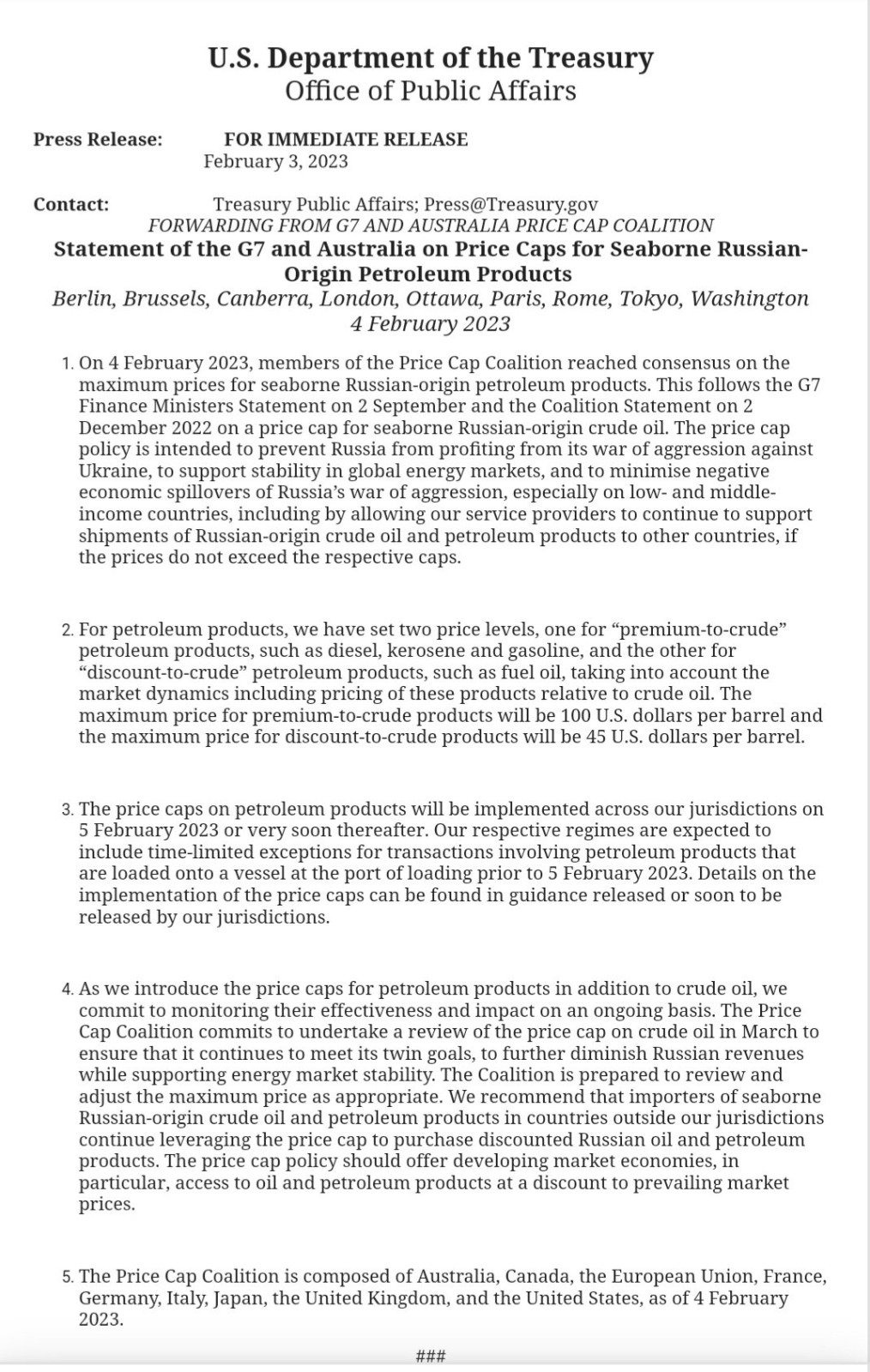

The countries of the European Union, the Group of 7, and Australia agreed on the new price ceiling for Russian oil derivatives, which is scheduled to enter into force starting tomorrow, Sunday, February 5 (2023).

And the countries, which met on Friday night, February 3, announced that they had reached an agreement on a new price ceiling for Russian oil derivatives, in a move aimed at imposing more restrictions on Russia’s oil revenues, to restrict President Vladimir Putin’s ability to finance his war in Ukraine. , according to Reuters news agency.

The price ceiling for Russian oil derivatives targeted setting the price of higher-priced products such as diesel fuel and gasoline at $100 per barrel, while the value of lower-quality products was set at $45 per barrel, according to information seen by the specialized energy platform.

It is noteworthy that the European Union imposed an embargo last December 5 (2022) on Russian oil transported by sea, and agreed with the Group of 7 industrialized countries to set a ceiling for the price of this oil at $ 60 a barrel.

A new response to war

Sweden, in its capacity as president of the current session of the European Union, announced that the new agreement on the price ceiling for Russian oil derivatives is important, as it comes within the framework of the continuous response of European countries and their partners to the Russian invasion of Ukraine.

It is expected that the new level of the ban at the level of the European Union will enter into force, starting tomorrow, Sunday, February 5, 2023, targeting Russian oil derivatives such as gasoline, diesel and heating fuel transported by sea, according to information obtained by the specialized energy platform.

Under the new agreed decision, the European Union prohibits European ships from carrying oil derivatives of Russian origin, unless the purchase documents are subject to the price ceiling approved by the coalition, or less than it, which also applies to technical, financial, brokerage and insurance services companies.

In conjunction with the entry of these derivatives under penalty of sanctions, the application of the ceiling on the prices of Russian oil derivatives exported to the global markets begins, which is scheduled to be re-reviewed next March, to determine its feasibility and the possibility of moving it in order to obtain stronger results.

The new ceiling came in line with the proposals of the European Union, which tried to take into account not to anger hard-line countries regarding the imposition of sanctions, such as the Baltic countries and Poland, and countries that want to ensure continued access to Russian oil derivatives, and are keen on their access to global markets to ensure that prices are not raised.

America welcomes the new roof

US Treasury Secretary Janet Yellen welcomed the new decision, considering it a continuation of previous efforts aimed at undermining Russian President Vladimir Putin’s ability to finance his war against Ukraine, according to the specialized energy platform.

She added, “The agreed ceiling on oil derivatives prices would play a pivotal role in the work of the international coalition, which is about to force Putin to choose between financing his brutal war in Ukraine or saving his economy, which is facing crisis.”

The United States of America played an important role in pushing the European Union and the G-7 major industrial countries to adopt strict policies towards the government of President Vladimir Putin, by imposing price ceilings on crude oil and then Russian oil derivatives.

It is noteworthy that Moscow relies mainly in its economy on oil and gas revenues, which are estimated at billions of dollars, which are directed to financing the state budget, and the sanctions and price ceilings come as a new crisis that adds to the burdens of its crisis economy.

According to data, Russia’s budget revenues from the energy item last January decreased by 54%, to 425 billion rubles ($6 billion), compared to December (2022) data of 931.5 billion rubles ($13.2 billion). Despite the increase in revenues after Gazprom paid an exceptional tax, according to Reuters.

related topics..

Also read..

Leave a Reply