India’s imports of Russian oil have been rising month-on-month, since shipments from Moscow have replaced crudes from the Middle East and Africa.

India’s national oil company “Indian Oil” – the country’s largest refiner in terms of production capacity – confirmed its commitment to long-term contracts with the Middle East, but spot purchases from the region fell as more Russian oil was imported.

“Spot purchases have decreased because there has to be a drawdown somewhere to offset all the Russian purchases,” said company chairman Shrikant Madhav Vidya, according to statements seen by the specialized energy platform, quoting Reuters.

Vidia explained – during his participation in the Middle East Oil and Gas Conference in Dubai – that India’s imports of Russian oil are commensurate with the specifications of refineries, and that the increasing Indian consumption has left room for more imports.

India’s imports of Russian oil increased

In a related context, India’s imports of Russian oil rose to a new record high in April 2023; Which further reduced the share of Middle East and African crudes to their lowest level in at least 22 years.

Refineries in India – the third largest importer and consumer of oil in the world – are rushing to buy Russian oil, which many countries are avoiding in light of the sanctions imposed on Moscow. In response to its war in Ukraine that broke out in late February 2022.

Russia remained the largest oil exporter to India for the sixth consecutive month in April, followed by Iraq and Saudi Arabia, according to information monitored by the specialized energy platform, quoting Reuters.

The data showed that India’s imports of Russian oil amounted to about 1.9 million barrels per day in April, an increase of 4.4% on a monthly basis. That represents about two-fifths of the country’s total purchases.

Indian oil imports from Russia also rose, after Oil India, the country’s largest refiner, raised the size of its annual import deal with Rosneft.

The increase in India’s imports of Russian oil increased the share of crude imported from the Commonwealth of Independent States, Azerbaijan, Kazakhstan and Russia, to 43.6% of the total 4.81 million barrels per day imported by India last month.

India’s imports from the Middle East decreased

The data showed that the rise in India’s imports of Russian oil reduced the share of Middle East crudes – which traditionally represented the largest part of total oil imports – to about 44% in April.

India’s oil imports from Africa also fell to 3.4% last month, according to information seen by the specialized energy platform.

The data showed that India’s oil imports from Iraq in April fell by 3.1% from the previous month to the lowest level in 4 months at 928.4 thousand barrels per day.

While imports from Saudi Arabia fell 11% to 723.8 thousand barrels per day, which is the lowest in 5 months.

The data showed that the decline in oil purchases from the Middle East led to a record drop in OPEC’s share of Indian oil imports, amounting to 46%.

“Indian refineries have reduced their spot purchases of Middle East and West African crudes because we are getting Russian oil supplies at low prices,” said an Indian refiner at a refinery.

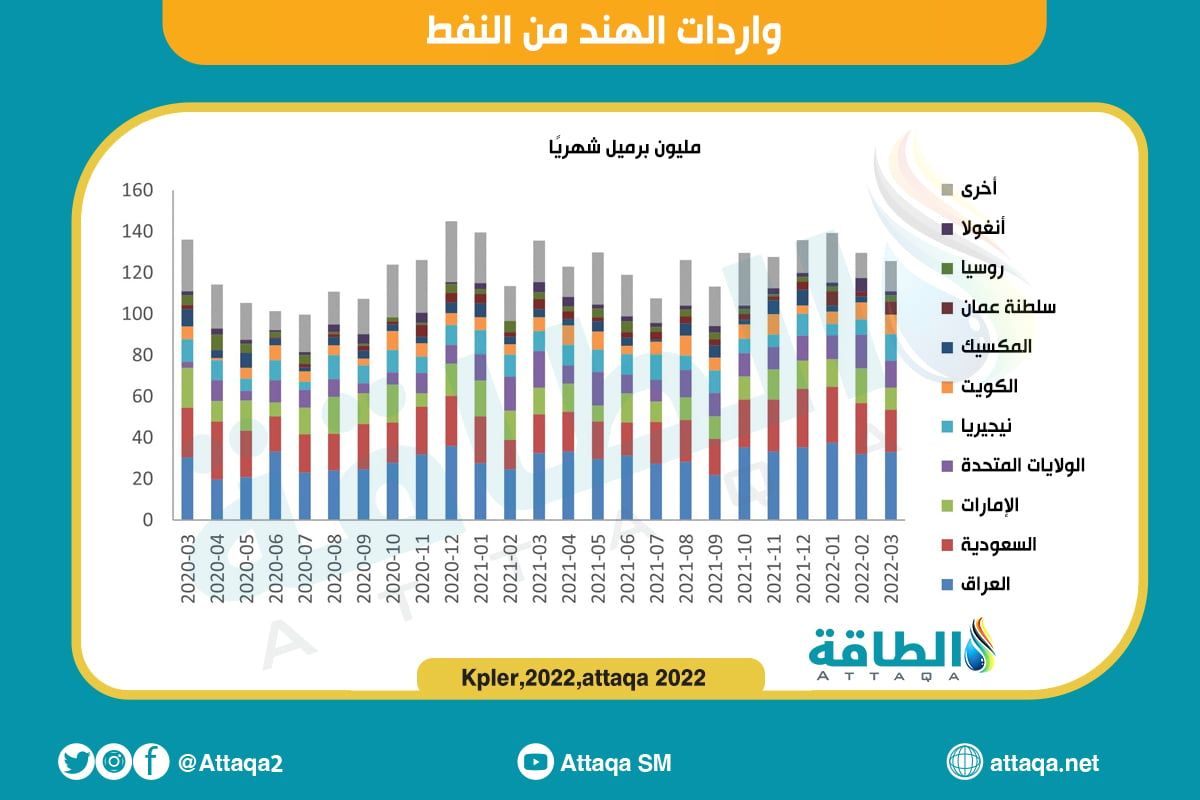

The following graph – prepared by the specialized energy platform – shows India’s oil imports until March 2022:

Indian interest in oil in Kenya

In another context, the Indian oil company ONGC Videsh entered into a partnership with Oil India to replace Indian Oil, in the potential acquisition of a 50% stake in the Kenya oil field project of Tollo Oil, valued at $ 3.4 Billion dollar.

However; They are now facing fierce competition from the Chinese oil giant, Sinopec, which is benefiting from the delay on the Indian side to complete the deal, according to information seen by the specialized energy platform, quoting the “Investing” platform.

Initially, ONGC Videsh, the international arm of the state-owned oil and natural gas company, sought to acquire half of Tolo, Africa Oil Corp and Total Energy’s stakes in the Lokichar oil field in Kenya.

Negotiations took place between ONGC Videsh and Indian Oil for several months regarding their stake in the project. However, the latter reconsidered moving forward with this deal, due to financial pressures resulting from losses in fuel sales.

The prolonged delay has created an opportunity for China’s Sinopec, which is exploring the possibility of acquiring stakes from Tollo and other partners involved in the project.

Tollo, led by Indian-born CEO Rahul Dhir, initially favored the Indian alliance because of the similarities between the Kenya project and the Barmer fields in Rajasthan.

If successful in their negotiations, the two Indian companies will become joint operators of this project, along with Tollo – which currently holds a 50% stake – as well as Africa Oil Corp and Total Energy which each own a 25% stake.

related topics..

Also read..

Leave a Reply