Read in this article

- • EU discussions focused on a range of $65-70 per barrel as a maximum

- • Poland and the Baltic countries saw that the price of 65 dollars per barrel was very generous to Russia

- • The continued drop in Crude Oil prices last week was somewhat surprising

- • The OPEC+ alliance is even ready to cut production further, if necessary

Oil markets had a week full of surprises, and the European Union’s policy to ban seaborne imports of Russian oil and offshore services for its shipments to third countries, starting December 5 (2022), did not lead to higher prices as expected. The opposite has happened.

The continued sell-off in Crude Oil indicates that concern about weak oil demand, triggered by China’s widening anti-COVID-19 restrictions, has removed all worries about Russian supply disruptions.

A meeting of European Union ambassadors who discussed setting a ceiling for oil prices in Russia, which they want to implement jointly with G-7 allies, last week, ended in a deadlock over the level at which it would be set.

The talks are scheduled to continue in the coming days.

EU discussions centered on a range of $65-70 per barrel, max.

Poland and the Baltic states thought $65 a barrel was too generous for Russia, and other members, including major shippers such as Greece, said they did not want to go below that level.

The idea behind the Russian oil price cap, a US-led initiative to allow companies in America, Britain and the European Union to continue providing shipping insurance, financing and other marine services for Russian crude exports to third countries, after December 5th.

The initiative requires that these exports be sold at or below the price ceiling.

Western allies saw this as a way to reduce Moscow’s oil revenues while ensuring that its crude exports, rejected by the European Union, find buyers elsewhere and avoid a supply crunch.

The complex plan deviates from its goal

It now seems likely that the first objective will not be achieved, and Russia will be able to redirect its oil flows and circumvent the EU embargo, but not because of the price cap.

Russia’s Urals is no longer publicly traded, and evaluating its spot price is nearly impossible, but the best estimate of its value, at the end of last week, was about $20 less than Brent, or about $63 a barrel.

This means that the EU price ceiling may devolve into the status quo for Russia’s oil export income.

Meanwhile, China and India, two major buyers who have stepped up their imports of Russian crude in recent months, are unlikely to subscribe to the price cap.

It is expected that these two countries, and any other new buyers that appear in the coming months, will be able to secure shipping and insurance outside the European Union and the Group of 7 countries.

Crude oil stagnation surprised some of them

Bearing in mind that the market was no longer concerned about supply issues by December 5th, and the lockdown in China was exacerbated by anti-COVID restrictions, the sustained drop in Crude Oil prices last week was somewhat surprising.

Brent crude futures hit a 10-month low, settling at $83.63 a barrel, on Friday, November 25.

Radical shifts occurred in the market structure of crude oil futures contracts.

The decline along the forward curves of Brent, WTI and Dubai has largely flattened.

The first two months of CME’s WTI and Brent crude futures shifted to a pricing system in which spot shipments cost less than just-in-time, tied to an oversupplied market.

