From the rise of oil revenues in the 1970s until now, the Gulf states have provided massive financial aid to countries in economic distress in the Middle East and North Africa region and beyond.

The Arab Gulf countries have emerged in the past five decades as one of the largest donors in the world, and have proven their role as a strong geo-economic force, and have developed a number of economic and financial tools to support the countries of their region.

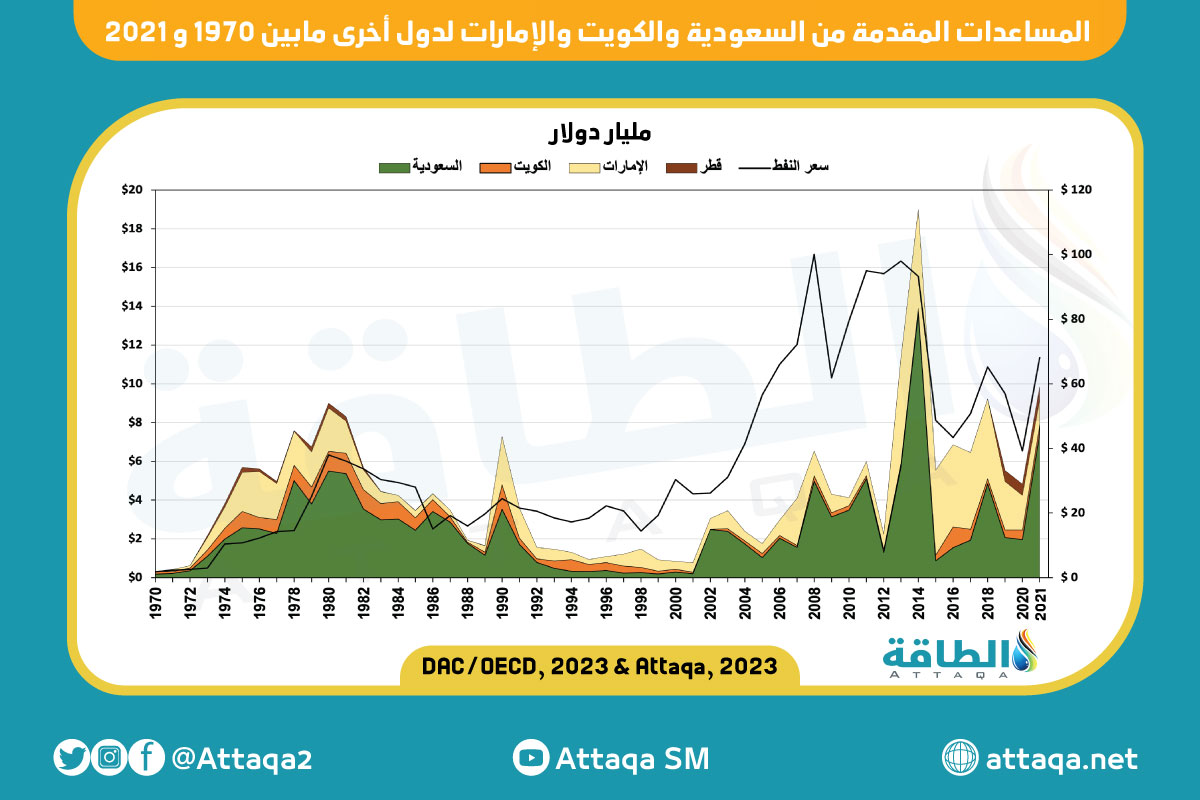

The data shows that there is a direct relationship between the increase in oil prices and the amount of aid, as shown in the graph.

The chart below – prepared by the specialized energy platform – shows the aid provided by Saudi Arabia, Kuwait and the UAE to other countries between 1971 and 2021:

Promote development

The Gulf countries used aid, investments and other capital flows to promote development in their countries, the countries of the region, and developing countries in the African and Asian continent in particular, as well as developing countries outside the regional framework, especially between the Iran-Iraq war in the eighties until the Arab Spring 2011 and what followed.

The Gulf countries played a unique role in providing aid and saving the Middle East and North Africa region.

