Read in this article

- Global oil production may rise to a record level in 2024.

- Higher oil production than consumption may drop crude prices.

- Growth in global oil demand may exceed 1.7 million barrels per day.

- Expectations of a decline in gasoline and diesel prices in the United States during 2024.

- Natural gas production in America is heading to a new record.

The US Energy Information Administration sees relative calm in the global oil and gas markets during the next year (2024), after another turbulent year that the markets are expected to experience in 2023. As a result of the continuing repercussions of the Russian invasion of Ukraine.

Concerns about the global economy and the repercussions of Corona in China increase uncertainty about the expectations of energy markets, according to what was monitored by the Energy Research Unit.

In front of this, the Energy Information Administration expects, in its preliminary estimates for the year 2024, an increase in global supply by more than consumption, whether in the oil or gas markets. Which leads to falling prices.

To follow the harvest of the Energy Research Unit for the year 2022 regarding the oil and gas markets, renewable energy, electric cars, and others, along with the forecasts for the year 2023, please click here.

Oil markets in 2024

The US Energy Information Administration expects oil demand to grow by about 1.72 million barrels per day, bringing the total to 102.20 million barrels per day; This represents an increase in the expected growth rate for the current year (2023) at 1.05 million barrels per day.

Economic concerns and the repercussions of Corona in China affected the growth in oil demand during the past year (2022), but it eventually rose by about 2.25 million barrels per day.

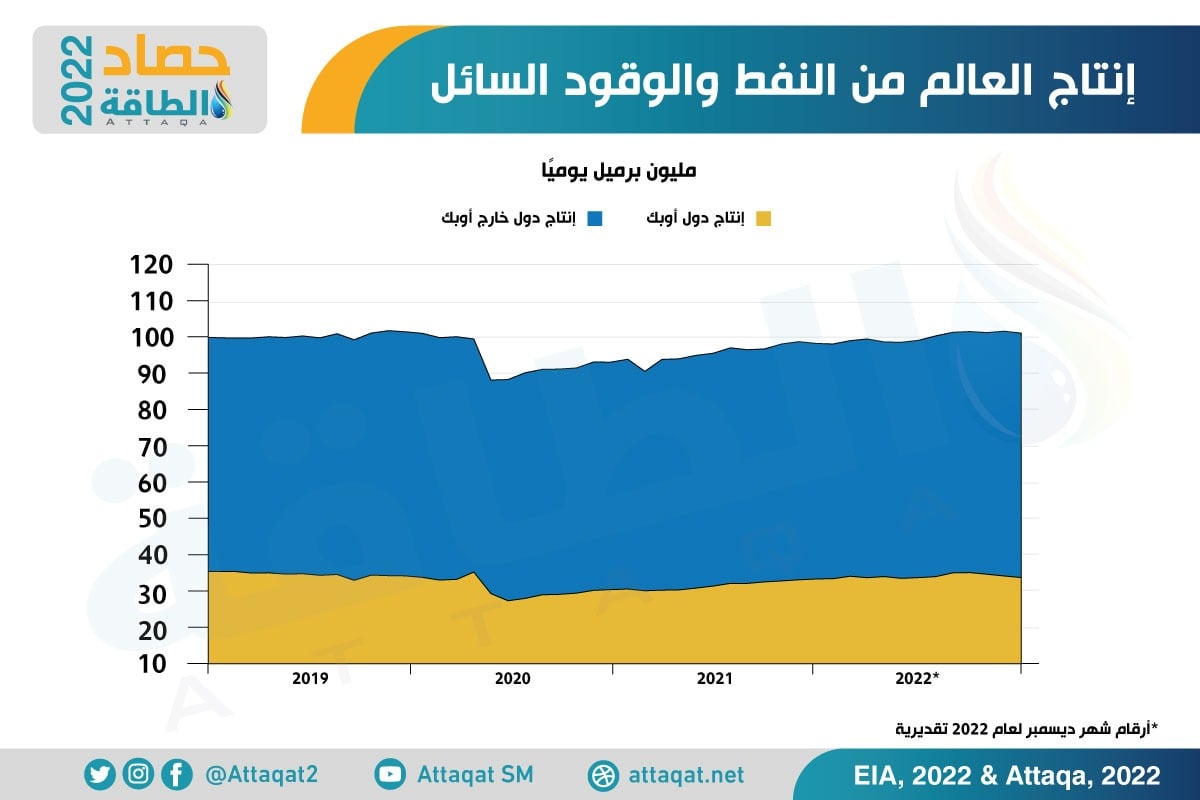

In terms of supply in the oil markets, world production of oil and liquid fuels is likely to rise to a new record level of 102.83 million barrels per day in 2024, compared to the expected level for 2023 at 101.10 million barrels per day, after failing to exceed the 100 million threshold last year.

Countries outside OPEC will lead the growth of oil supplies next year, by more than one million barrels per day, bringing the total to 67.81 million barrels per day, according to the report seen by the Energy Research Unit.

The Energy Information Administration estimates US crude oil production at 12.81 million barrels per day next year, up from the projected 12.41 million barrels per day this year.

It is also expected that OPEC countries’ production of oil and liquid fuels will rise to 35.02 million barrels per day next year, compared to 34.34 million barrels per day expected in 2023, while crude oil production alone is likely to reach 29.52 million.

The following graph shows the production of oil and liquid fuels in OPEC and non-OPEC countries on a monthly basis between 2019 and 2022:

Oil prices in 2024

With expectations that the supply in the oil markets will exceed global demand during the next year; Average crude prices may decline compared to 2022 and 2023.

