Crude oil prices jumped more than 6%, at the end of trading today, Monday, April 3, 2023, after countries from OPEC + announced voluntary cuts.

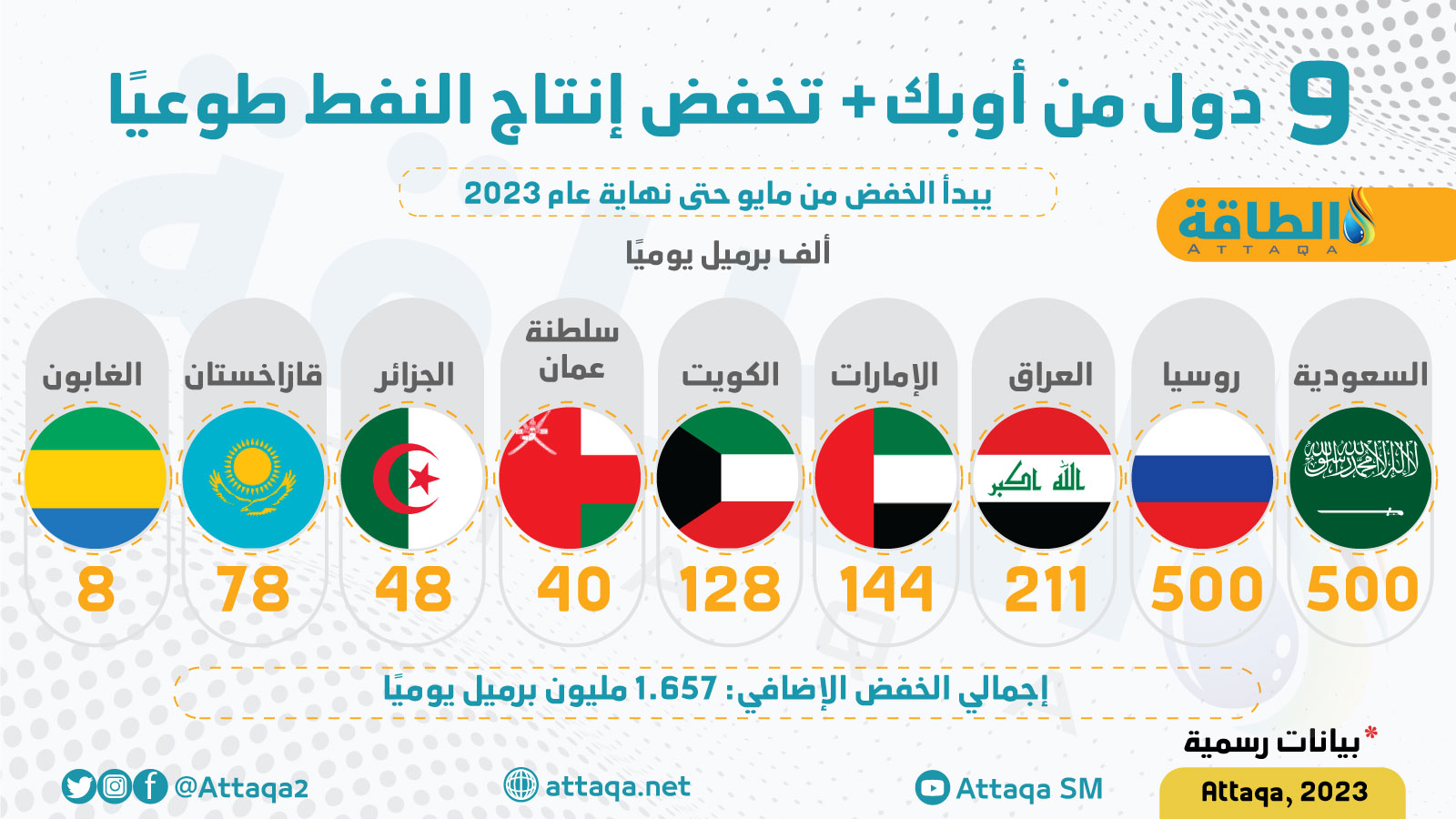

And 9 OPEC + countries, led by Saudi Arabia and Russia, announced voluntary cuts of more than 1.65 million barrels per day, starting next May, as a precautionary measure aimed at supporting the stability of oil markets.

