It seems that the recent decline in oil prices has prompted India to abandon the exceptional taxes imposed on crude producers, and has also made adjustments to taxes on some types of fuel.

New Delhi had previously pledged to review the tax rate linked to fluctuations in oil prices in global markets, according to what was followed by the specialized energy platform.

Following this review, the central government makes adjustments to the tax rate twice a month, the most recent of which was today, Tuesday, April 4, 2023, according to Reuters.

Exceptional tax adjustments

India decided to cancel the exceptional taxes imposed on crude oil producers in the middle of last year (2022), which amounted to 3 thousand and 500 rupees / ton, according to its latest amendment.

(Indian rupee = 0.012 USD).

The amendments included a decrease in the tax imposed on diesel to half of its previous rate, to record 0.5 rupees / liter, according to a government statement.

The Indian government maintained its previous decision to cancel the exceptional taxes imposed on exports of gasoline and aviation turbine fuel.

The Asian country has imposed – since July 2022 – crude oil producers and exporters of refined derivatives (gasoline, diesel, jet fuel) an exceptional tax, with the aim of prompting local refineries to sell their production to the local market and meet demand.

Fuel producers tended to take advantage of global refining margins, after geopolitical turmoil last year (2022) prompted a wave of strong fluctuations in energy prices.

Export restrictions

Other than exceptional taxes, the Indian government imposed other restrictions on the exports of petrol and diesel, to ensure its supply to the domestic market.

The restrictions announced in early April are considered a continuation of restrictions that were previously imposed and ended with the end of the fiscal year, but the government notice about the renewal of these restrictions did not link their expiry to a specific time limit.

(The fiscal year in India begins in April of each year and ends on March 31 of the following year).

The new restrictions on Indian gasoline and diesel exports included requiring refineries to take quotas to boost the local market, at 50% of annual gasoline exports, and 30% of annual diesel exports as well.

This step bears dimensions that are not limited to refineries only, but extends beyond that by influencing the rate of purchase from Russia, especially since India has intensified the purchase of Moscow crude since last year (2022), and plays the role of mediator. As it is working on refining crude and re-exporting it to other countries, such as European countries.

Oil prices

India staked the abolition of exceptional taxes on a drop in global oil prices below $70 a barrel, which was achieved last March, after Brent crude prices fell to their lowest levels in 15 months, driven by fears of weak demand.

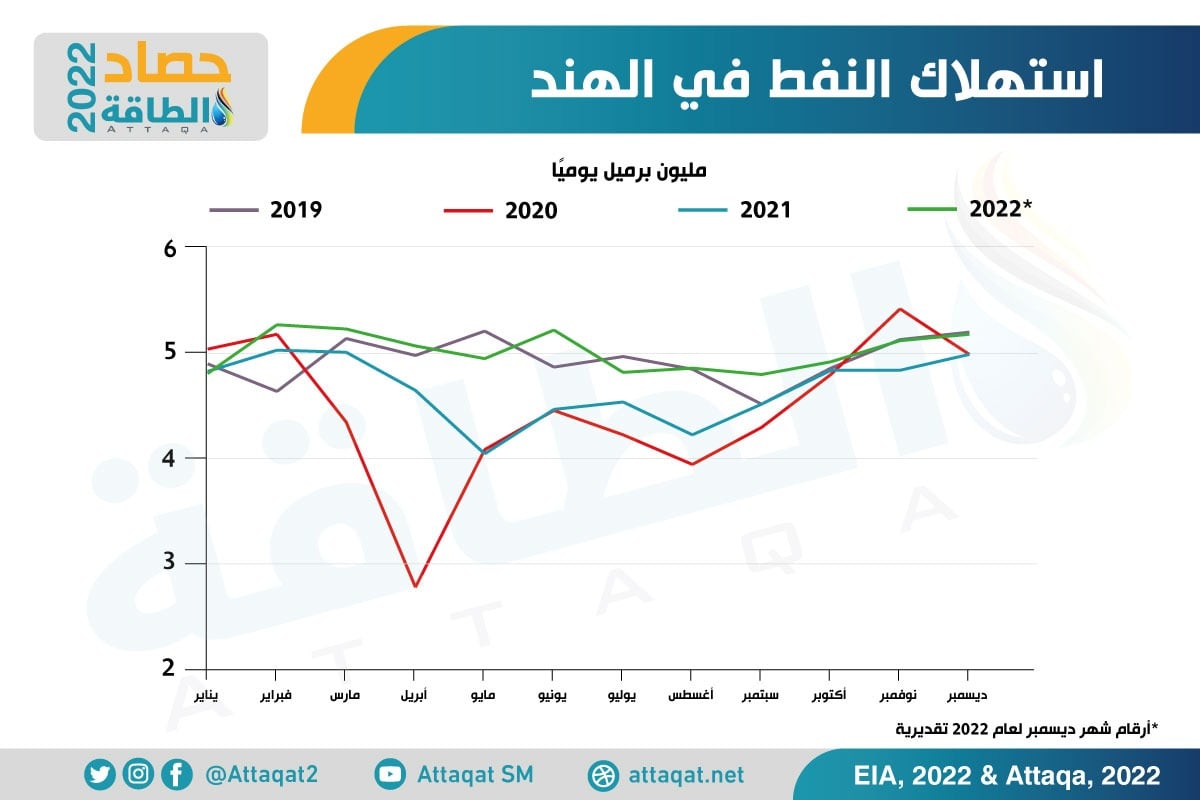

The chart below – prepared by the specialized energy platform – reveals the volume of oil consumption in India, during the period from 2019 to 2022:

It seems that the decision of – some – of the countries of the OPEC + alliance to make an additional reduction in production cuts previously decided, may affect the upcoming Indian government’s review of the tax rate.

This trend is reinforced by the jump in oil prices, following the announcement of additional cuts, to reach the level of $85 per barrel.

And 9 member states of the coalition – most notably Saudi Arabia and Russia – adopted a voluntary reduction in crude oil production at a rate of more than 1.65 million barrels per day, starting in May 2023.

Also read..

Leave a Reply