China’s imports of crude oil jumped during March 2023 to their highest levels since mid-2020, driven by an increase in domestic demand and a recovery in the industrial sector.

China’s imports of crude rose to 52.3 million tons, equivalent to 12.3 million barrels per day, during March 2023, according to Reuters.

China’s oil imports in March 2023 increased by 22.5% over the same month last year (2022), as it recorded 10.1 million barrels per day.

Imports for the month of March 2023 are also the highest in 33 months, that is, since June 2020, which recorded 53.18 million tons, according to what was monitored by the specialized energy platform.

First quarter imports

China’s oil imports rose during the first quarter of this year to 136.6 million tons, an increase of 6.7% from 127.9 million tons registered during the same period last year.

Beijing’s imports of natural gas also rose to 8.9 million tons during March 2023, an increase of 11.2% from the 8 million tons recorded in the same month last year.

Total gas imports during the first quarter of 2023 amounted to about 26.7 million tons, down by 3.6% from the same period last year.

Corona measures easing

China’s domestic demand has rebounded since coronavirus precautions were significantly eased in January 2023.

The demand of Chinese refineries for crude oil increased to meet the domestic demand for fuel derivatives in the industrial sectors, in addition to the transportation and daily life sectors.

External demand for Chinese fuel derivatives exports also increased, prompting refineries to increase purchases of crude oil, to meet both domestic and global demand.

China is making good profit margins from exporting gasoline and fuel derivatives abroad at the present time, taking advantage of the unprecedented rise in global oil and gas prices for decades due to the Ukrainian war.

fuel exports

China’s exports of refined fuel derivatives jumped by 35.1% to 5.5 million tons in March 2023, compared to 4.1 million tons during the same month in 2022.

Its exports also jumped during the first quarter of 2023, to record 18.2 million tons, equivalent to 1.62 million barrels per day, a growth rate of 59.8% over the same period last year.

China’s fuel exports during the first quarter of 2022 amounted to approximately 1.01 million barrels per day, which means an increase of 610 thousand barrels per day during the first three months of 2023.

Domestic gasoline consumption rates stabilized during March 2023, while diesel demand rose at less-than-expected rates, according to Xu Bing, senior analyst at GLC Commodity Consulting.

And it was expected that the domestic consumption of kerosene would grow on a large scale during the month of March 2023, based on estimates of the recovery of the aviation sector, after the lifting of travel restrictions within the Corona easing package.

Russian oil discounts

Some experts explain the jump in China’s oil imports with the generous discounts offered by Russian companies to Chinese refineries, which prompted them to intensify futures purchase contracts.

And the Australian and New Zealand Banking Group “ANZ” issued a research note to its clients, explaining the increase in Chinese demand for oil with reasons related to the improvement of industrial demand in addition to the low prices of Russian oil.

Private Chinese refineries acquired most of the Russian oil imports during March 2023, especially Espoo crude.

Espoo’s favorite ore

Tankers loaded with 43 million barrels of different types of Russian oil arrived at Chinese ports during March 2023, including 20 million barrels of Espoo blend and 11 million barrels of the main Urals crude.

Private Chinese refiners prefer Russia’s light Espoo crude for its good chemical composition and low sulfur content, according to the specialized energy platform.

The refineries “Xishing Petrochemical” and “Hengli Petrochemical” account for 6.6% of the total refining capacity in China, and they are the two largest independent refineries in the country.

Russia has directed most of its oil exports to China and India, the largest Asian economies, with offers of generous discounts, due to sanctions imposed on its crude since the Ukraine war.

Western sanctions

The Group of Seven and the European Union have imposed an almost complete ban on seaborne Russian oil exports since December 5, 2022, with a price ceiling for trading in global markets not exceeding $60 per barrel.

The European Union has tightened sanctions against Russia by adding Russian fuel derivatives, especially Russian diesel, to the list since February 5, 2023, which prompted Moscow to insist on flooding Asian markets with cheap oil to ensure the flow of revenues necessary for the continuation of the war.

Asia’s oil imports rose during March (2023) to 116.73 million tons, equivalent to 27.6 million barrels per day, an increase of 4% from February 2023.

