India has defended its Russian oil imports, which have peaked recently, stressing that it faces its biggest economic threat.

New Delhi confirmed the possibility of buying Russian crude at a level close to or exceeding the price ceiling imposed by the West in the aftermath of Moscow’s war on Ukraine, according to a report published by the local newspaper, The Economic Times, and seen by the specialized energy platform.

The European Union has set a price ceiling for Russian oil at $60 a barrel, with regular reviews to ensure that it is 5% less than the average price of Russian oil in the market.

However, shipments of Russian oil to India are being sold well below the Western price ceiling, which was put in place to eliminate sources of funding for Russia’s war on Ukraine.

Prices for Russian oil shipments to India

Asked about the possibility of continuing to buy Russian oil above the price ceiling, Indian Finance Minister Nirmala Sitharaman said: “Yes, otherwise I will end up paying more than I can afford.”

The Indian minister explained: “We have a huge population; therefore, we will have to search for suitable prices for us.”

India needs to constantly search for the “best deal”; It imports about 80% of its crude oil needs from abroad, according to the Minister of Finance.

“For us, it’s a very critical factor for the economy,” she continued.

The Finance Minister’s position was supported by External Affairs Minister Subramaniam Jaishankar, too; He said, in August 2022, that it was the government’s moral duty to provide cheaper oil to its citizens, The National reported.

The following graph – prepared by the specialized energy platform – shows oil consumption in India, from 2019 to 2022:

OPEC + and the Russian war…influencing factors

The minister confirmed that the impact of OPEC + production cuts on fuel prices and the repercussions of all decisions related to the Russian war on Ukraine “were the two most important factors that I think I would be concerned about more than any other internal factor.”

On April 2, the Kingdom of Saudi Arabia and several countries in the OPEC + coalition announced a voluntary cut in oil production, starting from next May until the end of this year (2023).

The move represents a precautionary measure aimed at supporting the stability of oil markets, according to a statement issued by the Saudi Ministry of Energy.

And while Indian officials have said in the past that New Delhi is unlikely to breach sanctions against Russia; Including the price ceiling, the situation seems to have changed after the recent OPEC+ decision to cut production.

“I think we should look at it more with humanity in mind,” Sitharaman said, when asked about the sanctions. “I hope the intention is not to harm economies that have nothing to do with war.”

She added that the “unintended consequences” of these actions should not be borne by the Global South.

India’s imports of Russian oil

India and China have emerged to be the largest buyers of Russian oil, and Russia is the largest supplier of crude oil to India, overtaking Iraq and Saudi Arabia.

India’s imports of Russian oil rose to 1.62 million barrels per day in February 2023, exceeding India’s share of combined imports from Iraq and Saudi Arabia.

The rise in India’s oil imports from Russia came at the expense of Saudi Arabia, whose supplies declined by 16% on a monthly basis, and the United States by 38%.

Moscow also announced, at the end of last March, an increase in Russian oil exports to India 22 times over the past year (2022).

Shipping company Vortexa reported that Moscow now accounts for more than the oil bought from Iraq and Saudi Arabia combined, which is at a 16-month low.

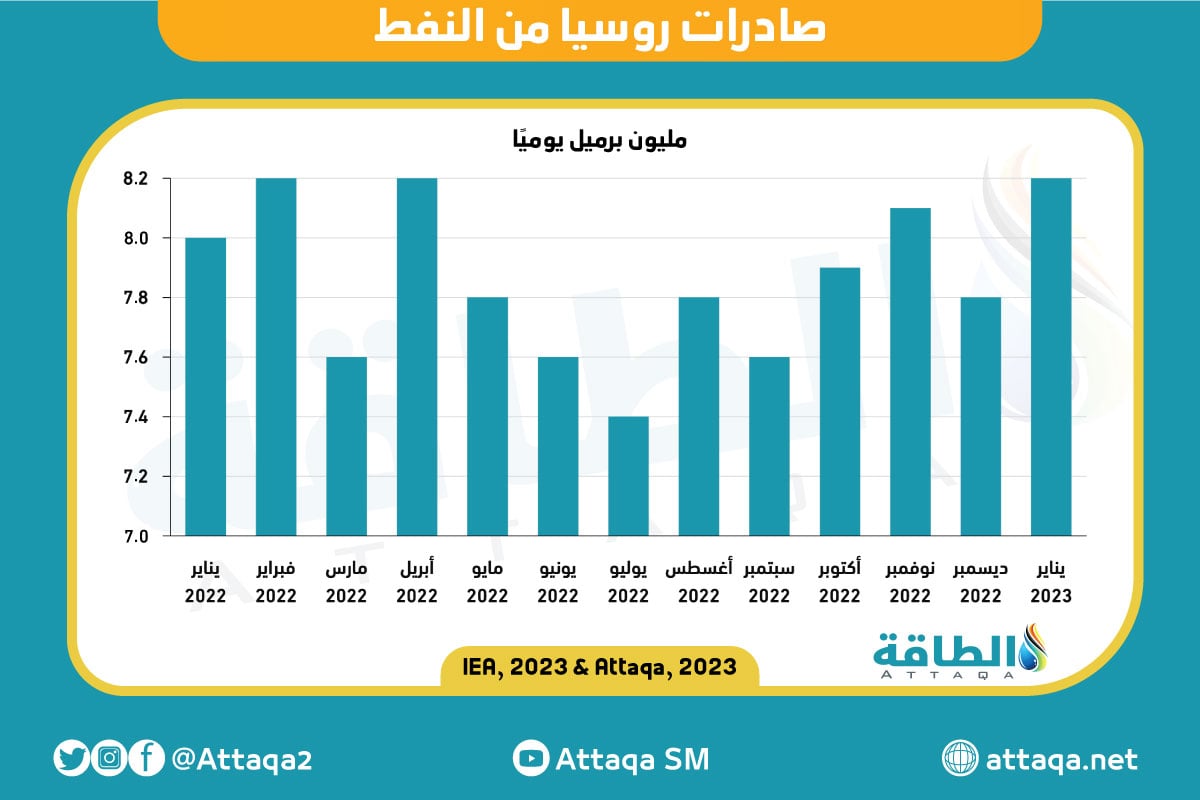

The following graph – prepared by the specialized energy platform – shows Russian oil exports from January 2022 to January 2023:

A stressful economy and an optimistic outlook

The current situation underscores the urgent need to curb inflation in India and stimulate growth, after the sudden production cuts announced by the OPEC+ alliance as well as Western sanctions on the Russian oil sector following the invasion of Ukraine.

The Indian economy is also expected to slow for the second year in a row, due to tightening financial conditions, supply chain problems and war in Europe, according to Bloomberg.

As the decline in domestic and foreign demand resulting from the interest rate hike pushed the Indian economy to decline, and growth during the period between October and December recorded a growth rate of 4.4%, compared to 6.3% from the previous quarter; Due to weak consumption and investments.

The International Monetary Fund also cut its growth forecast for India to 5.9% for the current fiscal year starting April 1, compared to a forecast of 6.1% growth in January.

Inspite of that; The Minister of Finance holds a positive vision based on political reforms in recent years and digitization, saying: “The economy will continue to recover.”

related topics..

Also read..

Leave a Reply