Fuel demand in India decreased by 4.6% on a monthly basis in January (2023), to 18.7 million tons (132.77 million barrels).

This decline came after it reached the highest level in 9 months during December 2022, affected by a decrease in mobility due to cold weather in parts of the country and a slowdown in industrial activity, according to what was monitored by the specialized energy platform, quoting Reuters.

Data from the Oil Planning and Analysis Cell in the Indian Ministry of Oil, issued on Wednesday, February 8 (2023), showed that diesel sales fell 7.6% in January, compared to the previous month, to 7.18 million tons (50.98 million barrels), while they declined. Gasoline sales rose 5.3% to 2.82 million tons (20 million barrels).

However, India’s fuel demand – a proxy for oil demand – rose 3.3% year-on-year, diesel sales rose 12.6%, while petrol sales jumped 14.2%.

fuel consumption in India

Sales of cooking gas or liquefied petroleum gas decreased by 2.1% year-on-year, to 2.51 million tons (17.8 million barrels), while sales of naphtha decreased by 14.4% to 1.23 million tons (8.7 million barrels).

Sales of bitumen used in road construction fell by 20%, while fuel oil use jumped 9.1% in January.

In a related context, a special survey showed that the manufacturing industry in India started the current year (2023) in a weaker way, as it expanded at the slowest pace in 3 months in January, with slower production and sales growth.

The following graph – prepared by the Energy Research Unit – shows oil consumption in India from 2019 to 2022:

“The festive season is over, and cold temperatures may have played a role,” said Ehsan-ul-Haq, analyst at Refinitiv.

Ehsan-ul-Haq added, “Auto sales remain strong, and overall, Indian demand for oil remains on the right track and will motivate refineries to maintain high refining cycles.”

Passenger car sales jumped 22% year-on-year to 3.4 million units in January, while growing 8% from pre-pandemic levels in 2020, according to data from the Federation of Automobile Dealers Associations.

India’s imports of Russian oil

In another context, Gurmeet Singh, President of the Indian Petroleum Industry Association, confirmed that India’s imports of Russian oil are expected to increase further in 2023, given the drop in its prices in the wake of the European sanctions imposed on Moscow in response to the invasion of Ukraine.

This supports the import growth witnessed last year (2022), but refineries will continue to make independent purchase decisions based on purely commercial considerations, Singh said in an interview with S&P Global.

Singh explained – on the sidelines of the Indian Energy Week – that more than 60% of the Indian crude basket was composed of Middle Eastern crudes before the conflict between Russia and Ukraine, while the rest consisted of North American crudes by about 14%, and West African crudes by 12%. Latin American raw materials accounted for 5%, while Russian raw materials accounted for only about 2%.

He said, “India’s imports of Russian oil have witnessed a significant increase in the past few months, and Russia remained the largest supplier of oil to India in December, followed by Iraq and Saudi Arabia, perhaps as a result of deepening rivalries due to additional sanctions imposed by the Group of Seven and the European Union, including That’s a price ceiling of $60 a barrel.”

Singh also noted that Russian oil accounted for 15% of total Indian purchases by the end of 2022, and the share of the Organization of the Petroleum Exporting Countries (OPEC) fell to the lowest level in more than a decade.

Singh explained that OPEC’s share of India’s oil imports shrank to 64.5% in 2022, from a peak of 87% in 2008, but Iraq and Saudi Arabia are still India’s largest suppliers last year (2022).

He added, “The increase in Russian oil circulation reduced India’s appetite for African grades, whose share in 2022 imports fell to its lowest level in 17 years, while Latin America’s share fell to its lowest level in 15 years.”

