The sudden announcement of a number of OPEC+ countries to cut production led to a rise in oil prices by about 8%, as it jumped above $85, before witnessing a slight decline.

Christoph Rohl, senior researcher at the Center for Global Energy Policy at Columbia University, said – in statements to the specialized energy platform – that the alliance continues to practice the same policy, expecting that crude prices will continue in the range of 80 and 86 dollars, with the possibility of another surprise.

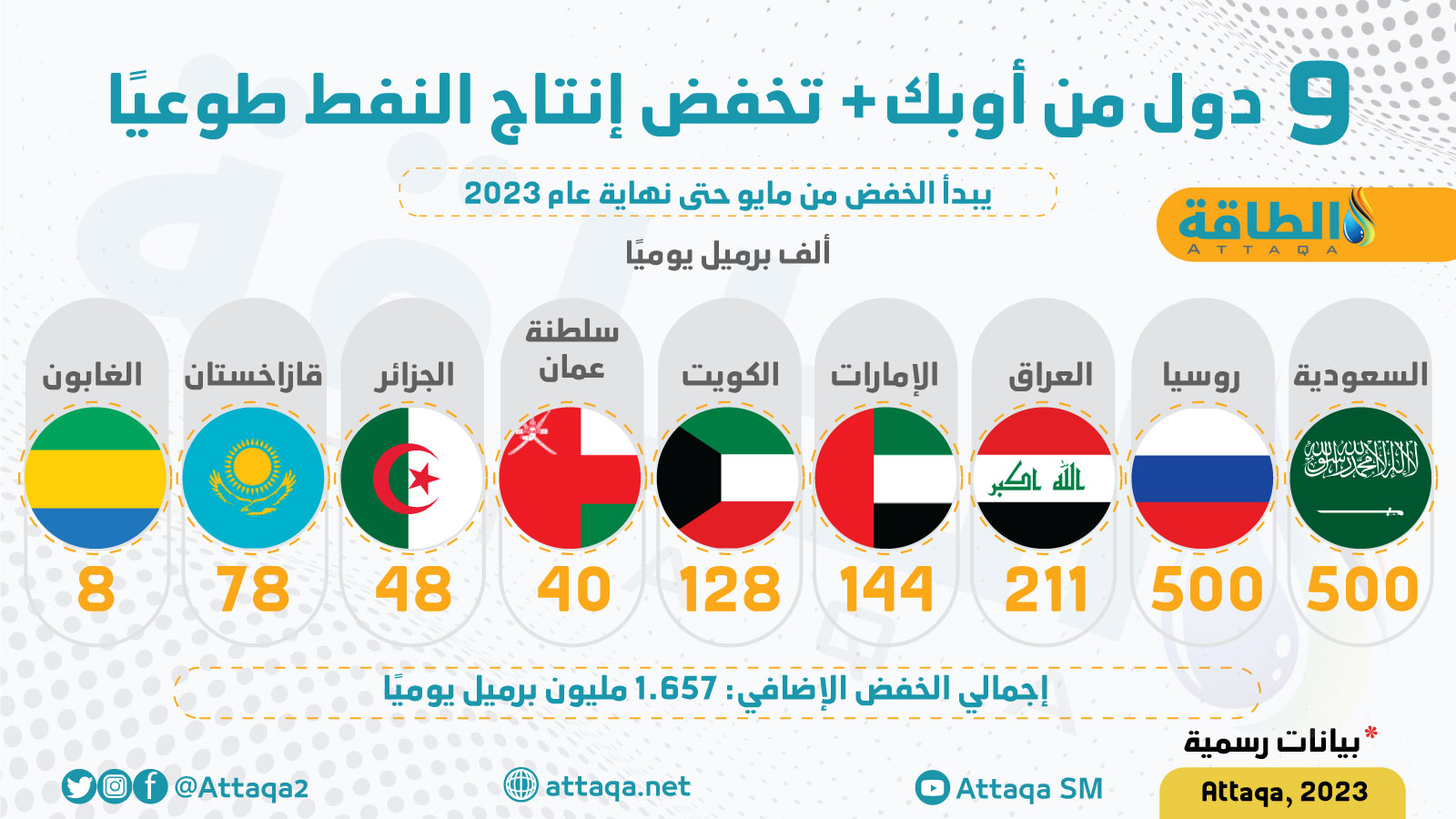

Saudi Arabia and 8 countries in the OPEC + coalition had announced a voluntary production cut of about 1.6 million barrels per day, including a cut of two million barrels announced in October (2022), which is equivalent to 3.7% of global demand.

production quotas

“Because members of the OPEC+ alliance may produce less than they are allowed to produce under their quotas, the announced cuts – as measured by the quota criterion – will actually be low,” says Christoph Ruhl.

He added that the announced cuts — including the previously announced 500,000 bpd from Russia — amount to a total of 1.7 million bpd.

He explained that the target production of the OPEC + coalition, that is, the production allowed according to the quota before the cuts, was 40.1 million barrels per day, but the actual production in February (the last month for which we have data) was less than 2 million barrels per day, or at 38.2 million. barrels per day.

He pointed out that when applying the announced cuts only by countries that currently produce according to their quota levels, it follows that their total will reach about one million barrels per day.

“It’s interesting that Russia is one of the countries that produces below the quota…so we may not see any additional cuts in Russia, on top of what they have to close after the recent EU and G7 sanctions,” he continued.

The repercussions of the decision on America

“There’s not much the United States can do in the short term, or in the area of economic policy in general,” said Christoph Ruhl, senior research fellow at the Center on Global Energy Policy at Columbia University.

He added, “In the long term, if the cuts succeed in stabilizing prices at a higher level than they would have otherwise, this could accelerate shale oil production in the United States, which means that the cuts will be partially offset by additional production elsewhere.” .

