Petroleum Development Oman leads the energy sector in the Sultanate. As it is responsible for producing the largest percentage of crude oil and natural gas, its concession area covers the equivalent of a third of the country’s geographical area, and it owns about 205 producing oil fields and 64 fields for natural gas production.

In this regard, PDO General Manager, Steve Phimster, says that his company is a major player in the oil and gas sector in the Sultanate of Oman, and is also among the world’s largest pioneers in enhanced oil recovery technologies, according to an interview he had with The Energy Year. energy year) specialist.

The company produces between 650,000 and 660,000 barrels of oil equivalent per day, more than 100,000 barrels per day of oil derivatives, and 60 million cubic meters per day (2.12 billion cubic feet) of gas, according to Phimster.

It is noteworthy that PDO is 60% owned by the government, while the rest of the shares are distributed between Dutch Shell (34%), French Total Energy (4%), and Thai PTTEP (2%), according to the company’s official website. .

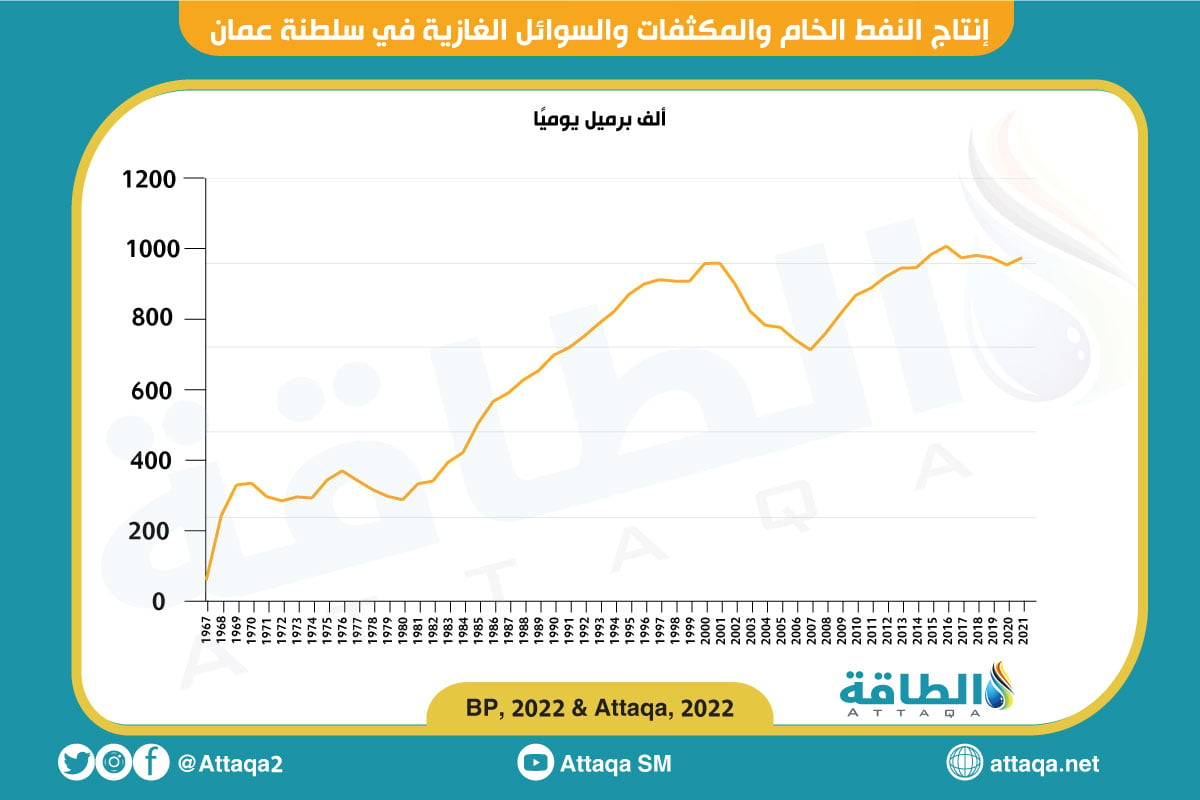

Oil and gas production in the Sultanate of Oman

The oil and gas sector in the Sultanate of Oman is the largest supporter of the economy. It contributes 80% to total public revenues, and hydrocarbons supported the Sultanate by about 1.674 billion Omani riyals ($4.34 billion) by the end of February 2023.

“In 2022, oil and gas accounted for about 85% of the Sultanate’s revenues, and the average price of crude oil sales was $95.4. This highlights the importance this industry holds for the country, whose economy is based on hydrocarbons,” Phimster said.

“Our goal is to preserve the oil revenues on which the Omani economy depends,” he added.

He continued, “Our goal in the medium term is to produce more than 700,000 barrels per day of oil equivalent, and perhaps 800,000 barrels per day of oil equivalent, which is a significant increase that will be achieved at the same time that emissions are halved by 2030.”