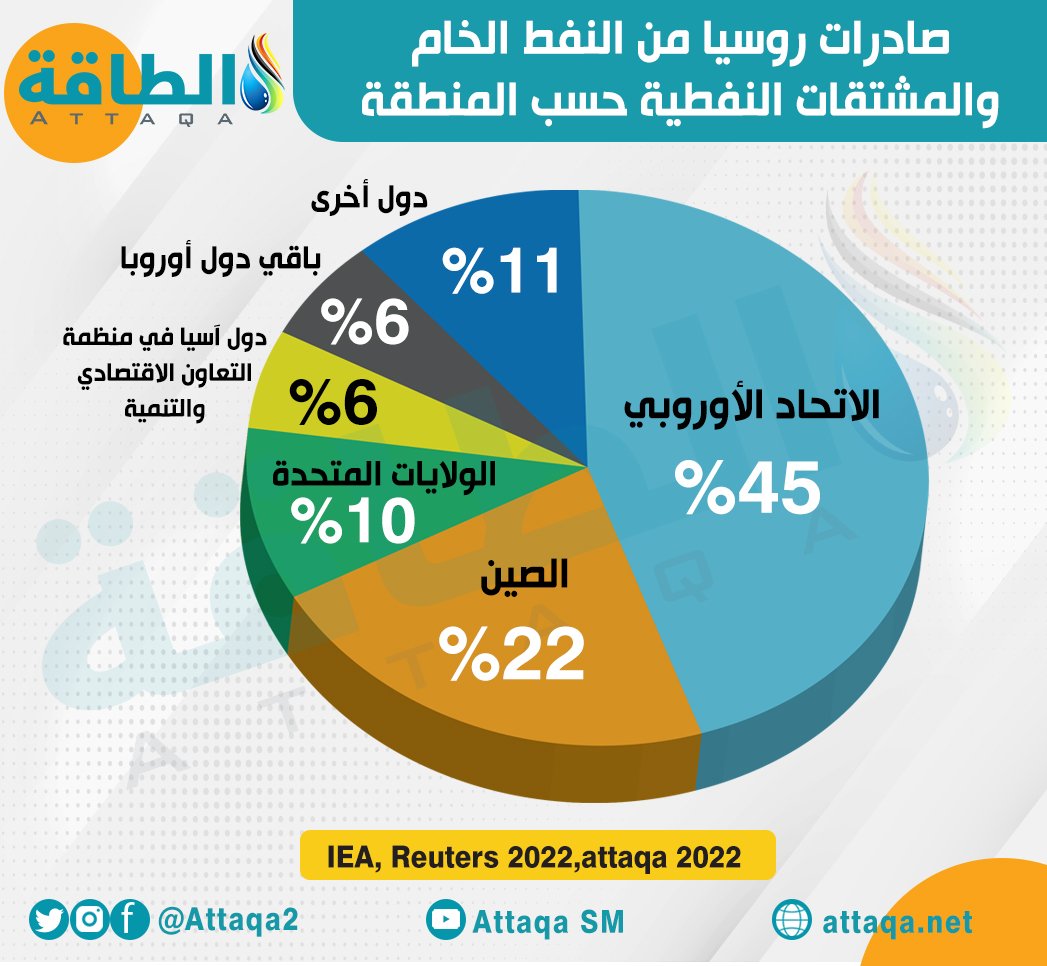

The following graphic shows the volume of Russian oil exports and its derivatives to some European and Asian countries, according to data from the International Energy Agency and Reuters and what was monitored by the specialized energy platform:

The Wall Street Journal published an “exclusive” front-page report on Monday, November 21, that the OPEC+ alliance is discussing increasing production by up to 500,000 barrels per day. The news came out of the blue and was attributed to anonymous “commissioned” sources.

Saudi Energy Minister Abdulaziz bin Salman, the de facto leader of OPEC, issued a categorical denial, adding that: “If necessary, to take further measures to reduce production to rebalance supply and demand, we are always ready to intervene.”

On the other hand, crude oil futures contracts, which fell by more than 5% after the Wall Street Journal report, regained all that was lost just as quickly, after the comment of Saudi Energy Minister Abdulaziz bin Salman, which led to the production of a sharp V-shaped price curve.

An upcoming meeting of OPEC +

Surprisingly, the Wall Street Journal bolstered its original story the next day, this time specifically mentioning Saudi Arabia that it was in discussions with OPEC+ members about whether to reconsider the target cut of 2 million barrels per day agreed last month, for November. November and December.

The newspaper said that Saudi Energy Minister Abdulaziz bin Salman’s denial of the news simply reflected his “discomfort with the public discussion of the group’s decision-making process prior to the agreement,” and continued to cite anonymous delegates as a source of information.

The reports indicated the alleged OPEC+ discussions in an attempt to counter any supply disruptions that might result from the EU embargo on December 5, especially as it comes in the midst of the winter season when demand for oil is high.

In turn, OPEC members Kuwait and the United Arab Emirates joined Saudi Energy Minister Abdulaziz bin Salman in publicly denying that a potential production increase was under discussion.