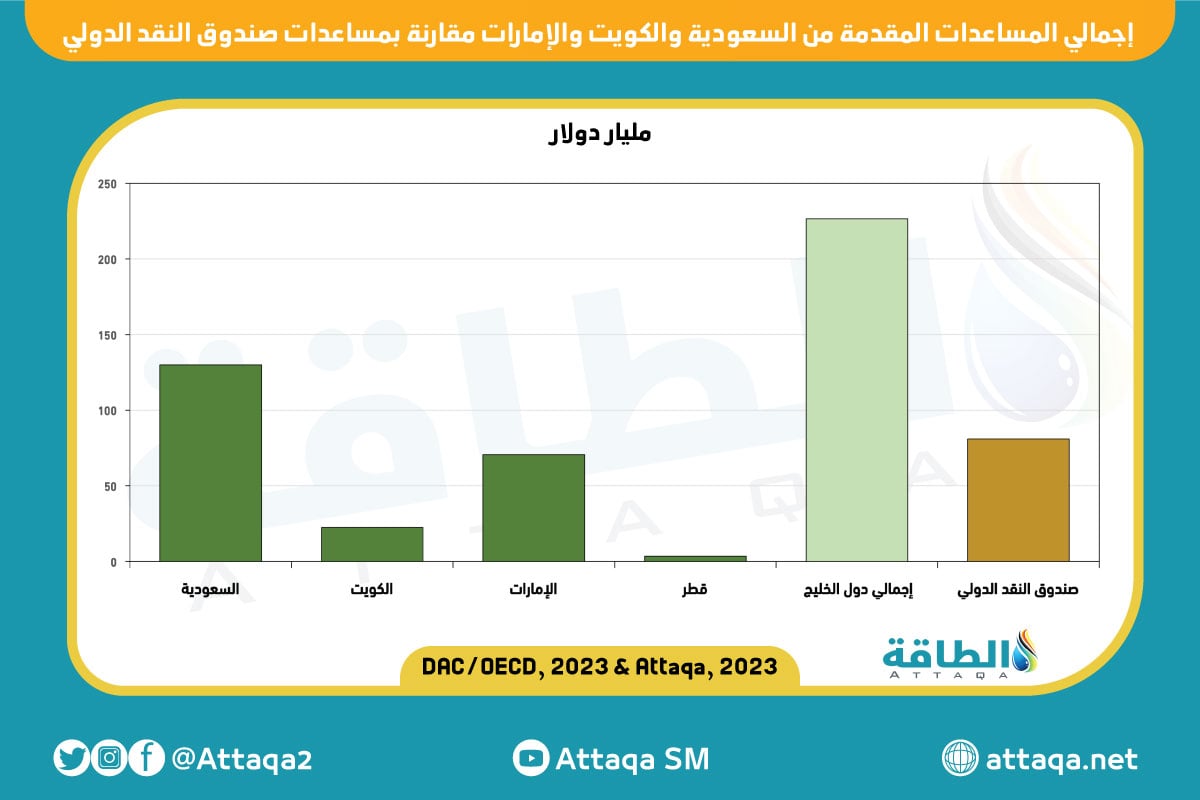

The Gulf states spent an estimated $245 billion between 1974 and 2020.

The aid provided to the 12 countries in the Middle East and North Africa region amounted to 53.6% of the total amount, which is equivalent to ($131.3 billion).

The data indicates that Gulf countries’ spending on aid to save the Middle East and North Africa region was more than most traditional bilateral and multilateral donors, including the International Monetary Fund, which spent about $81 billion in loans to those countries over the same period.

By providing rescue aid on this scale, the Gulf countries have established themselves as major players in the development aid scene in the MENA region.

When we compare what the International Monetary Fund provides to countries that need its assistance, we find that the Arab countries do not enjoy the support of the Fund in the same way as the countries of the western hemisphere that are equal to the Arab countries in credit rating (Argentina, Brazil, Colombia, Honduras, Mexico, Suriname, etc.). etc.).

This made the Gulf states cover the financing gap to enhance the stability of the economies of the Arab countries. Here, the Arab member states must put pressure on the Fund to make the principle of justice and equality among all countries prevail, and not to give specific countries more aid than what is given to the rest.

In addition to the technical support and human capacity development provided by the Fund, no Arab country is among the top 10 recipients of such aid.

rescue packages

For 5 decades, the Gulf states have used rescue capabilities to protect the countries of the region, although some have attributed rescue packages paid for security or political considerations since the 1973 oil price hike.

Since then, Gulf states have provided rescue assistance to no fewer than 17 countries in the broader Middle East and North Africa region, amounting to more than $245 billion.

While Gulf aid contributed to saving the affected countries in the region from bankruptcy on multiple occasions, most of the aid was provided in response to regional shocks that posed a direct threat to those countries and the Gulf interests that are fully linked with them.

In the year 2008, after the rise in oil prices, the Kingdom of Saudi Arabia presented an energy initiative to support developing countries affected by the high energy bill at an amount of 500 million riyals (133.25 million US dollars). One million riyals, from which a large number of developing countries in Africa and Asia benefited.

