The American ExxonMobil Corporation has renewed its ambition to sell its assets in shallow Nigerian waters, after the results of the presidential elections – a few days ago – resulted in Paula Tinubu winning power, succeeding outgoing President Muhammadu Buhari, who had previously retracted his approval of the sale.

And it seems that the practices of oil theft and sabotage of facilities and pipelines growing locally in Abuja have prompted major oil companies to exit their assets in the largest oil producers in Africa, according to what the specialized energy platform followed.

And the American company – nearly a year ago – expressed its desire to abandon the shallow water assets and sell them to the “Seplat Energy” company, and despite announcing presidential approval for the sale, Bukhari retracted that approval a few days later.

Siplat Energy, the Nigerian buyer of ExxonMobil’s shallow water assets, is seeking to appease the Abuja government and complete the sale within two months, according to Reuters.

Hold on to the deep roots

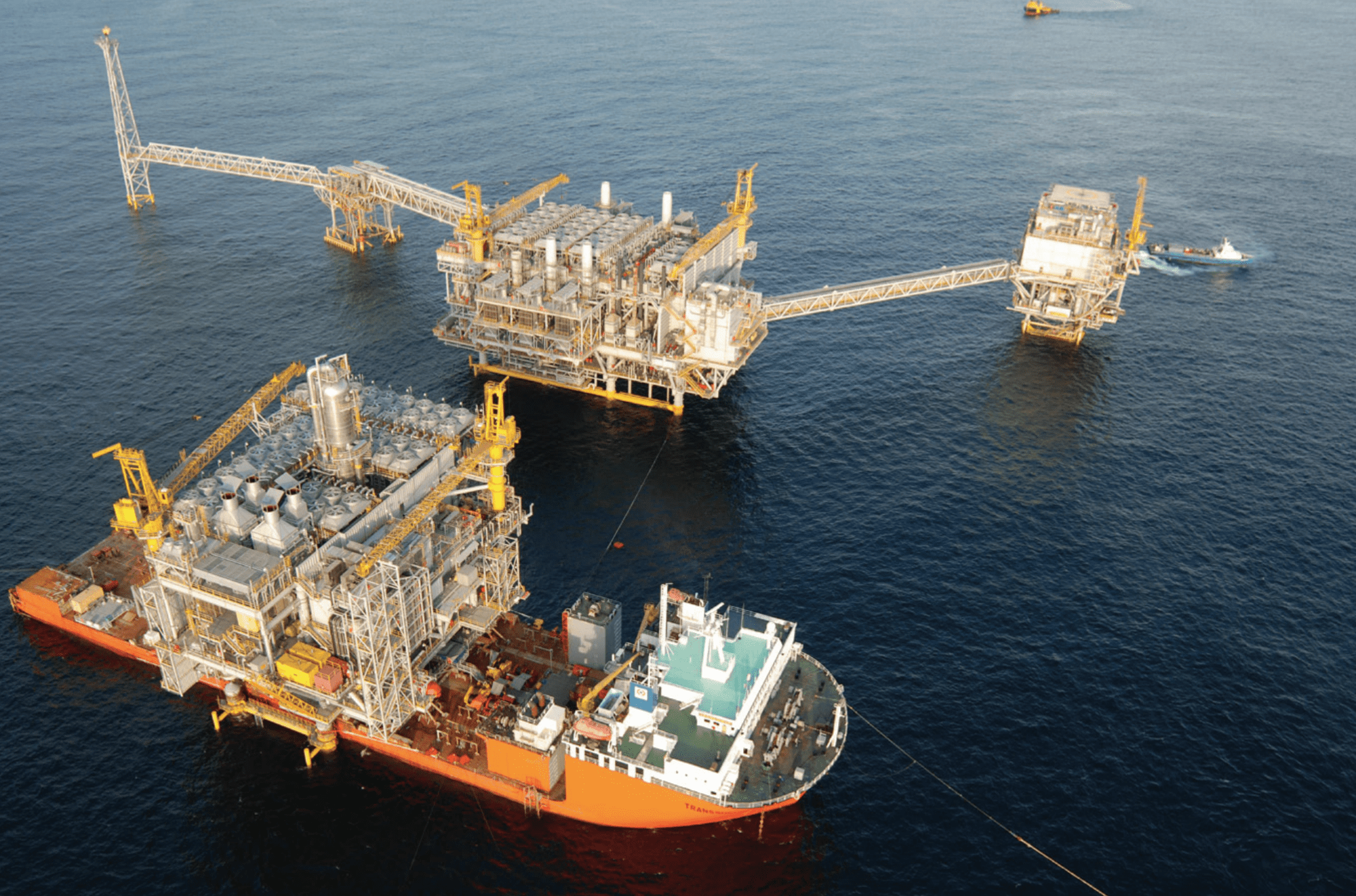

ExxonMobil’s global head of upstream business, Liam Malone, confirmed his company’s adherence to its assets in the deep waters of Nigeria, but stressed at the same time that Abuja is a challenging and difficult work environment.

Despite his confirmation of the continuation of the company’s assets in deep waters in Nigeria, he conditioned future investments in it on market developments, according to his statements prior to the start of the “Sira Week” business, which begins today in the American city of Houston.

Malone explained that the deep waters in Nigeria are still attractive areas for investment, which prompts ExxonMobil not to give up those assets, but the internal factors that the West African country suffers from, and the American company’s desire to open the way for investments in other countries, may affect its adherence. with those assets.