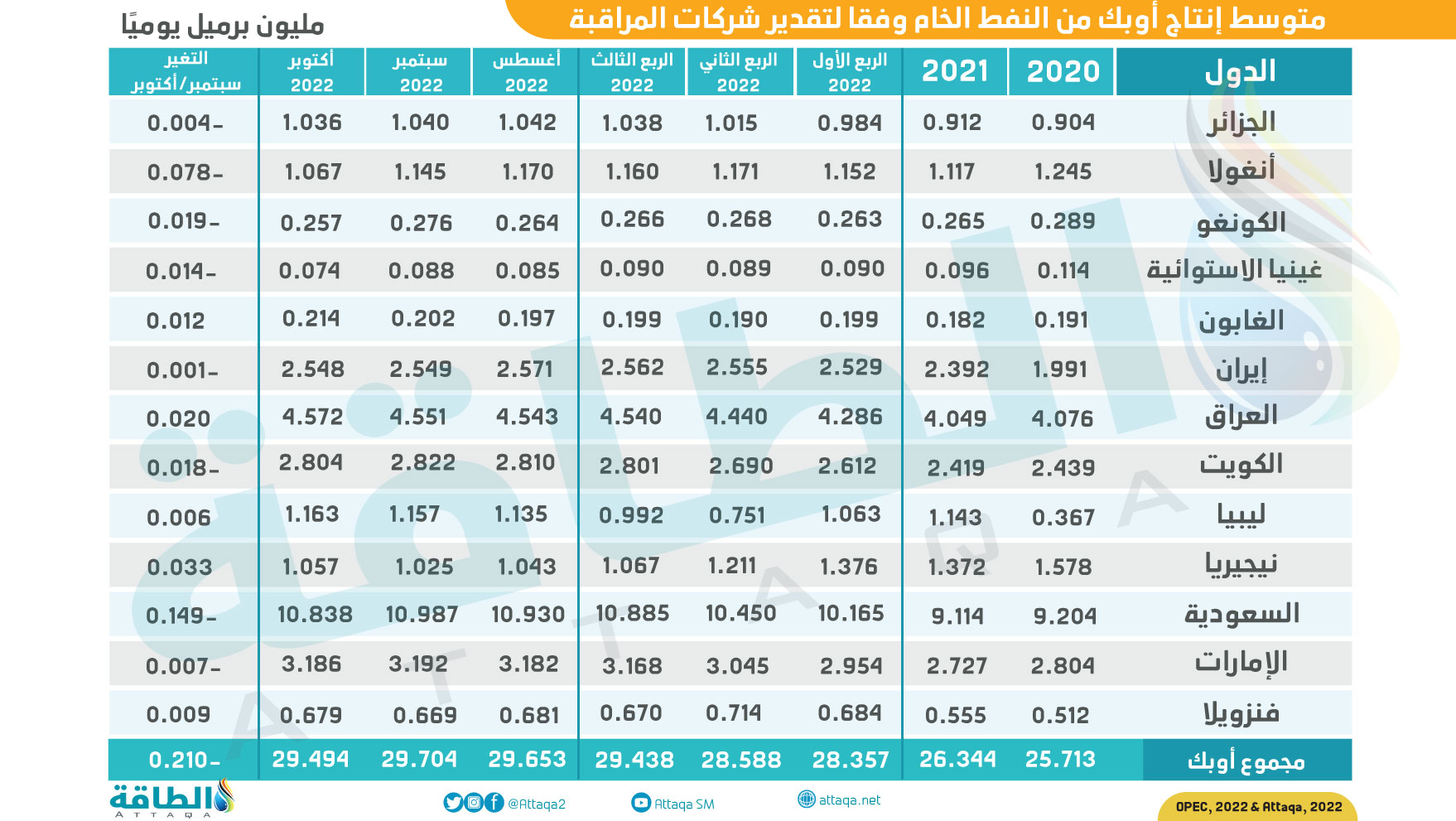

The chart below – prepared by the specialized energy platform – monitors the average production of OPEC oil countries from 2020 until last October, according to the organization’s data:

OPEC+ ministers are due to meet on December 4 to set their production target for January, and we expect the alliance to adopt a wait-and-see attitude.

The persistent weakness of crude oil prices in recent weeks indicates that the market is far from ready for a supply shock, so it is unlikely that OPEC+ countries will want to boost production.

It should be noted that the alliance is now well accustomed to frequently adjusting its policies, which allows it to respond quickly to unexpected market imbalances.

The coalition can call an emergency meeting if prices suddenly rise and remain in an upward trend.

Conversely, a deeper cut without time to assess the impact of the target cut of 2 million barrels per day in November and December would appear premature.

The action would appear premature and could spark bullish sentiment just ahead of the European embargo, which carries marginal risks of supply disruptions.

* Vandana Hari is the founder of the Vanda Insights Center on Energy Markets.

*This article represents the opinion of the author, and does not necessarily express the opinion of the energy platform.

Also read..

Leave a Reply