(Saudi Riyal = 0.27 USD)

In addition to the huge aid provided by the Kingdom during the Arab Spring crisis, by supplying a number of Arab countries with huge quantities of oil, such as Jordan, Egypt, Yemen, and Morocco.

For example, oil derivatives were provided to Egypt worth 50 billion Saudi riyals.

During the global financial crisis in 2008, the Kingdom provided a grant to the World Food Program in the amount of $500 million to bridge the financing gap caused by the rise in food and fuel prices.

The Kingdom’s aid was not limited to official development assistance, as development support for any country is through 4 basic methods: –

1- Official development aid.

2- Foreign direct investment.

3- Trade for development.

4- Transfers (remittances of expatriates).

The Kingdom invested directly in large amounts in a number of developing countries, especially the Arab countries, which exceeded 150 billion US dollars, in addition to the Saudi Public Investment Fund seeking to invest in the countries of the region, as it established 6 companies with 6 countries in the region (Egypt – Sudan – Bahrain – Iraq – Amman – Jordan) to promote investment in these countries.

The Kingdom is also the second largest country in expatriate remittances after the United States, with an amount of no less than $40 billion annually.

In addition to the Kingdom’s signing of a number of trade agreements with a number of developing countries, through which it made significant concessions and customs exemptions to facilitate the arrival of the goods of those countries to the Kingdom.

The chart below – prepared by the specialized energy platform – shows the total aid provided by Saudi Arabia, Kuwait and the UAE compared to the aid of the International Monetary Fund:

Salvation diplomacy

Salvage diplomacy in the Gulf has gone through 3 major turns that closely coincide with the geopolitical trajectory of the Middle East and North Africa region.

The first turning point was the Iran-Iraq war 1980-1988, in which the Gulf states provided Iraq with huge amounts of aid for fear of Iran’s plans to export its revolution in 1979 and stir up unrest.

The war between Iran and Iraq was the most important link in the interventions of the Gulf rescue plan, as it accounted for more than 29% of the total Gulf rescue aid disbursed since 1974, and it has remained unparalleled since then.

The Gulf states’ experiment in bailout diplomacy quickly backfired, when Saddam Hussein invaded Kuwait in 1990.

During the second turn, the Gulf states used bailout diplomacy to garner international support for the liberation of Kuwait and reward their regional allies, particularly Egypt, Morocco, Syria and Pakistan for standing by them.

The third critical turning point was the 2011 Arab Spring, a pivotal moment in the history of the region. The Gulf states found the fall of Egypt, and the spread of unrest in Bahrain, Jordan, Morocco, Oman and Yemen, deeply troubling.

To achieve stability, they disbursed more than $52 billion in rescue aid to Egypt, Jordan, Morocco, Pakistan, Sudan, and Yemen between 2011 and 2018.

Challenges facing the economies of the region

With deteriorating credit conditions and high refinancing needs after the Russia-Ukraine crisis, emerging market economies in general and markets in the Middle East region are facing greater challenges.

First, tightening global liquidity may erode investors’ appetite for risk towards emerging market economies, which in turn will make access to international capital markets more difficult for sovereign bond issuers.

Second, the fallout from the war in Ukraine is likely to exacerbate existing challenges, and higher global energy and food prices, as well as slower global growth as a result of the conflict, will negatively affect the economic prospects of emerging market and developing economies.

The interaction of the major downside risks poses particularly significant debt management challenges for low-income countries, which have limited room to manoeuvre.

In this context, lending and other financial support to these countries, such as grant facilities by international financial institutions, will be critical in terms of sustaining their debt and supporting their economies.

These challenges, which exceed the capabilities of donors in the region (the Gulf countries), did not make them retreat from their commitment to support the countries of the region, but rather made them think of new methods to support development in countries affected by these successive crises.

At the forefront are investments through the sovereign funds of the Gulf states, as well as trade for development, opening markets to commodities from the countries of the region to access the Gulf markets, and providing guarantees to international institutions, such as the International Monetary Fund and the World Bank, to provide support to the countries of the region.

The reader may notice the interruption (absence) of Qatar’s data, and this is due to the fact that Qatar did not join the club of countries providing official development assistance until late, as the Qatar Fund for Development, which is the main channel for providing Qatari official aid, was established only in 2002, and it did not Its actual activity was only in 2010, and it began issuing annual reports in 2016.

Sources:

– Unified Arab Economic Report.

– Development Assistance Committee of the Organization for Economic Co-operation and Development (DAC/OECD).

* Eid Al-Eid, Saudi economic advisor.

*This article represents the opinion of the author, and does not necessarily reflect the opinion of the energy platform.

related topics..

Also read..

Leave a Reply