The Norwegian company Equinor is diversifying its portfolio of oil and gas projects outside Norway as part of plans to increase production by 2030.

The global leader in the oil and gas sector has made the final decision to invest in a new $9 billion project in Brazil, after years of consideration and appreciation.

The project is expected to increase Equinor’s capacity to produce from deep waters off Norway to 400,000 boepd by 2030, according to estimates by energy consulting and research group Wood Mackenzie.

Equinor currently produces small amounts of oil and gas outside Norway; Most of its production is concentrated in local fields in the Arctic, the North Sea and elsewhere, according to the Energy Research Unit.

Equinor stake 35%

Equinor made the final investment decision in the Brazilian BMC 33 field development project, on May 8, 2023, in alliance with Repsol Sinopec Brasil and Petrobras, with production expected to start in 2028.

The Norwegian company owns 35% of the Brazilian gas project, Repsol also owns a similar stake, and Petrobras has a 30% stake, according to details published on the website.

This Brazilian field was discovered by Repsol Sinopec in 2010, while Equinor became the main operator of the project in 2016.

This project is located in the vicinity of the Campos Basin, 200 km from the shore, with depths of up to 2,900 meters, and contains reserves of natural gas, oil and condensate in excess of one billion barrels of oil equivalent.

Meet domestic demand by 15%.

The Brazilian BMC-33 field development project is expected to provide 15% of the country’s gas needs and reduce its exposure to the global LNG market.

This comes with the expected production capacity to reach 16 million cubic meters per day, when projects start operating in 2028.

It is planned to establish a floating storage unit connected to the project with a capacity of 126 thousand barrels per day, according to what was monitored by the Energy Research Unit.

The Norwegian company has planned for years to expand oil and gas production outside Norway, through ambitious projects in the United Kingdom, Brazil, Canada and the US Gulf of Mexico.

UK and Canada projects soon

Analysts expect Equinor to make final investment decisions for other high-priority projects outside Norway in 2023 and 2024.

The decision to invest in the UK Rosebank project is expected before the end of 2023, while the decision on the Pays du Nord project in Canada is expected before the end of 2024, according to estimates by Wood Mackenzie senior analyst Louise Hayom.

He also expects to develop two projects in the US Gulf of Mexico before the end of the decade. This will significantly increase Equinor’s oil production over the next 7 years.

Equinor has been using modern low-emission technologies in oil and gas projects for years. This has made it a hot spot for competitors who are facing intense pressure to cut emissions from the sector.

emissions reduction technologies

Equinor relies on combined-cycle gas turbine technologies for their efficiency in reducing emissions during field service life in oil and gas fields over their lifetime, as monitored by the Energy Research Unit.

The company expects these gas turbines to reduce the carbon dioxide intensity of the Brazil project to less than 6 tons of carbon dioxide equivalent per 1,000 barrels of oil equivalent, according to details monitored by the Energy Research Unit.

Equinor contributed to saving Europe over the past year by increasing its imports of Norwegian gas at record rates to compensate for the sudden shortage of Russian gas, until it became the largest gas supplier to Europe through pipelines.

Record profits in 2022

The Norwegian company, in turn, made record profits by exporting gas to Europe and elsewhere at prices multiples of 300% or more over the pre-war average.

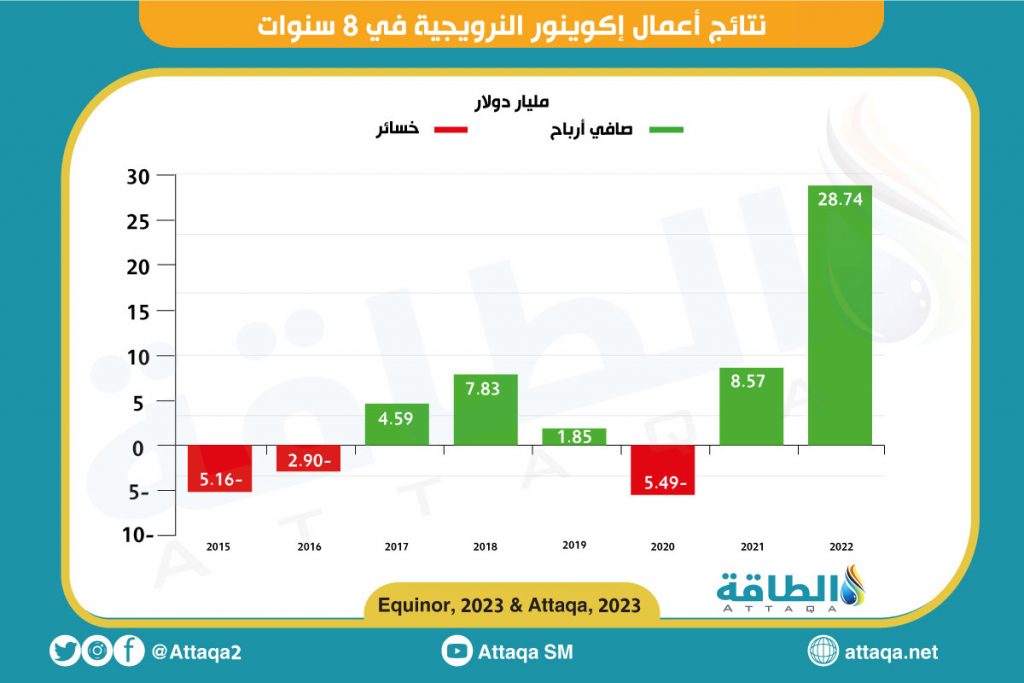

The following graphic, prepared by the Energy Research Unit, shows Equinor’s business results from 2015 to 2022:

And annual business results published in February 2023 showed that the company’s net profit jumped to $28.7 billion in 2022, compared to $8.57 billion in 2021.

In the first quarter of 2023, the Norwegian company’s profits amounted to $4.97 billion, compared to $4.7 billion in the first quarter of 2022, and $1.8 billion in the same quarter of 2021.

related topics..

Also read..

Leave a Reply