The Energy Information Administration expects Brent crude to average $77.57 per barrel in 2024, as global oil inventories build; This puts downward pressure on crude oil prices.

The price of Brent crude is expected to average $83 per barrel in 2023, down 18% from the 2022 level of $100.94 per barrel, andThe graphic below shows daily oil prices over the past year:

As for West Texas Intermediate crude, it is expected to fall to $71.57 a barrel next year, compared to the expected average for the current year at $77.18 a barrel.

The Energy Information Administration expects average retail gasoline prices in the United States to decline from $3.32 per gallon in 2023 to $3.09 per gallon next year, after rising to an average of $3.97 in 2022.

The decline in gasoline prices comes with expectations of a decline in crude oil prices and wholesale refining margins, according to data seen by the Energy Research Unit.

Diesel prices in the United States are likely to decline to an average of $3.69 per gallon in 2024, with refining margins estimated to drop by 38% in the same year.

Diesel prices in the United States averaged $5.02 per gallon last year and are likely to ease to $4.20 per gallon in 2023.

gas market in 2024

As in the case of oil markets, the Energy Information Administration, in its first estimate of the US natural gas market, expects prices to be more subdued next year; Where local production exceeds the increase in LNG exports.

Henry Hope’s US natural gas price is likely to be $4.80 per mmbtu in 2024, down slightly from the projected average for 2023 of $4.90.

Last year, natural gas prices jumped to a 14-year high, hitting $6.42 per million British thermal units, with global market turmoil caused by Russia’s invasion of Ukraine.

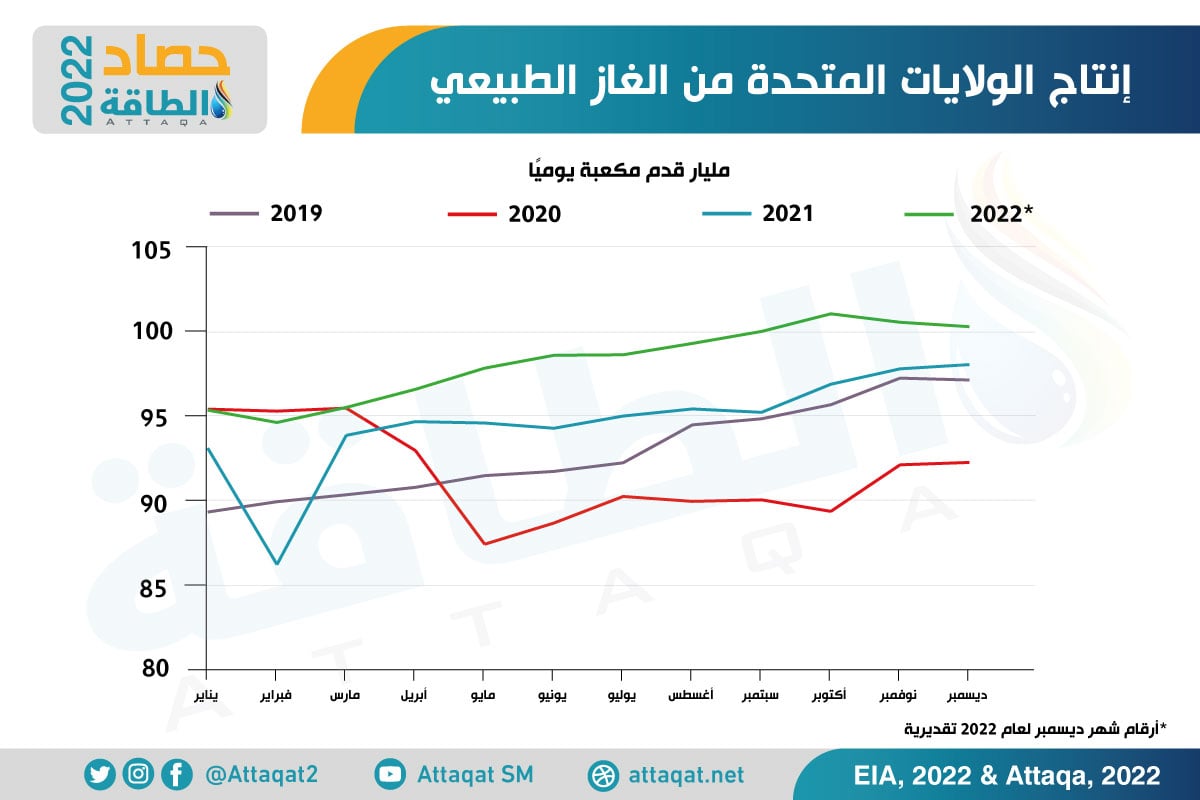

The Energy Information Administration expects dry natural gas production in the United States to rise to a new record of 102.29 billion cubic feet per day in 2024, compared to an expected level of 100.34 billion cubic feet per day this year.

The following graphic monitors natural gas production in the United States on a monthly basis between 2019 and 2022:

While gas consumption in America is heading to decline to 85.79 billion cubic feet per day, next year, compared to the expected average for 2023 at 86.74 billion cubic feet per day, after it reached 88.72 billion, last year.

With higher production and lower consumption, the United States is likely to boost its LNG exports to 12.59 billion cubic feet per day, compared to 12.06 billion and 10.65 billion cubic feet per day expected in 2023 and 2022, respectively.

related topics..

Also read..

Leave a Reply