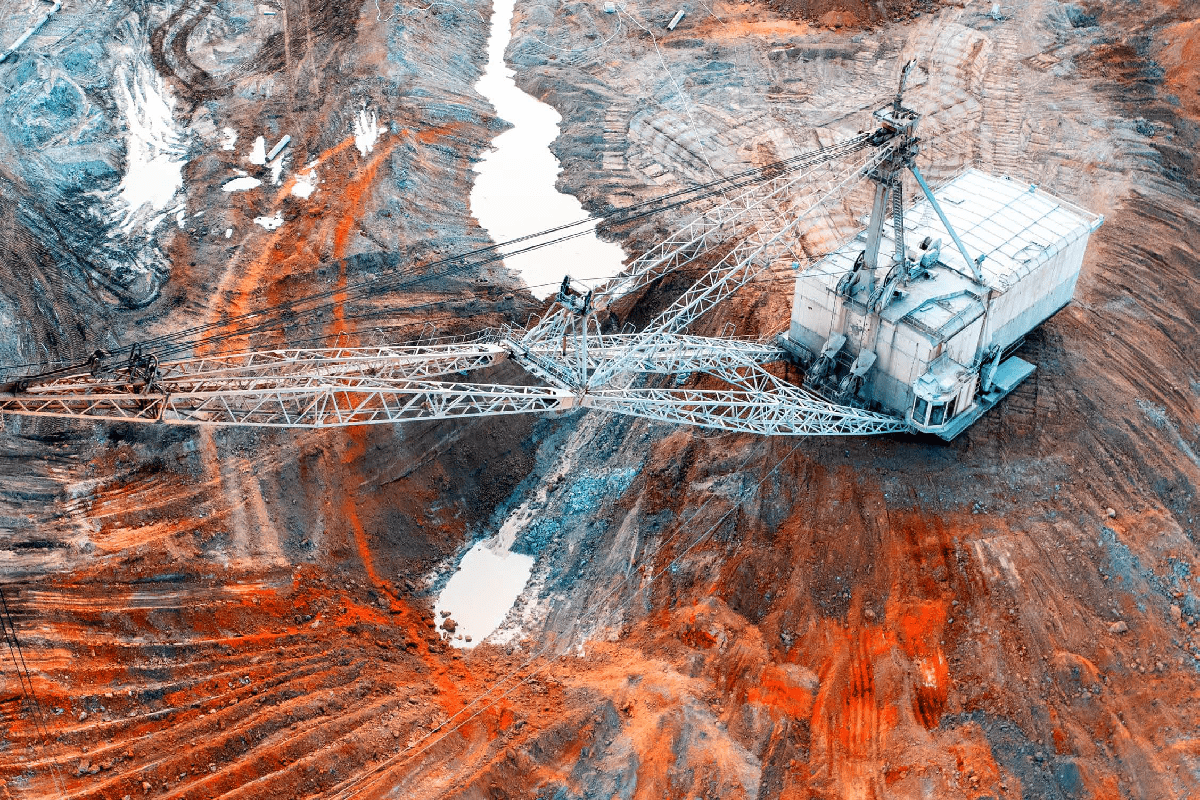

Namibia is accelerating its oil exploration and mining activities in an effort to enhance its production from these two vital sectors that have huge potential, and then the possibility of relying on them to enhance the national income of the state, after they have been untapped for many years, and this requires concerted efforts to attract foreign and domestic investments. Both.

Oil exploration has continued in the country located in South Africa in recent years. Which made it a destination for major international energy companies wishing to expand their investment portfolios in that promising industry in the country.

In this context, Namibia intends to acquire minority stakes in oil and mining companies. In order to maximize the utilization of its vast mineral wealth, Reuters reported, quoting the Namibian Minister of Mining.

largest producer of uranium

Namibia is one of the world’s largest producers of uranium, a major producer of diamonds, and has many deposits of hard rock lithium.

“We are entrenching the concept that local ownership should start with the country that owns our natural resources,” said Minister of Mines and Energy Tom Alwindo, in remarks he made to a group of lawmakers at a parliamentary workshop yesterday, Monday, May 29 (2023). According to what was seen by the specialized energy platform.

Alwindo stressed that the proposed state ownership should take the form in which the country acquires a minimum percentage of shares in all mining companies, oil-producing companies, to which the state does not have to pay money for stakes.

stocks falling

Namibia’s announcement to acquire minority stakes in oil and mining companies had immediate effects on shares in most of the mining companies listed in Australia during today’s trading, Tuesday, May 30 (2023).

Trading in the shares of the Australian “Paladin Energy Limited” company, which produces uranium in Namibia, was suspended during today’s trading session, after it fell by 24%.

Likewise, the shares of the “Bannerman Energy” company working to develop the “Istango Uranium” project fell, by 7.4%, to their lowest level in a month, and the shares of the Australian “Deep Yellow” company fell by 13.4%, recording its worst performance since May 9. (2023).

Deep Yellow recently completed a final feasibility study for the Thomas Uranium Project.

It is not yet clear – yet – the percentage that Namibia wants to acquire in resource development projects, but in March (2023) Alwindo said that his country’s government will deal with the matter with a broad mentality, in his speech to Parliament.

“We need to be aware of the fact that there is a level that no investor can exceed, and it is a position that no one wants to find themselves in,” he explained.

oil discoveries

Last year (2022), the French company Total Energy and the Anglo-Dutch oil giant Shell announced oil and gas discoveries in Namibia.

And in March (2023), Namibia announced the third discovery of light oil 270 kilometers off its coast in the Orange Basin, although experts say that Windhoek will not likely reap revenues from these discoveries until a few years later.

Drilling work in the Orange Basin began in December (2022) and ended successfully in March (2023), according to what was announced by the National Oil Corporation of Namibia (Namcor) and its two partners in the “Jonker-1X” deepwater exploration project: Shell and Qatar Energy.

Promising future

Namibia may become another major oil producer on the Atlantic coast of Africa, and may even consider joining the Organization of the Petroleum Exporting Countries (OPEC) if it makes new oil discoveries, according to what was stated by the Windhoek government and published by the North Africa Post.

Since the Russian invasion of Ukraine on February 24 (2022), oil exploration activities in Africa have been increasing at a rocket rate, with promising positive indicators emerging in Uganda and Tanzania.

However, despite its recent large discoveries in the Orange offshore basin, which pave the way for huge oil revenues in the future, Namibia will not reap those revenues until after the end of the current decade (2030), according to a leading wealth management company in Namibia.

Namibia has over 11 billion barrels of oil and 2.2 trillion cubic feet of natural gas, but its hydrocarbon potential has long been untapped.

Namibia relies heavily on the cooperation between Namcor, the Ministry of Mines and Energy and international oil companies, in improving the performance of the country’s large and diversified hydrocarbons sector.

related topics..

Leave a Reply