Russian oil shipments had to change course, after harsh Western sanctions that followed the war on Ukraine in February 2022.

Although the West aimed, behind these restrictions, to dry up the sources of funding for the Russian war led by Vladimir Putin, Moscow succeeded – unexpectedly – in making the most of the new situation, and attracted alternative markets armed with its cheap prices.

The most prominent of these countries were Saudi Arabia and the UAE, which found an opportunity to import, store and re-export Russian oil, despite strong US efforts to persuade them to join the Western campaign against Moscow, according to a report published by the “Oil Price” website, which was viewed by the specialized energy platform.

Ship tracking and commodity services data revealed that Saudi Arabia and the UAE (although they have huge reserves) tended to import diesel, naphtha and fuel oil from Russia.

The UAE

An embargo, approved by the European Union, on imports of Russian refined petroleum products transported by sea entered into force on February 5.

And after Europe closed the doors in his face, about one million barrels per day of Russian diesel, naphtha and other types of fuel were forced to search for other countries to receive it.

The UAE has emerged as a major international center for the import, trade and redistribution of Russian oil, after Western countries imposed restrictions and price ceilings on crude oil and other Russian oil products.

Russian oil exports to the UAE hit a record high in the past 2022, and tripled compared to 2021, to record 60 million barrels, according to data from Kepler, a ship tracking company that was monitored by the Wall Street Journal.

Fujairah – the largest commercial center in the Emirates – currently receives a lot of Russian oil products, whose volumes now rank second after fuel oil coming from Saudi Arabia, according to estimates by the “Argos Media” agency concerned with energy news.

The commercial director at Fujairah Ports (VTTI) Maha Abdul Majeed said last March that the port of Fujairah – the third largest refueling center in the world – witnessed a large flow of Russian oil, especially Urals and naphtha.

The following graph – prepared by the specialized energy platform – shows Russia’s production since the start of the invasion of Ukraine:

Saudi Arabia

Saudi Arabia is the largest exporter of crude oil in the world, and together with Russia, it forms the leadership front of the Organization of Petroleum Exporting Countries (OPEC) and the OPEC + alliance, which has been coordinating crude oil supplies to the global market for more than 6 years.

Russia began exporting fuel to Saudi Arabia at the beginning of this year (2023); The Kepler data indicates that Moscow has now sent about 100,000 barrels of fuel to Saudi Arabia, compared to zero imports before Russia’s invasion of Ukraine.

Russian diesel exports to Saudi Arabia also appear to be accelerating, whether through direct shipments or ship-to-ship transfers.

Moscow is resorting to ship-to-ship transfers of Russian oil to shorten the paths of tankers heading to Africa and Asia, according to the report seen by the specialized energy platform.

Russia began exporting diesel to Saudi Arabia in February, according to Reuters, citing merchants and ship-tracking data.

other Arab countries

Other countries receive Russian fuel flows to third countries through a price cap, if the deal is carried out through Western insurance companies.

Russian diesel is capped at $100 per barrel under the price cap, while the price of low-cost petroleum products is set at $45 per barrel.

Russian diesel exports jumped 33% in March, and shipments that left Russian ports on the Black Sea went to regions in the eastern and western Mediterranean, such as Libya, Egypt and Tunisia.

Pamela Monger, senior market analyst at Vortexa, said that the exports of the Baltic Sea ports “have shifted to equal percentage shares to Brazil, Saudi Arabia, Egypt and Morocco.”

“Some of the Russian oil trading patterns are consolidating, as the landscape continues to change,” said Serena Huang, Head of Analytics for Asia Pacific at Vortexa.

“India and China have emerged as Russia’s two largest strategic trading partners, and each accounted for a third of Russia’s total oil imports in March,” Huang said.

Huang said, “Looking at the alternative markets for Russian oil after the EU ban, we see an interesting differentiation of crude oil, naphtha and fuel exports to countries in Asia and the Middle East, while diesel exports witnessed more diversification, heading towards Saudi Arabia, Turkey, Brazil and others.”

