Oil production in Sudan and its south has become a new concern in global markets, in light of the intensification of political conflict between military leaders for the third day in a row, amid fears of a civil war.

Oil production in Sudan – the smallest producer in the OPEC + alliance – is estimated at about 60,000 barrels per day, according to information seen by the specialized energy platform, citing S&P Global.

This production is about 100 thousand barrels per day less than neighboring South Sudan, the third largest producer in sub-Saharan Africa.

However, South Sudan relies on Sudan to export its crude oil, which travels through a pipeline to the Red Sea via Khartoum, where explosions and gunfire were heard today, Monday (April 17, 2023).

Oil exports in and south of Sudan

The fighting in Sudan revolves around a power struggle between the commander of the armed forces and the de facto president, Major General Abdel Fattah al-Burhan, and his deputy, Lieutenant General Muhammad Hamdan Dagalo, who leads the Rapid Support Forces.

The oil market is anticipating the repercussions of this conflict, although there have been no immediate reports of impacts on operations in Sudan’s oil production, refining or export infrastructure since fighting broke out on April 15 in the capital, near the South Sudanese border and in Port Sudan.

Exports through the pipeline could be affected, Alex Vines, head of the Africa program at Chatham House, told S&P Global Commodity Insights, “and I think it’s one of the reasons Juba has to mediate.”

“The prevailing feeling around South Sudan is that if the conflict continues to escalate, it will affect oil production and income,” said South Sudanese analyst Adio Majok.

The following chart – prepared by the specialized energy platform – shows the development of oil production in Sudan:

Possible repercussions of the conflict in Sudan

So far, there are no signs that oil exports will be affected, however, previous uprisings in Sudan have led to an exodus of barrels from the market.

For oil markets, the concern is that the civil war could disrupt oil exports from South Sudan, which is dependent on Sudan, suitable for getting crude to market through the Red Sea oil port.

In 2021, tribal protests in eastern Sudan disrupted exports from South Sudan, according to information seen by the specialized energy platform, citing the Oil Price platform.

Now, the oil markets are closely watching the power struggle between the military and paramilitary forces, looking for indications that South Sudanese crude may be disrupted again.

And since the Red Sea port, which handles South Sudan’s crude oil, is a strategic infrastructure asset, oil market watchers are watching developments warily.

oil in South Sudan

While most of the oil belongs to South Sudan, the two countries together exported about 132,000 barrels per day of crude oil in 2021.

The raw materials exported by Sudan and South Sudan are Nile Blend and Dar Blend, which are mostly sold to Asian refineries in China, India and Malaysia.

Platts valued Dar Blend on a FOB basis from the Red Sea oil port of Marsa Bashayer at $84.38 per barrel on April 14, at a discount of $3.5 per barrel to Brent.

Under the transitional financial agreement, signed after South Sudan became independent in 2011, Juba pays Khartoum non-commercial fees and tariffs to ship its crude to international markets.

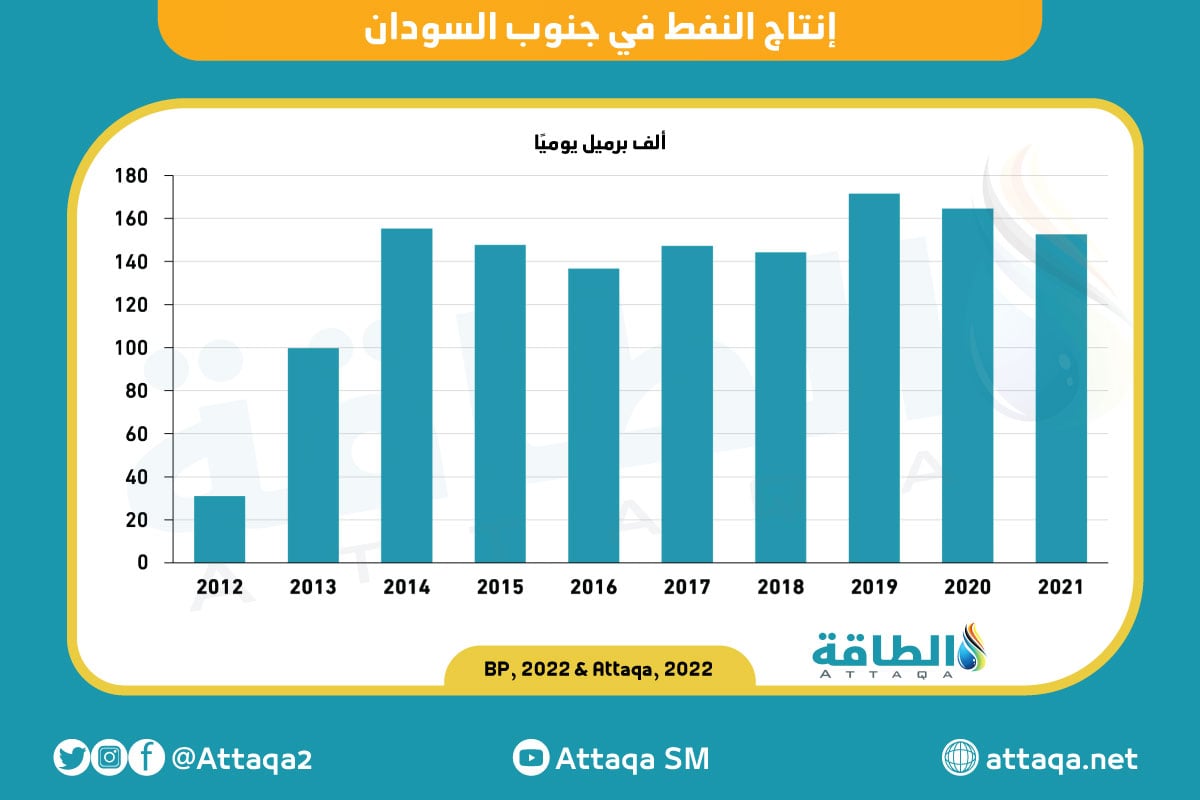

The following chart – prepared by the specialized energy platform – shows the development of oil production in South Sudan:

South Sudan, which relies on oil revenues for 95 percent of its national budget, has in the past accused Sudan of diverting crude to internal refineries without its consent.

In September 2022, South Sudanese officials said they had bought land in the small coastal nation of Djibouti to build a new export terminal. The country is also part of a long-delayed regional freight transport network that began in Lamu on the Kenyan coast.

South Sudan’s oil reserves are estimated at 3.5 billion barrels, but production has stagnated in recent years, despite efforts to boost production from old wells.

related topics..

Also read..

Leave a Reply