Iran has become open to foreign investment, following the recent agreement between Riyadh and Tehran to resume their diplomatic relations, after a 7-year break.

And the Iranian Ministry of Oil issued a statement – on March 19, 2023 – in which it said that it welcomed any offer of foreign investment in its projects in the oil and gas sector, in what appeared to be courting Saudi Arabia and the Gulf states.

The Ministry of Oil stated that any offer to invest in Iranian oil and gas projects, especially from members of the OPEC + alliance, would be welcome in Tehran, according to information seen by the specialized energy platform, quoting the “Press TV” platform.

She said that any such investment would benefit global energy security. Since Iran has one of the largest oil and gas reserves in the world.

An important role for OPEC + in stabilizing the market

For his part, Iranian Oil Minister Javad Auchi said, “Any interference, including political and legal interference, in the economic foundations of the energy market will be a losing game for all players in the sector, and will fail to help eradicate energy poverty and provide security for the global energy market.”

The ministry’s statement said that “the global energy market needs to get rid of politicization to achieve stability,” according to what was reported by the Iranian Oil Ministry News Agency (SHANA).

The statement added that political and legal interference to achieve short-sighted goals threatens the stability and security of the global energy market.

He added that despite uncertainties, such as the coronavirus pandemic and its consequences for the global economy, the decisions taken by the member states of the OPEC+ alliance over the past 3 years have largely ensured stability and balance in the energy market in a way that serves the interests of producers and consumers.

He also stressed that the member states and non-members of OPEC were unanimous on this point, which indicates that creating a state of economic and political instability and insecurity prevents pre-planned investments in projects to develop the oil and energy industries, which consequently leads to instability and insecurity in the market. global energy.

The following graph – prepared by the specialized energy platform – shows Iranian oil production from 2019 to 2023:

Saudi Arabia is ready to invest

The political authorities of Iran and Saudi Arabia announced – earlier this month (March) – in the Chinese capital, Beijing, that the two countries will restore their diplomatic relations by reopening embassies that were closed in 2016.

Last week, Saudi Finance Minister Mohammed Al-Jadaan said that Saudi investments in Iran could happen “very quickly” after an agreement to restore diplomatic relations.

Al-Jadaan said – during the financial sector conference in Riyadh -: “There are many opportunities for Saudi investments in Iran … We do not see obstacles as long as the terms of any agreement are respected.”

He added – in an interview with Reuters later -: “Stability in the region is very important for the world and the countries of the region, and we have always said that Iran is our neighbor, and we have no interest in a conflict with our neighbors, if they are willing to cooperate.”

He also said, “We have no reason not to invest in Iran, and we have no reason why they should not invest in Saudi Arabia. It is in our interests to make sure that both countries benefit from each other’s resources and competitive advantage.”

Oil exchange between Iran and Russia

In another context, Iranian Minister of Economy Ehsan Khandozi said that Iran relies on “huge quantities” of oil and gas exchanges from Russia during the current year (2023), according to Reuters.

Khandozi said, “This year will witness huge amounts of barter supplies… We are very happy because Tehran and Moscow have started cooperation on the issue of exchanging oil and gas supplies,” in an interview with the Russian “RIA Novosti” agency published today, Tuesday (March 21, 2023). .

No details were given on the volume of oil and gas that Iran expects.

In October 2022, Russia said that the swap deal with Iran could initially include 5 million tons of oil (35.5 million barrels) and 10 billion cubic meters of natural gas annually.

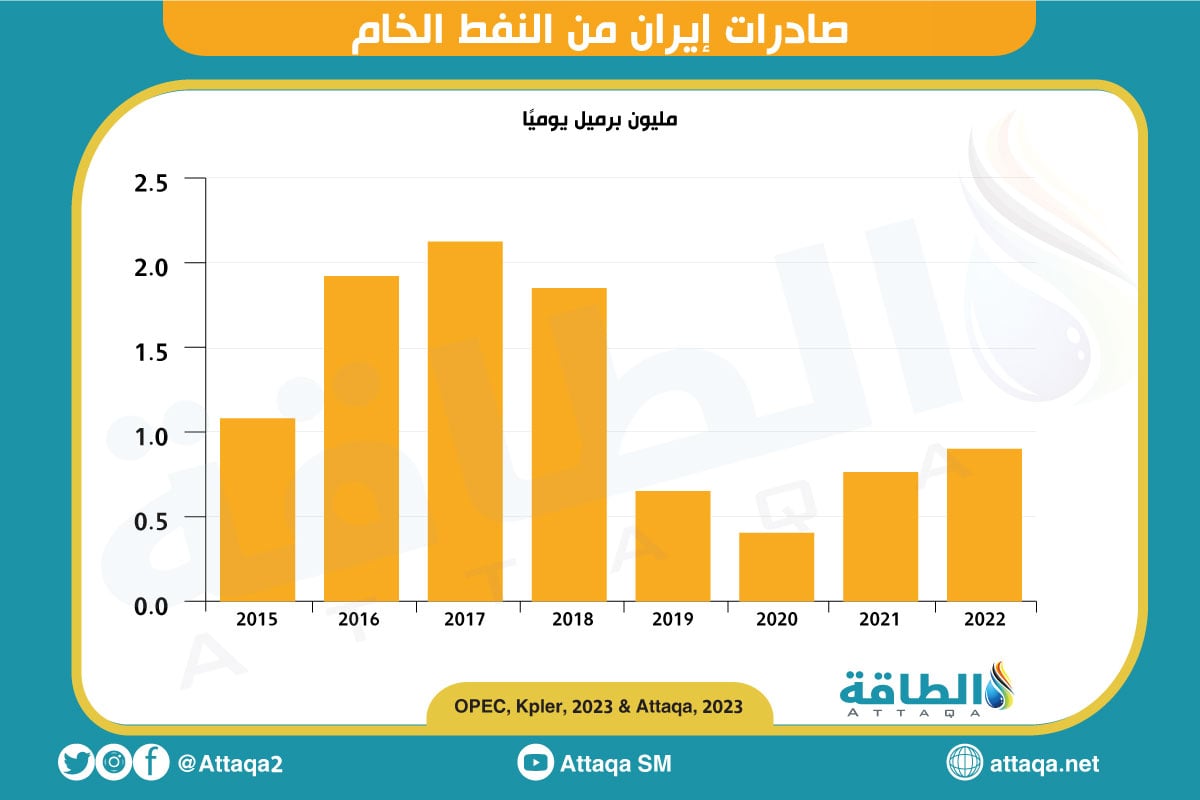

The following graph – prepared by the specialized energy platform – shows Iranian oil exports from 2015 to 2022:

related topics..

Also read..

Leave a Reply