Christoph Ruhl said: “I do not expect the United States to use the strategic oil reserves again, if there is no clear price effect that makes this attractive.”

He pointed out that “the strategic oil reserve is not a limited group of oil that can be used every time there is a change in the market through OPEC + policies.”

As for the repercussions of the decision on oil prices, Christoph Rohl said: “No one can predict what will happen.”

He suggested that it is best to assume that, absent additional unforeseen shocks to the regime, this reduction will not be sufficient to bring prices anywhere near $100 per barrel.

He added, “Global economic growth is the single most important driver of global demand for oil… It seems to me that China and the G-7 are facing a slowdown in growth, not an acceleration.”

He pointed to an overestimation of the increase in Chinese demand after the end of the closure procedures due to the outbreak of the Corona pandemic to a large extent, by the International Energy Agency and other oil analysts.

He explained: “In light of this, I think that oil prices will continue in the range of 80 and 86 dollars a barrel for a while longer – until the next surprise, which will certainly happen.”

Voluntary cuts

In a related context, Sarah Emerson, president of energy market analysis and forecasting firm ESAI Energy, believes that the voluntary nature of the agreement reduces the burden on the group to negotiate future production increases with members who do not meet their targets.

And it believes that the voluntary cut can be reversed without referring to all members for approval, which increases the concentration of power within the largest producers, according to a report published by the specialized energy platform recently.

Emerson said: “The decision to maintain voluntary cuts indicates solidarity with Russia in light of the imposition of price ceilings on oil and derivatives.”

On the other hand, the strategic expert in the field of energy, Shoaib Botmin, indicated that there are two important blocs within OPEC and OPEC +, the first is led by Saudi Arabia at the head of the Arab countries as the largest producer within the organization, and the Russian bloc as the third largest oil producer in the world, and both of them will not be satisfied with prices less than 85 or 90 dollars per barrel.

The following graphic – prepared by the specialized energy platform – shows the size of the voluntary production cut announced by OPEC +:

related topics..

Also read..

Leave a Reply