The voluntary cut is added to the cut in production by how much The two million barrels agreed upon by OPEC+ countries at the 33rd ministerial meeting held on October 5, 2022, which will last until the end of December 2023.

For its part, the International Energy Agency warned that the OPEC + cuts risked increasing oil market turbulence and raising prices.

Crude oil prices today

At the end of trading, Brent crude futures for June 2023 delivery rose by 6.3%, to record $84.93 a barrel.

West Texas Intermediate crude futures – for May 2023 delivery – also rose by 6.3%, to record $80.42 a barrel, according to what was seen by the specialized energy platform.

Crude oil prices ended their dealings on Friday, March 31, with an increase of about 2%, but recorded monthly and quarterly losses.

Brent crude achieved weekly gains of about 5.5%, but it recorded monthly and quarterly losses of 5% and 7.1%, respectively, while WTI achieved weekly gains of 9.2%, but it recorded monthly and quarterly losses of about 1.8% and 5.7%, respectively.

OPEC + moves

The decision of several countries from the Organization of Petroleum Exporting Countries (OPEC) and its allies, including Russia, shocked the markets by announcing further cuts in production.

The OPEC + alliance was expected to maintain its previous decision to cut production by two million barrels per day until December at its monthly meeting today, Monday.

The pledges raise the total volume of OPEC+ cuts to 3.66 million barrels per day, equivalent to 3.7% of global demand.

The following infographic, prepared by the specialized energy platform, reviews the size of the voluntary cuts announced by Saudi Arabia and 8 other OPEC+ countries:

Crude oil price forecast

Goldman Sachs cut its forecast for OPEC+ production by the end of 2023 by 1.1 million barrels per day and raised its Brent crude price forecasts to $95 and $100 per barrel for the years 2023 and 2024, respectively.

Goldman Sachs estimated that production cuts could provide a 7% boost to crude oil prices; This contributes to increasing the revenues of OPEC + countries.

For his part, the energy platform editing advisor, energy economics expert, Dr. Anas Al-Hajji, believes that the announcement of the OPEC + countries aims primarily at not declining crude oil prices during the second half of this year, amid indications of a decline in demand.

Al-Hajji said, in statements to Al-Arabiya TV, that OPEC + moves are precautionary, especially with the presence of some information related to the banking crisis in the United States, and if it is greater than it really is, which could lead to a financial crisis and the possibility of an economic recession.

America’s response

For its part, the Biden administration said the move announced by the producers was not wise, Reuters reported.

A spokesman for the US National Security Council said: “I do not think that the OPEC + cuts make sense at this time, given the uncertainty in the market.”

Washington’s view was supported by a number of analysts, noting that he is the founder of the “Vanda Insights” center for oil market analysis, Vandana Hari: “It is difficult to buy the ‘precautionary’ and ‘precautionary’ logic now, when the banking crisis is over and Brent has crawled back about $80 from its lowest levels.” In 15 months earlier than March.

Last month, Brent crude fell towards $70 a barrel, its lowest level in 15 months, on fears that a global banking crisis and high interest rates would hurt demand despite a decrease in OPEC oil production in March due to maintenance of oil fields in Angola and some outages. Iraqi exports.

demand for oil

Analysts at JPMorgan said the move came later than expected, and that a slow response to weak prices will have a limited impact on supply and demand balances and may delay the impact on prices.

They added, “Since November, the global balance between oil supply and demand indicates that strong political action is needed to control global oil surpluses,” Reuters reported.

On Friday, Energy Information Administration data showed that US oil production rose in January to 12.46 million barrels per day, the highest level since March 2020.

related topics..

Also read..

Leave a Reply