Carbon Neutrality 2050 Journey

Hamster stressed the necessity of diversifying the economy as an important element to ensure future growth, pointing in this regard to the role of PDO and Oman’s Vision 2040 to promote the development of the non-hydrocarbon economy, in addition to the pledge of Sultan Haitham bin Tariq, in October during the activities of the COP27 climate summit, achieve carbon neutrality by 2050.

“Our new goal is to build a sustainable, low-carbon economy to maximize the value of Oman,” said the Managing Director of PDO.

He added that the Sultanate has set clear sectoral goals and a roadmap to achieve carbon neutrality, but the results depend on the response of the various sectors and the plans that are currently under development.

For its part, PDO has set the goal of achieving carbon neutrality by 2050 in mid-2021, in addition to the goal of halving emissions in 2030, while continuing to develop its projects. The company is also working with other parties in the oil and gas sector, within the framework of the 2050 plan. According to Phimster.

He added that the decarbonization journey in Oman is based on 5 axes, which are cost competitiveness, carbon competitiveness, sustainable growth of hydrocarbons, diversification of revenue sources, support for the ownership and operation of infrastructure for energy facilities and offloading of oil and water.

Phimster explained that his company is among the highest oil and gas producers in terms of cost competitiveness, in light of macroeconomic analyzes and forecasts that indicate a decline in overall prices, and it is also possible to introduce carbon prices, stressing that success requires achieving the element of competitiveness, with the tools to achieve this.

On carbon competitiveness, the company’s general manager said, “We have a complete decarbonization action plan, which includes projects for energy efficiency, gas flaring reduction, fugitive methane removal, waste water disposal, carbon capture and sequestration, low-carbon fuels and nature-based solutions.”

The following chart, prepared by the Energy Research Unit, monitors the volume of oil, condensate and liquids production in the Sultanate of Oman in 2022:

Carbon capture and storage

“PDO’s commitment to sustainability is strong and deep-rooted, and this is evident in the 150 projects we have in 2023 to reduce carbon emissions, in 2019 we were targeting a reduction of about 12 million carbon equivalent per year, now it is down to 10.5 million, and we are aiming to reduce it to 6 million by 2030,” according to the managing director of the company.

In this regard, Steve Phimster emphasized the role of carbon capture and storage for EOR and combustion recycling.

He pointed to the conclusion of an agreement with Shell Development Company – Oman to study and cooperate on carbon capture and storage for the production of blue hydrogen in Block No. 10, stressing that the main goal – in this regard – is to use carbon dioxide in the atmosphere.

He also pointed out the importance of building the necessary capabilities and infrastructure, saying: “Indeed, there are a number of work sites that allow this for the company and other companies, whether in aquifers or in depleted reservoirs.”

He continued, “There is a lot of carbon dioxide in Oman, and plans to remove it from oil and gas affect the transportation, household and industry sectors, which requires support and compensation.”

He also said: “Electricity generation contributes to more than 60% of emissions in the company and the oil and gas sector in general. The company produces about 1.6 gigawatts of electricity for its own consumption, and only 10% comes from renewable sources, and we aim to reach 35% by 2026, and 50% by 2030.” This goal requires investments to generate 300 megawatts of renewable energy, to rise to 400 megawatts over the next three or four years.

Green hydrogen in Oman

The General Manager of PDO confirmed the continuity of uncertainty around all aspects related to green hydrogen in the Sultanate, so the greatest focus is still on basic oil and gas projects, as well as carbon capture and storage and blue hydrogen, both of which are close to the company’s business.

However, Oman began the exploration of green hydrogen, taking advantage of its strategic location between Europe and Asia. It also has one of the highest rates of sun exposure throughout the year in the world, in addition to its outstanding capabilities and supply chain, with the increasing presence of investors and developers interested in green hydrogen in Oman.

Phimster expected that the peak demand would come from the European continent, despite the challenges related to accreditation requirements in the European market and the carbon taxes set by the European Union. Then Asia would come second, as Japan and South Korea are expected to be among the first markets for Omani hydrogen.

He also emphasized the need for long-term market access, a clear price for green hydrogen, and maturity of both technology and costs for economic viability.

He explained, “If you want to be first in the green hydrogen race, you need to have first-class contractors who can guarantee strong performance, high quality standards and strong health, safety and environmental practices. International, the important thing is to develop the appropriate capabilities, skills and competencies.

Regarding the challenges of the green hydrogen market, he said that the main missing link is the production of electrolysis devices on a large scale globally, attributing this to the costs of the global market and dependence on large players such as China, but he expected to overcome this within about a decade.

He also pointed to another problem related to the size of renewable energy projects needed to produce green hydrogen, adding that the domestic market is not large enough, and it must be an international primary market.

related topics..

Also read..

Leave a Reply