This increase is due to China and India’s record high imports of Russian oil, in addition to Saudi oil, which regained its first place in export to China during March 2023, according to what was monitored by the specialized energy platform.

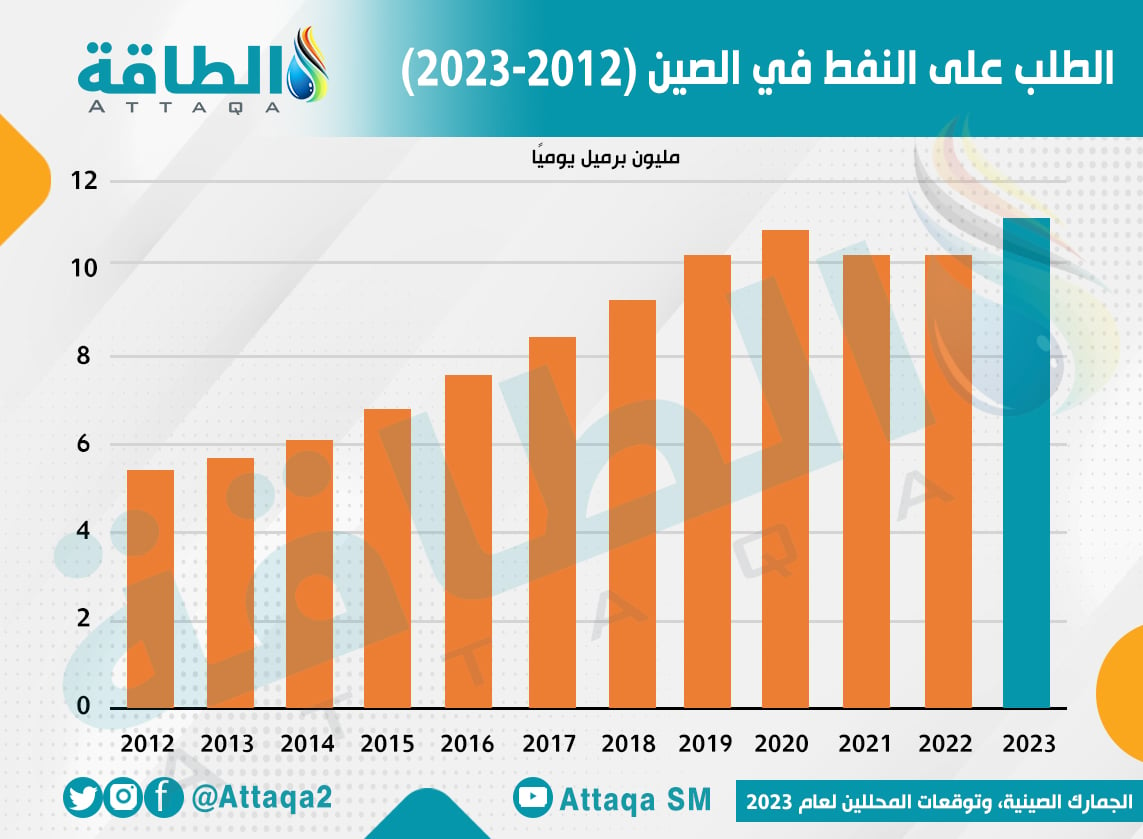

The following graph – prepared by the specialized energy platform – shows the demand for oil in China during the years 2012 and 2023:

Overestimated estimates

Most international estimates say that China will continue to increase oil imports to meet the growing domestic demand, while others question these estimates and see them as greatly exaggerated, especially with regard to excessive optimism about the growth of Chinese industrial activity, according to Clyde, senior analyst at Reuters. Russell.

Some estimates suggest an increase in China’s fuel exports, which will lead to a decrease in the demand for fuel derivatives exported by some competing countries to China, as Chinese products often replace the supplies of other exporters.

This weighting confirms the decline in profit margins for diesel products in Singapore on April 12, 2023, to their lowest levels in 13 months, since the return of Chinese refineries to export markets.

It is expected that China’s oil imports will continue to grow during April 2023, with an increase in global demand for fuel, according to the specialized energy platform.

related topics..

Also read..

Leave a Reply