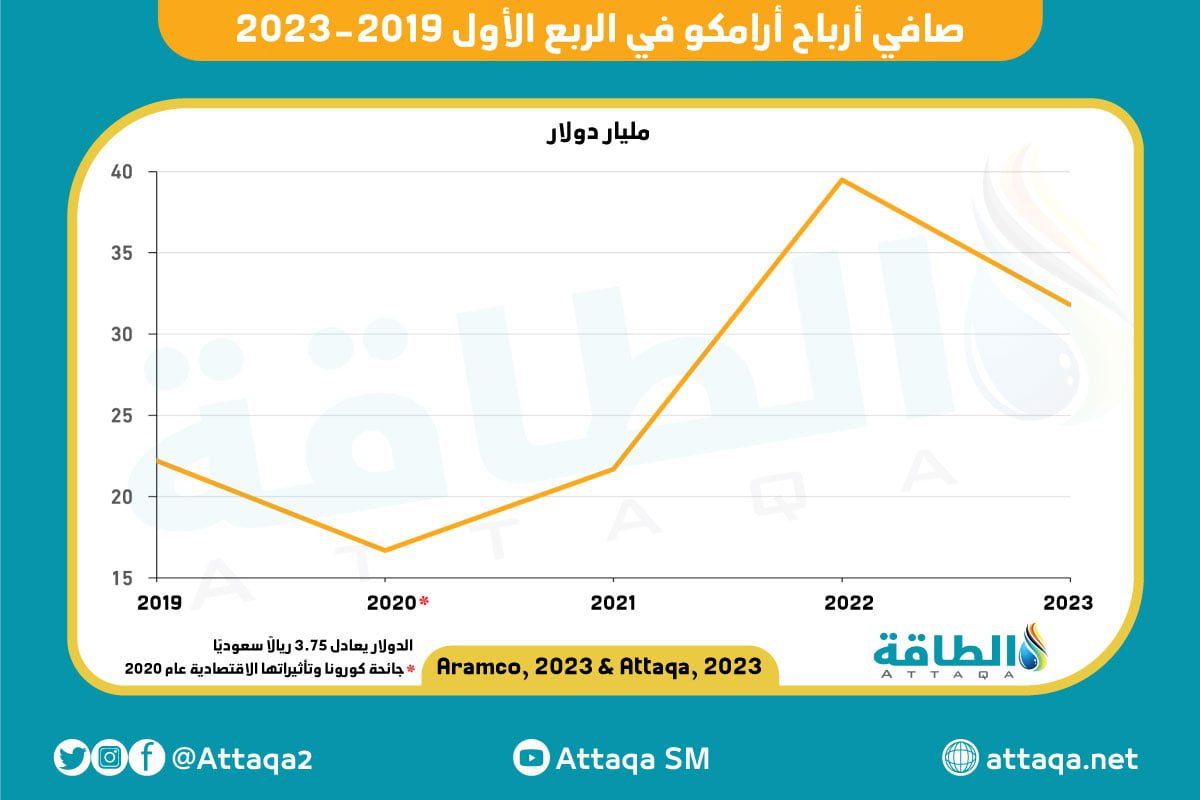

Saudi Aramco’s business results in the first quarter of 2023 matched the expectations of many analysts, recording a net profit of $31.88 billion, close to experts’ expectations, which it set at $31.2 billion.

Despite this, Aramco’s profits declined by 19.25%, compared to the same period last year, when the Saudi oil giant recorded a net income of 148 billion riyals ($39.5 billion), according to data monitored by the specialized energy platform.

Aramco’s business results attributed the decline in the company’s profits during the period from January to March (2023) to the decline in oil prices on an annual basis, amid fears of a global economic recession.

Crude oil prices recorded a decline of about 7.1% during the first quarter of 2023, bringing Brent crude to $ 79.77 a barrel at the end of March 2023, despite production cuts by the OPEC + alliance.

