Russian companies tended to reduce offers of generous Russian oil discounts offered to China and India, the largest Asian and global economies, amid fierce competition for demand over the past months.

Private Indian refineries are competing with their Chinese counterparts for future purchase contracts for Russian Espoo crude for delivery in April (2023), according to Reuters.

And the competition for Russian oil among the largest Asian economies contributed to giving Russian companies space for price maneuvering, by reducing the attractive discounts granted to Beijing and New Delhi since the outbreak of the Ukrainian war last year (2022), according to what was monitored by the specialized energy platform.

Russian companies also reduced the volume of exports of the main Urals crude by 10% during the month of March 2023, in an attempt to thirst the market and reap higher returns from selling its crude oil at lower discounts to the largest Asian economies.

Independent Chinese refineries prefer the light Russian Espoo crude for reasons related to its good technical specifications, which made them among the largest buyers of it in Asia.

43 million barrels on the way

Chinese refineries have contracted record shipments of Russian oil, and they are expected to arrive at Chinese ports in stages during March 2023.

The quantities contracted for their arrival amounted to about 43 million barrels, including 20 million barrels of Espoo crude, 11 million barrels of Urals crude, and 12 million barrels of other Arctic Russian crudes.

Russia produces different types of heavy and light oil, most notably the main Urals crude, East Siberia and the Pacific Ocean blend, Sokol blend, and Sakhalin blend.

It also produces Farandi Blend, Novi Port Blend, Espoo Blend and Arko Heavy Sour Blend. Most of these brands were sold to European refineries before the Ukraine war, but the sanctions imposed on Russia forced it to change its direction to Beijing and New Delhi.

Indian companies crowd out

Chinese refineries often receive Espoo crude from the Russian Pacific port of Kozmino, due to its geographical proximity to Chinese ports, according to the specialized energy platform.

Recent data showed the entry of major Indian refiners into fierce competition for future contracts for Espoo crude, which is favored by its Chinese counterpart.

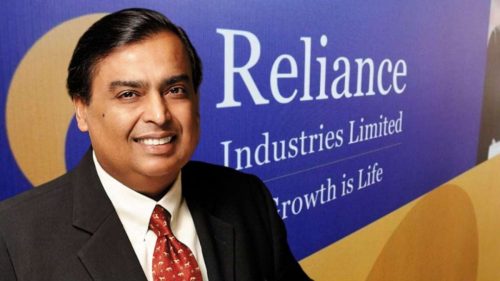

And the Indian companies Reliance Industries Limited and Nayara Energy seized 5 out of 33 shipments of Espoo crude that were destined for China at low prices during the month of April 2023.

Indian refiners did not succeed in seizing this number of Espoo shipments during the past months, as they obtained one shipment for delivery in March 2023, according to data from Kepler, a company that specializes in tracking ships and oil tankers.

Other data from Refinitiv, which also specializes in tracking, showed that Indian refiners obtained 3 shipments of Espoo crude in November 2022, making next April shipments the highest in nearly 5 months.

$5 less than Dubai crude

Moscow sold Espoo crude cargoes to India – for April 2023 delivery – at prices $5 less than comparable Dubai crude prices on a FSC basis, according to the specialist energy platform.

Indian refiners often contract to buy Russian oil on a delivery basis, which means Russian companies bear the cost of insurance, freight and vessels.

Since December 5 (2022), Russia has been forced to sell its raw materials at prices below the maximum price imposed on it by the European Union and the Group of 7, which is $60.

The rise in demand in China and India during the past months contributed to the recovery in the prices of some Russian crude oil, and its return to levels that exceed the maximum limit, while other crudes remained trading in the Asian markets at just under $60.

over $60

Prices of Russian low-sulphur oil that India is buying have risen above $60 a barrel – for April 2023 delivery – and China’s refiners’ favorite Espoo crude has also risen above the level, according to Reuters calculations.

Russian crude prices rose on China due to shrinking discounts, as the discount granted on Espoo crude loaded to Chinese ports – for April 2023 delivery – decreased to $6.8 a barrel, compared to $8.5 a barrel in contracts for March 2023 delivery.

Russian raw materials still enjoy a high price attractiveness to Chinese and Indian refineries alike, despite the decrease in their discounts by values ranging between 2 and 3 dollars in recent contracts.

Murban crude above $9

The sale of Emirati Murban crude – similar to Espoo crude – was sold at a price of $ 9 more than its Russian counterpart in contracts for April 2023 delivery, according to what was monitored by the specialized energy platform.

Espoo crude exports by sea averaged 800,000 barrels per day in 2022, representing 17.3% of all Russian seaborne oil exports.

While the average exports of the main Urals crude amounted to approximately 1.74 million barrels per day during the past year (2022), according to data from Kepler, a company specialized in tracking the movement of ships and tankers.

It is expected that the demand for Russian raw materials in China will increase in the coming months, driven by the recovery of domestic demand for fuel in industry and transportation, after Beijing eased the precautionary measures against Corona since January 2023.

Jump shipping rates

China is awaiting the arrival of record shipments from Moscow of more than 43 million barrels in March 2023, including 20 million barrels of Espoo crude alone, according to Reuters.

In the coming months, China will face the problem of high freight rates for tankers carrying Russian oil from the Russian port of Kozmino, the main hub for exporting Espoo crude to Beijing.

Freight rates to China rose to an all-time high in February 2023, to record $2.4 million, before falling to $2.3 million for shipments agreed to be transported during March 2023.

It is noteworthy that Indian companies use currencies other than the dollar to buy Russian raw materials, and also avoid banking transactions through Western banks to avoid European sanctions, in addition to avoiding Chinese state refineries to disclose their data periodically, according to what was monitored by the specialized energy platform.

related topics..

Also read..

Leave a Reply