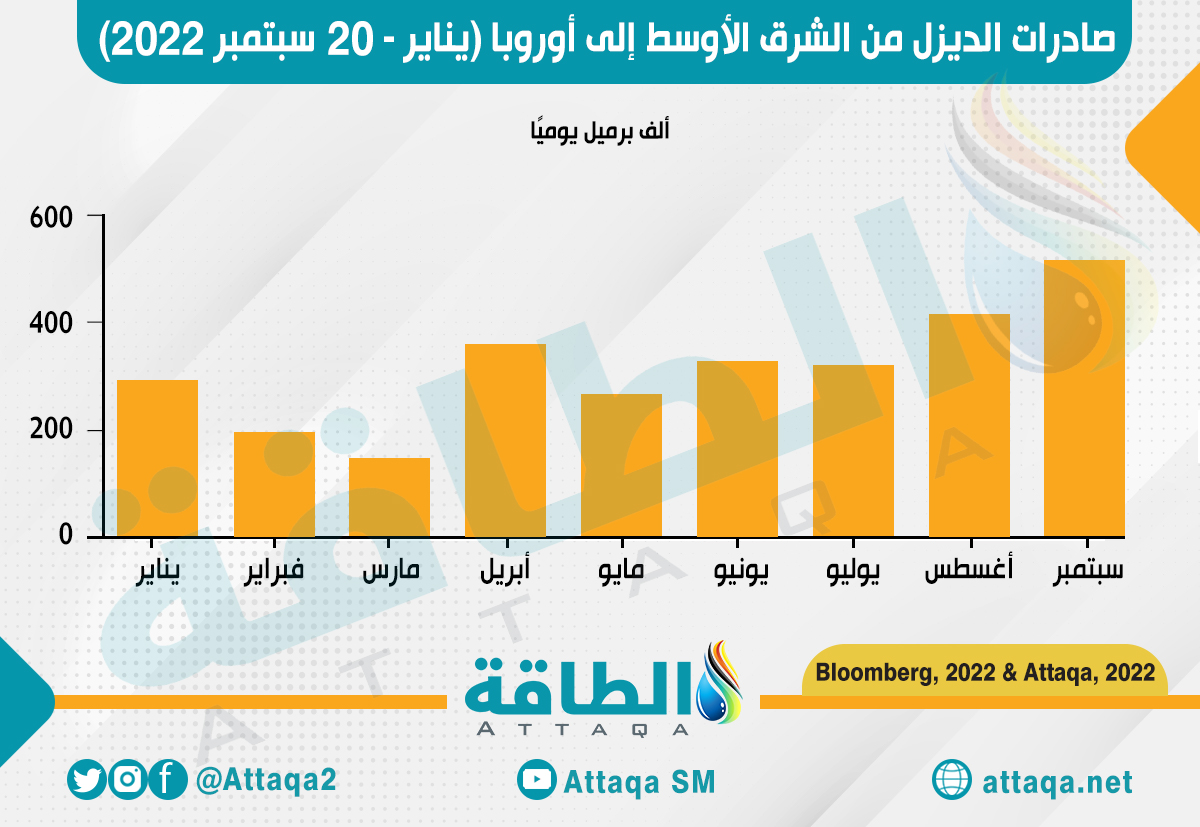

The following graph – prepared by the specialized energy platform – shows diesel exports from the Middle East to Europe, during the first 9 months of 2022:

The hegemony of the Middle East.. and the enhancement of refining capabilities

Russia’s dominance in the supply of European oil products was turned upside down by the Ukraine war. Russia was the main exporter of diesel and red diesel to Western Europe before the war.

However, the Middle East took over in the first quarter of this year (2023), at 369,000 barrels per day, according to S&P Global forecasts issued on May 11, 2023.

By the second quarter of 2024, diesel exports from the Middle East to Western and Eastern Europe are expected to reach 505 thousand barrels per day.

The Middle East is brimming with new refineries to meet demand from Europe. With capacity increasing in Saudi Arabia, Kuwait, Iraq and Oman, while the giant Ruwais complex in Abu Dhabi is being upgraded.

Designed to process domestic crude, these projects will help boost crude distillation capacity in the Middle East to 10.04 million barrels per day by the end of 2023, an increase of nearly 20% in just 5 years, according to the S&P Global World Refinery database.

The Kuwaiti Al-Zour refinery exported the first “winter” diesel shipment to Europe in December 2022, estimated at 66,000 metric tons.

The Saudi Jizan refinery is also expected to eventually become a major supplier of diesel to Europe.

Saudi imports of Russian diesel

In a related context, Saudi Arabia’s imports of Russian diesel recorded a record level in May (2023); Which allowed his role in increasing the Kingdom’s exports to Singapore.

Saudi Arabia is expected to import up to 500,000 tons (3.7 million barrels) or more of Russian diesel in May, most of which will arrive at Ras Tanura, where one of the state-run Aramco refineries is located, according to Reuters.

Meanwhile, volumes of diesel coming from the kingdom to Singapore are set to reach around 400,000 tonnes (2.92 million barrels), an unprecedented level, according to data from Refinitiv and Vortexa.

However, it is unclear whether Saudi Arabia is hoarding some of its own production and shipping Russian diesel supplies via exchanges instead, since both have typical diesel specifications.

related topics..

Also read..

Leave a Reply