Moscow described the “waivers” of the Russian oil price cap as tangible evidence of continued demand for Russian supplies.

On Tuesday, February 7 (2023), the European Commission published an explanation of the decision to impose a price cap on Russian oil products, in which it specified the cases to which the price ceiling does not apply.

Russian Deputy Prime Minister Alexander Novak said that the European Union’s moves to add what he called “exemptions” to the price ceiling showed that Russian oil is still required, according to what was monitored by the specialized energy platform, quoting Reuters.

He added, “This confirms once again that our oil products are needed in Europe, as European politicians indicated that their actions defy any logic, and that they take such decisions and think about how to get out of this situation.”

Russian oil price cap exemptions

Last week, the European Union announced its agreement to cap the prices of Russian refined oil products, to limit Moscow’s ability to finance its war in Ukraine.

Meanwhile, the European Union has made several exemptions to the way the price ceiling works.

He clarified – in his latest directive update – that the price ceiling will not apply after the release of crude oil or oil products for trading in a jurisdiction outside Russia and delivery to the buyer.

The price cap no longer applies to Russian oil products when blending operations in a third country lead to a “tariff shift” or changes in the type of oil product.

The European ban on Russian seaborne oil supplies entered into force on December 5, 2022, and the European Union and the Group of Seven countries, as well as Australia, agreed to a maximum price of seaborne Russian crude at $60 per barrel.

Starting on February 5, 2023, similar restrictions on the supply of petroleum products from Russia came into effect, with price ceilings set at $100 and $45 per barrel, depending on the class of oil products.

The following graph – prepared by the specialized energy platform – shows Russian oil exports to the European Union in the first 10 months of 2022:

Russian supplies are indispensable

In a related context, Novak stated that the embargo imposed by the European Union on the supply of Russian oil products may lead to an imbalance and a shortage of supplies in the global market.

He said – in statements reported by TASS and seen by the specialized energy platform -: “When guided by decisions such as the ban and the imposition of maximum price limits, there may be a major imbalance, a shortage of energy resources, and a decline in investment in this field.”

Novak commented on the European Commission’s document on price ceiling exceptions, saying: “With this decision, they confirmed once again that European consumers will not be able to do without Russian oil products, because we occupy a large share in their market.”

He added, “Without our oil products, there will be a huge shortage and a rise in prices, and with this, EU politicians have once again shown the contradiction of their previous decisions and the lack of logic.”

By making such a decision, European officials legalized the “gray” schemes for the supply of Russian oil products to Europe, Novak confirmed.

“On the one hand, they want to please their voters as politicians by making strict statements about our energy resources, and on the other hand, they realize that this will lead to negative consequences, and here they will also have to respond to the voters,” he said.

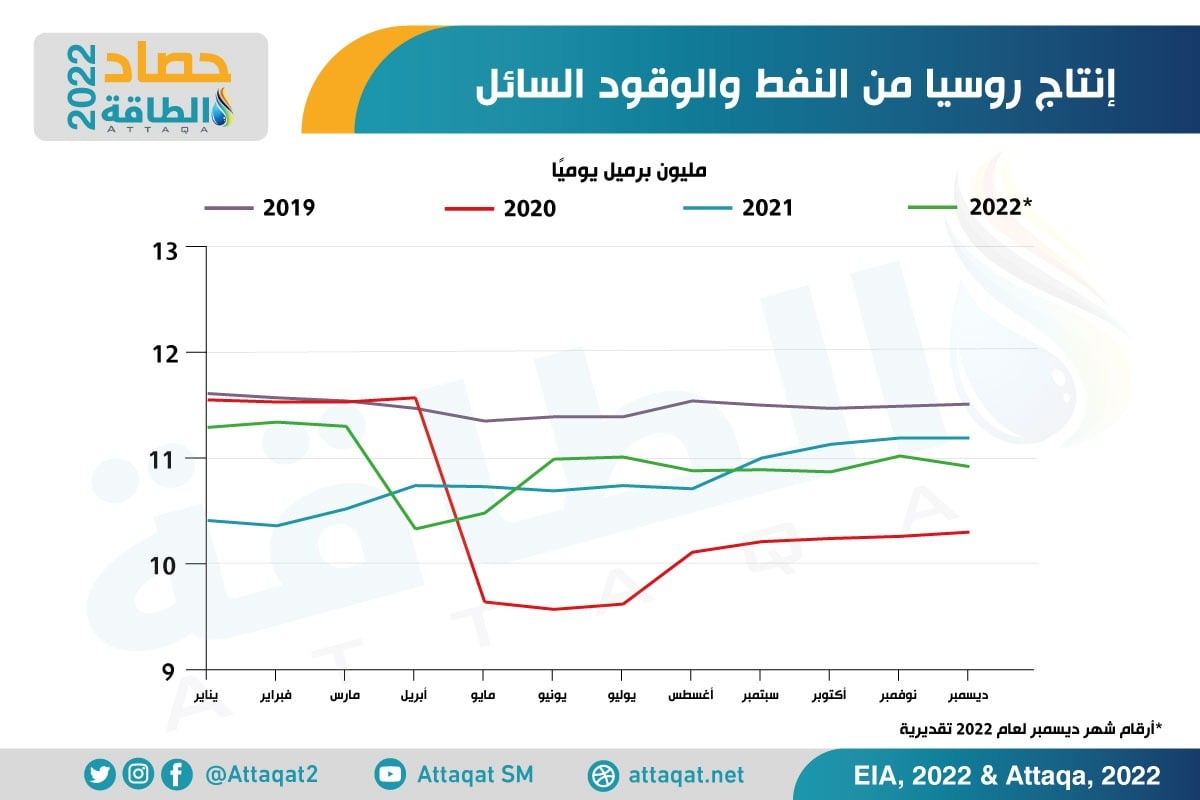

Russian oil production

Novak confirmed that Russian oil production in January 2023, and during the first week of February, remained unchanged at the November-December 2022 level of 9.9-9.8 million barrels per day.

“In February, production is still at the level of January,” he added, according to the Russian news agency TASS.

The following graph – prepared by the Energy Research Unit – shows Russia’s production of oil and liquid fuels from 2019 to 2022:

Novak had stated – at the beginning of this month – that Russian oil production and exports are stable despite Western sanctions and price ceilings, as Russian oil finds alternative buyers under these circumstances.

“Our companies have taken all the necessary measures – first of all – to find new supply chains, markets, and transport our oil,” Novak said. “It finds demand for it in other markets.”

He did not specifically mention these markets, “because the situation today requires great secrecy,” according to statements reported by Reuters, and seen by the specialized energy platform.

related topics..

Also read..

Leave a Reply