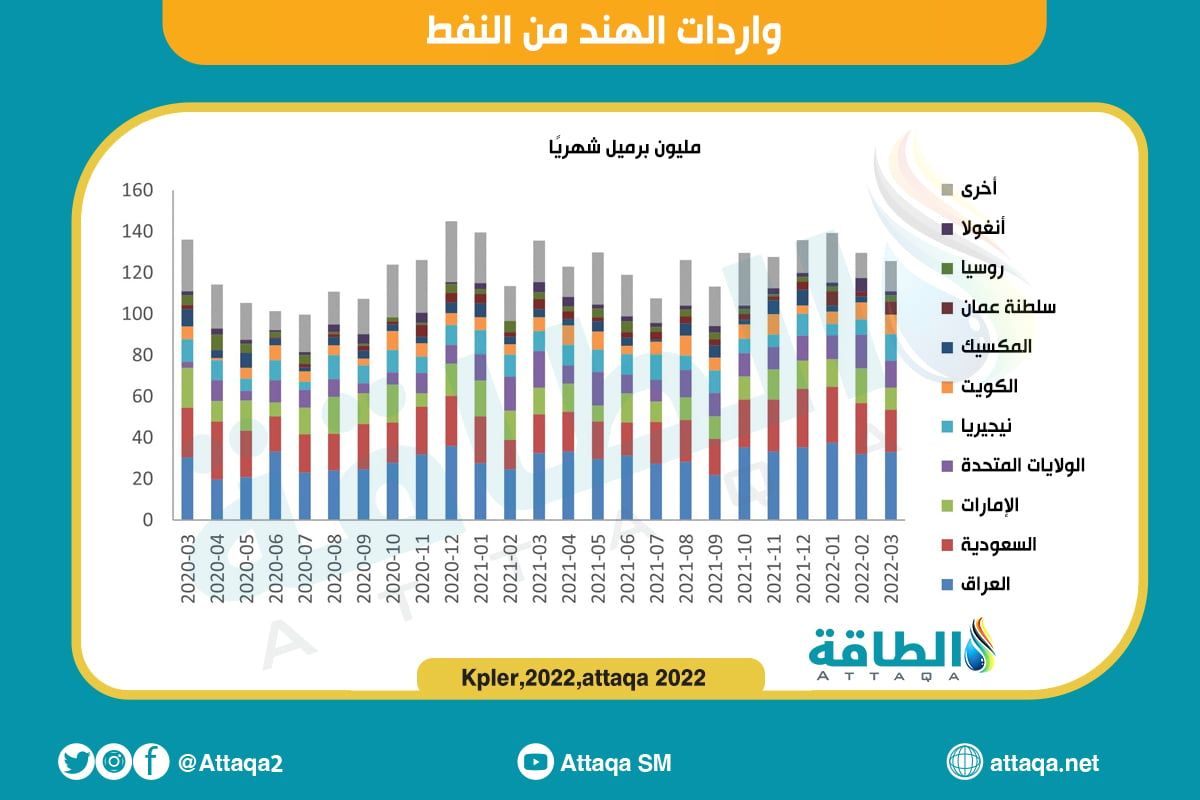

The following graph – prepared by the specialized energy platform – shows India’s oil imports from March 2020 until the same month 2022:

Increase refining capacity in India

In his remarks, which were seen by the specialist energy platform, Singh said that India has plans to increase its current refining capacity of 248.9 million metric tons per year (nearly 5 million barrels per day) to 450-500 million metric tons per year (8.8-9.7 million barrels per day). ) in the next 10 years, to meet the growing demand for fuel in India, as well as meet the needs of the export market.

He added that while oil and gas will continue to play an important role in India’s energy mix, the share of new and alternative energy sources – such as renewables – will continue to rise.

In May 2022, the Government of India approved changes to its biofuels policy to bring forward the target of blending 20% ethanol into gasoline to 2025-2026, from an earlier target of 2030.

The government also plans to set up 5,000 compressed biogas plants by 2023, according to Singh.

“Indian oil and gas industry will also remain engaged in moving towards increasing volumes and technology for non-fossil fuels, such as hydrogen and biofuels,” he added.

Singh stressed that the energy transition would reduce the demand for petroleum products, but increase the chances of attracting increased demand for petrochemicals.

Therefore, India’s refining sector will need to adopt a dual approach to diversify into petrochemicals and alternative fuels, as well as improve the efficiency of its oil business amid tougher emissions standards, to meet the challenges of a changing energy landscape.

related topics..

Also read..

Leave a Reply