Unprofitable investment

ExxonMobil was not the only international oil company that expressed its desire to exit some of its assets in Nigeria, as it was preceded by “Shell” and “Total Energy” last year (2022), due to factors, including corruption and lawlessness.

In addition to local factors that drive away investments in the oil sector, such as theft of crude flows and sabotage of lines and facilities, many major oil companies prefer to reduce the production of their oil assets in Nigeria and focus more on gas investments in Africa, in addition to investment-intensive projects in North and South America.

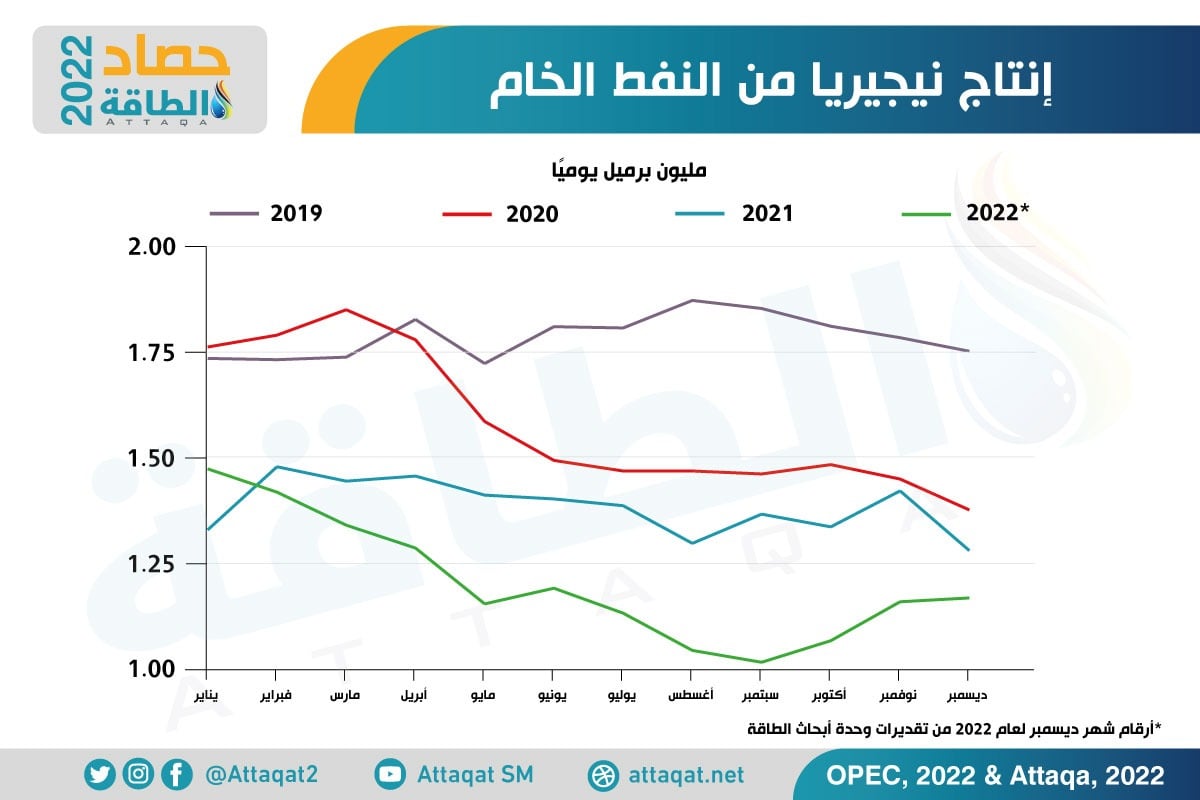

These developments removed Nigeria from its position as the largest crude producer in Africa, and reinforced its inability to meet its production quota within the OPEC + alliance.

Barely 3 months have passed since the Nigerian Oil Minister pledged to fulfill his country’s quota in OPEC + by next May, after addressing acts of theft and sabotage, but it seemed that the explosion of one of the main crude transport pipelines a few days ago, killing more than 12 people, blew this up. aspirations.

The chart below – prepared by the specialized energy platform – monitors the decline in Nigerian oil production from 2019 until last year (2022), according to OPEC data:

Freeze approvals

Seplat Energy had expressed its desire to acquire the assets of the American company Exxon Mobil in Nigeria, at the end of February last year, in the largest deal for the country, since the adoption of the oil industry law in August 2021.

The American company’s desire to abandon the shallow water assets in Abuja coincided with the ambitions of the Siplat company to join the major energy companies in the African country.

It was planned that the value of the acquisition deal would reach $ 1.2 billion, subject to increase, provided that Seplat Energy would start paying during the past year (2022), and finish paying the full value of the deal for Exxon Mobil by 2026.

The completion of the deal at that time depended on the approval of a number of bodies, including: (the Ministry of Oil, the Oil Regulatory Authority, and the Federal Competition Commission), and President Muhammadu Buhari announced approval of the sale in August 2022, but he retracted a few days later, after the Oil Regulatory Authority refused. she has.

Since then, the sale of ExxonMobil assets in Nigerian shallow waters has faced a freeze, but has picked up again, after new presidential elections were held a few days ago, and Paula Tinubu won the post to succeed Buhari.

Also read..

Leave a Reply