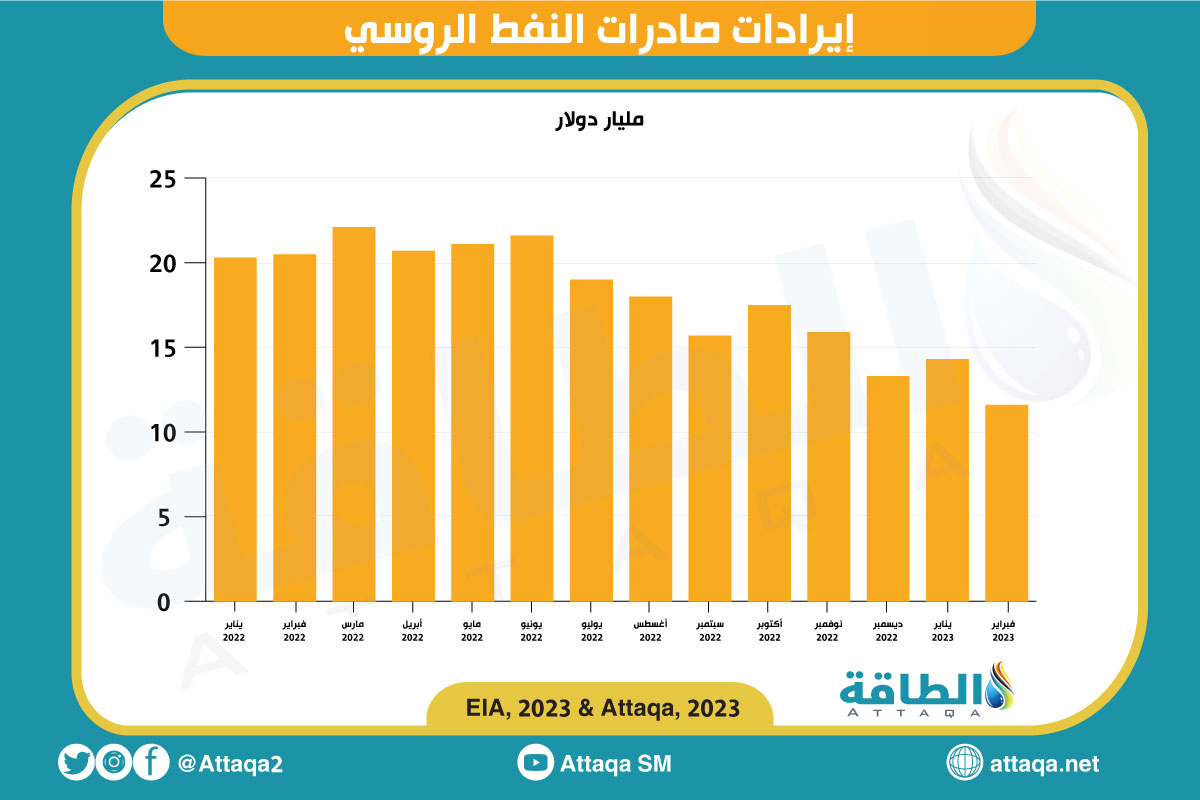

The following graph – prepared by the specialized energy platform – shows the revenues from Russian oil exports since the start of the invasion of Ukraine:

Weak American position

The administration of US President Joe Biden has failed to persuade his strategic allies in the Gulf to abandon importing tempting Russian oil and join an anti-Russian Western alliance.

Russian fuel exports to Saudi Arabia and the UAE are clear evidence of the weakness of US influence over its main allies in the Middle East.

Undersecretary of the Treasury for Terrorism and Financial Intelligence Brian Nelson traveled to the Middle East and Turkey in early April.

During visits to Oman, Abu Dhabi, Dubai and Turkey, Nelson “discussed the Treasury Department’s efforts to thwart Russia’s attempts to sidestep international sanctions and export restrictions imposed in the wake of its brutal war on Ukraine.”

related topics..

Also read..

Leave a Reply