Andurand Capital hedge fund manager Pierre Andurand expected oil prices to reach $140 a barrel by the end of this year (2023).

As Andurand indicated – during his participation in the “Financial Times Commodities” global conference in Switzerland – that the recent decline in oil prices due to banking tension is nothing but speculation.

However, electric cars will eventually reduce the demand for gasoline and cause a slowdown in oil demand growth in the coming years, according to Andurand’s remarks, which were reported by Reuters and seen by the specialized energy platform.

He said that demand will peak by 2030, adding: “Even when we reach the peak, oil demand will not decline so quickly… We will reach peak demand around 110 million barrels per day, and then it will slowly decline from that point.”

Oil price forecast

For its part, the US bank Goldman Sachs lowered its forecast for oil prices, citing that concerns about the banking sector and the possibility of a recession outweigh the increase in demand from China.

The bank’s analysts now expect Brent crude to reach $94 a barrel for the next 12 months, and $97 a barrel in the second half of 2024, compared to $100 a barrel previously.

And the bank said – in a note on March 18, 2023 -: “Oil prices fell despite the boom in demand in China, given the pressures of banks, fears of recession, and the exodus of investor flows,” according to Reuters.

“Historically, after such high profile events, prices recover only gradually, especially over the longer term,” he added.

Oil prices fell to a 15-month low, with Brent crude falling 12% this week, to below $73 a barrel.

After the price drop, Goldman Sachs now expects OPEC producers to increase production only in the third quarter of 2024, as opposed to the second half of 2023 that the bank projected before the price drop.

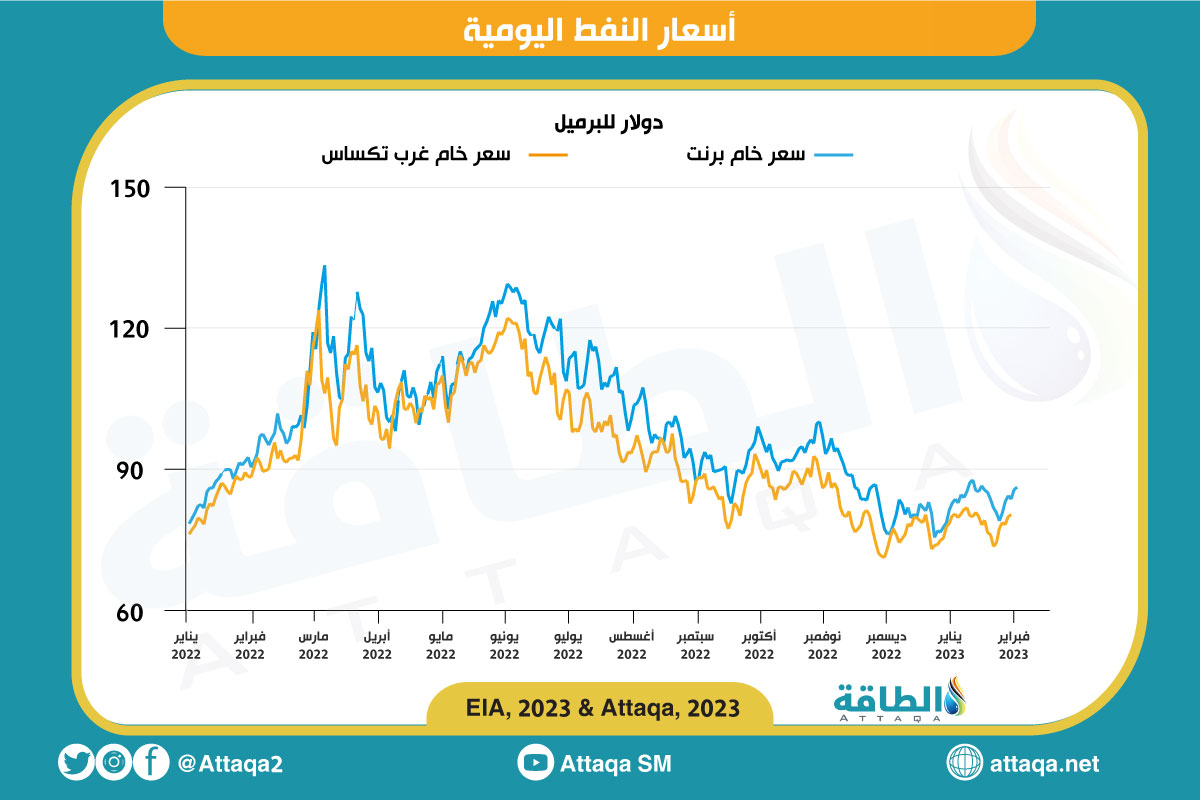

The following chart – prepared by the specialized energy platform – shows daily oil prices since the start of the Ukraine war:

Oil prices today

Oil prices rose today, Tuesday (March 21, 2023), continuing their recovery from a 15-month low hit the day before, as the Credit Suisse bailout eased concerns about global banking sector risks that could hurt economic growth and reduce fuel demand.

Sentiment in financial markets improved after UBS’ acquisition of Credit Suisse, which was announced on Sunday (March 19, 2023), and after major central banks said they would enhance market liquidity and support the banking system, according to Reuters.

Brent crude was up 79 cents, or 1.1%, at $74.58 a barrel by 2:22 pm GMT (5:22 pm Mecca time).

West Texas Intermediate crude rose by $1.39, or 2.1%, to $69.03.

Analysts from Haitong Futures said that crude oil prices now mainly depend on the effects on investor confidence at the macro level, attributing market stability and price recovery to the banking crisis not spreading further.

Among these influences, analysts said, is the Federal Reserve’s decision on whether and how much to raise interest rates.

The meeting of the Ministerial Monitoring Committee of the OPEC + alliance is scheduled to be held on April 3, amid expectations that production policy will not change, as a source within the alliance said, “The drop in prices reflects banking concerns, not the deterioration of the balance between supply and demand,” according to Reuters. .

related topics..

Also read..

Leave a Reply