Chevron has announced the enhancement of its production of US shale oil with a new acquisition deal, which is the company’s second in 3 years.

Today, Monday (May 22, 2023), the American oil company completed its acquisition of all shares of the “BDC Energy” company, which produces shale oil in the United States, in a deal worth $ 7.6 billion, including debt.

The acquisition of BDC provides Chevron with high-quality assets that are expected to yield higher returns in lower-carbon basins in the United States, according to a press release seen by the specialist energy platform.

BDC provides strong free cash flow, development opportunities adjacent to Chevron’s DG Basin site, as well as additional space for Chevron’s leading position in the Permian Basin.

The deal was unanimously approved by the boards of directors of the two companies and is expected to close by the end of 2023, Chevron confirmed in its statement.

Boosting US shale oil production

“BDC’s attractive and integrated assets strengthen Chevron’s position in the major production basins in the United States,” said Mike Wirth, Chairman and Chief Executive Officer of Chevron.

He added, “This transaction is cumulative of all important financial measures, and advances Chevron’s goal of safely achieving higher returns and reducing carbon… We look forward to welcoming the BDC team and shareholders to Chevron, and continuing both companies’ focus on safe and reliable operations.”

“The merger with Chevron is an exciting opportunity for BDC to maximize value for our shareholders,” said Bart Brockmann, President and CEO of BDC Energy. “It provides a global portfolio of best-in-class assets.”

“I look forward to integrating our highly complementary businesses, and I’m excited that PDC’s assets will help propel Chevron toward our shared goal of a low-carbon energy future.”

The following graph – prepared by the specialized energy platform – shows US shale oil production, from 2019 to 2022:

Details of the acquisition transaction

The transaction values BDC Energy at $72 per share, a 14% premium to its 10-day average ending Friday (May 19, 2023).

Chevron expects the transaction to be accretive to all major financial measures within the first year after closing, and to add about $1 billion in annual free cash flow at $70 a barrel.

The company said the deal would increase Chevron’s capital spending by about $1 billion annually, raising its annual range to $14 billion to $16 billion through 2027, according to the statement seen by the specialized energy platform.

In morning trading, Chevron shares lost 1%, while BDC Energy shares rose 8%, according to Reuters.

The US oil giant said that with the acquisition of BDC, Chevron will add 10% to its proven reserves at an expected cost of less than $7 per barrel of oil equivalent.

The acquisition will add 260,000 barrels per day of combined oil and gas production to Chevron’s production in the Permian Basin, and in the DJ Basin that spans Colorado and Wyoming.

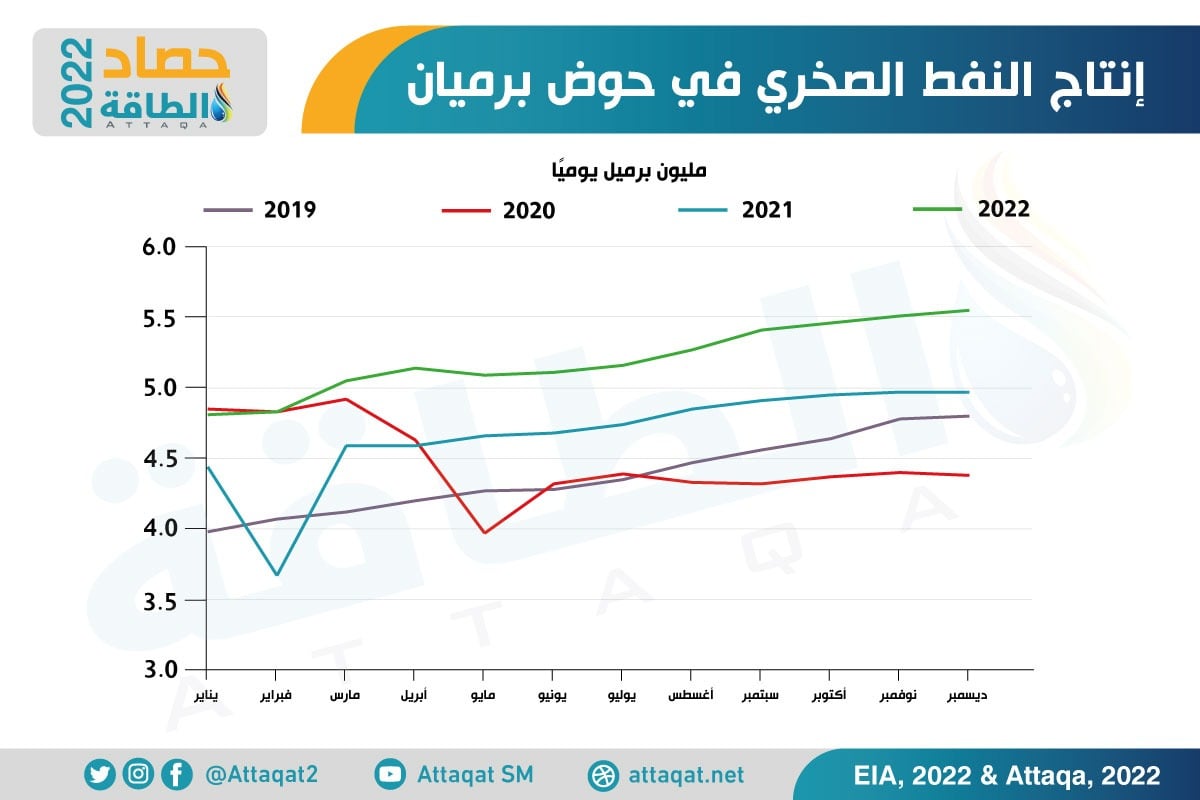

The following graph – prepared by the specialized energy platform – shows US shale oil production in the Permian Basin, from 2019 to 2022:

Biden’s criticism of oil companies

Chevron is one of the largest producers in the DJ basin, following its $13 billion acquisition of Noble Energy in 2020.

The company and competitors were criticized last year (2022), by US President Joe Biden, for not increasing production as fuel prices rose.

Chevron – which is the second largest US oil company – has come under pressure on Wall Street to show its ability to continue expanding US shale oil production after 2027, in the Permian Basin of West Texas and New Mexico.

Chevron executives say that since last year (2022), the company has been looking for American acquisitions.

The company has also recently indicated its desire to reduce its cash stock in a way that will enhance shareholder profitability.

Forecasts of US shale oil production

In a related context, the US Energy Information Administration expects US shale oil production to increase by 41,000 barrels per day during next June (2023), according to what was stated in the drilling productivity report, issued on May 15, 2023.

The report – which was seen by the Energy Research Unit – showed that shale oil supplies from the 7 main basins in America may reach 9.332 million barrels per day next month, compared to the expected level of 9.291 million barrels per day in May.

Shale oil production in the Permian Basin is expected to rise by 15,000 barrels per day in June, bringing the total to 5.707 million barrels per day.

The US Energy Information Administration also expects an increase in oil supplies in the Bakken Basin by about 13 thousand barrels per day, bringing the total to 1.232 million barrels per day.

It is also expected that production will increase in the Anadarko and Niobara basins by about 5 thousand barrels per day each. While preliminary expectations indicate an increase in shale oil production from the Eagle Ford and Appalachia basins by about 2 and 1 thousand barrels per day, respectively.

related topics..

Also read..

Leave a Reply