The head of the OPEC Conference, Gabriel Mbaga Obiang Lima, called for caution before making any change to the production quotas of the OPEC+ alliance.

Obiang Lima – who chairs the 2023 OPEC conference – confirmed that it would be “wise” for the OPEC + alliance to wait until there is more clarity about the future of the oil market before adjusting production targets.

He made it clear – speaking during a briefing organized by the African Energy Chamber – that the group should be “cautious” in planning its policy in view of the great uncertainties facing the market, according to what was reported by the “Argus Media” platform.

Obiang Lima is the Minister of Oil in Equatorial Guinea, a member of OPEC, and he succeeded Congolese Oil Minister Bruno Jean-Richard Itua in the OPEC presidency on January 1, 2023, according to information monitored by the specialized energy platform.

Cautious approach and uncertainty

At its last ministerial meeting in December, the OPEC+ alliance chose to extend the cut in the production ceiling of 2 million barrels per day agreed at the previous meeting in October (2022), citing similar concerns about the uncertain market outlook.

The group has said – since then – that the decisions of October and December helped to achieve balance in the oil market.

Although ministers will not meet again until June 4, the Joint Ministerial Monitoring Committee is scheduled to meet on February 1 to discuss the market and assess whether any change in production policy is needed.

Obiang Lima said the group would monitor future developments pending that meeting, but urged a cautious approach, particularly in light of new uncertainty around the pace of oil demand recovery in China, following Beijing’s abrupt decision to end its coronavirus crackdown policy last month.

He also described 2022 as “very special”, with a host of competing factors making it “extremely difficult” for OPEC and its non-OPEC partners.

“We had a lot of events,” Obiang Lima said, “a big conflict between Russia and Ukraine, and also a complete change in the resource flows coming from Russia all the way to Asia.. Europeans were diversifying their energy sources, and you had a group of African countries, and even some developing countries.” The other, she says, rejects the idea of giving up fossil fuels.

expected recession

Obiang Lima said it is clear that Chinese demand and the fallout from the war in Ukraine are “the two main issues that everyone is watching closely”, but the possibility of a broad recession is also on OPEC’s radar.

“We are going into 2023 with many countries entering a recession,” he said. “Countries will need to reassess their budgets and economies.”

The British bank Barclays – in its recently released forecasts for the first quarter of 2023 – indicated that advanced economies – led by the eurozone and the United Kingdom – are “heading into recession” and that the US economy is “likely to contract”.

Obiang Lima acknowledged that high inflation and economic slowdown in advanced economies could limit oil demand in the short term, but said he expected a strong recovery in consumption by the end of this year (2023) and into 2024.

“Everyone will want to avoid going into a recession, and those who do go into a recession will want to make sure it’s for the shortest possible time,” he said.

Oil demand growth

In a related context, OPEC kept its expectations for oil demand growth unchanged in 2022 and 2023, as well as estimates of oil supply from outside it.

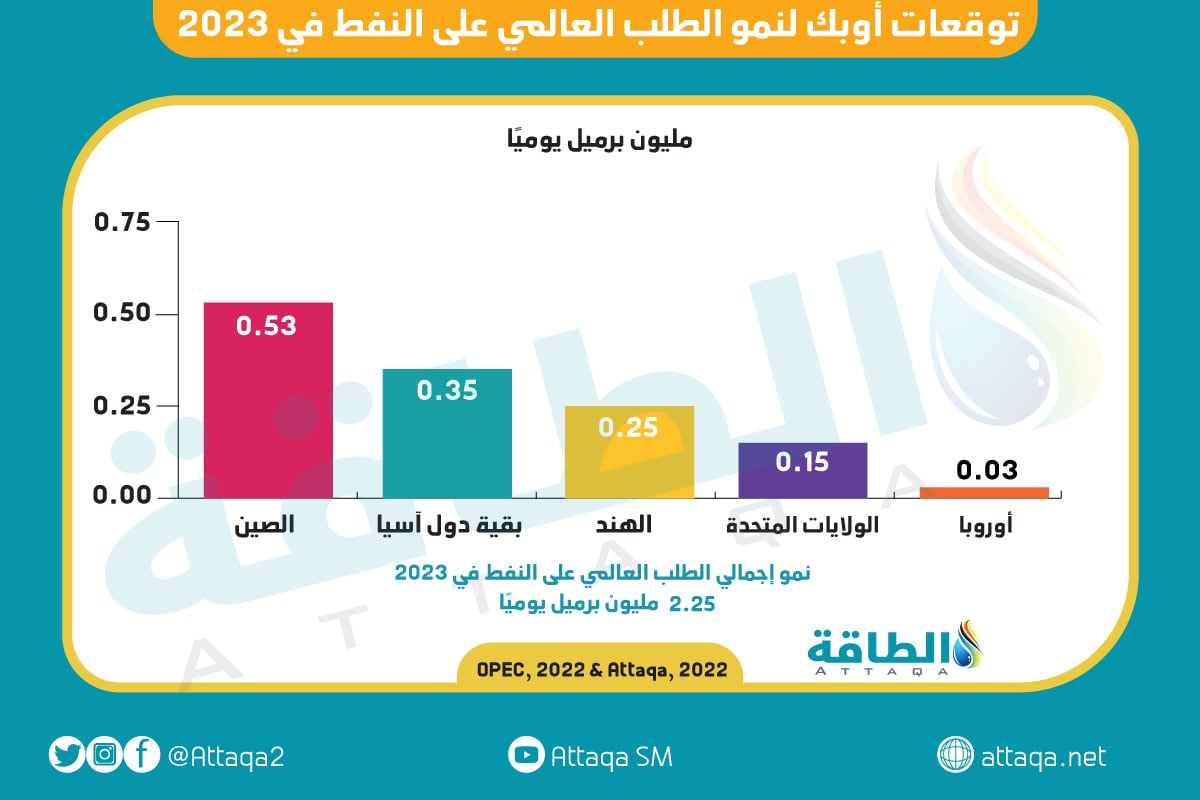

The organization expected global oil demand to grow by about 2.25 million barrels per day during 2023, almost unchanged from the November 2022 forecast.

This means that the world’s total oil consumption may reach 101.80 million barrels per day in 2023, according to the monthly report issued by the Organization of Petroleum Exporting Countries on December 13, 2022.

The following chart – prepared by the Energy Research Unit – shows the organization’s expectations for global oil demand growth in 2023:

OPEC expected oil supply from outside the organization to grow by 1.54 million barrels per day in 2023, unchanged from previous estimates, for a projected total of 67.11 million barrels per day.

Oil supply growth is likely to come from the United States, Norway, Brazil, Canada and Kazakhstan, while production declines from Russia and Mexico are likely.

The report stressed that the expected improvement in geopolitical conditions and the containment of coronavirus infections in China support the growth of global oil demand in 2023.

On the supply side, there are still big doubts about EU sanctions on Russian oil imports, and the potential for US shale oil production in 2023.

related topics..

Also read..

Leave a Reply