Aramco business results in the first quarter of 2023

Aramco said in a statement to the Saudi Stock Exchange, Tadawul, that the net profit during the current quarter, compared to the same quarter of the previous year, net income amounted to 119.54 billion riyals ($31.88 billion) for the first quarter of 2023, compared to 148.03 billion riyals ($39.47 billion). ) for the same period in 2022.

It attributed the decline mainly to the decline in crude oil prices, which was partially offset by a decrease in income and zakat taxes and an increase in financing income and other income.

She also attributed the reason for the increase in net profit during the current quarter, compared to the previous quarter, which amounted to 115.22 billion riyals ($30.73 billion) for the fourth quarter of 2022, to a decrease in income and zakat taxes, a decrease in operating costs, an increase in financing income and other income. This was partly offset by lower crude oil prices.

Aramco’s business results in the first quarter of 2023 showed that net cash generated from operating activities amounted to 148.6 billion riyals ($39.6 billion), compared to 143.3 billion riyals ($38.2 billion) during the same period of 2022.

Free cash flows amounted to 115.9 billion riyals ($30.9 billion), compared to 114.9 billion riyals ($30.6 billion) in the first quarter of last year, while the debt ratio declined by 10.3% on March 31, 2023, compared to 7.9% in the previous quarter. end of 2022.

Aramco strategy

Aramco’s business results in the first quarter of 2023 confirmed that the company’s major investments are working to enhance the strategic expansion of the refining, petrochemical and marketing sectors in major global markets.

The sufficiency program agreements, worth an estimated 27.0 billion riyals ($7.2 billion), are expected to enhance supply chain efficiency.

She noted that the agreement with Linda Engineering to develop a new ammonia cracking technology supports progress in low-carbon energy solutions.

For his part, Amin Al-Nasser, CEO of Saudi Aramco, said: “Aramco’s business results in the first quarter of 2023 reflect Aramco’s continued high reliability, focus on cost and ability to respond to market conditions.”

He added, “We have achieved strong cash flows while further strengthening the financial position of the company.. And to reinforce our commitment to maximizing shareholder value in the long term, we also announce our intention to adopt a performance-related dividend distribution mechanism, in addition to the basic dividends that the company currently distributes.”

He pointed out that the company’s growth strategy is on the right track, and we have made great progress in the strategic expansion of our business in the refining, petrochemical and marketing sectors during the first quarter.

Aramco announced a major acquisition in the United States, in addition to important investments and partnerships in China and South Korea, giving the company’s global strategy in the refining, petrochemical and marketing sectors great momentum.

Al-Nasser said: “In it, we benefit from advanced technologies to increase our ability to convert liquids into chemicals, and to meet the expected demand for petrochemical products.

He noted that the company is moving forward in expanding its capabilities, and its long-term outlook remains unchanged.

He stressed that crude oil and gas will remain two main components of the global energy mix during the foreseeable future, according to the company’s statement, which was viewed by the specialized energy platform.

And he stressed that Aramco aims to remain a leading and reliable supplier of energy and petrochemicals, with the ability to provide more sustainable energy solutions, and support efforts to achieve an orderly energy transition, by working to reduce carbon emissions, and adding new low-carbon energy options.

Aramco dividend date

He revealed the results of Aramco’s business in the first quarter of 2023, distributing cash dividends to shareholders in the amount of 73.16 billion riyals ($19.51 billion) for the first quarter of 2023, with the share per share of the distribution being 0.3024 riyals.

And the Saudi oil giant revealed the date of the dividend distribution, noting that the eligibility will be on May 16, provided that the cash distribution to shareholders will take place on May 31.

She said that the right to distribute profits will be for the shareholders who own the shares on the due date and are registered in the company’s shareholder register at the Securities Depository Center at the end of the second trading day following the due date.

In the first quarter, Aramco paid dividends of 73.2 billion riyals ($19.5 billion) for the fourth quarter of 2022, an increase of 4% over the previous quarter.

The Saudi oil giant intends to adopt a performance-related dividend distribution mechanism, in addition to the basic dividend distribution, as the Extraordinary General Assembly agreed to grant bonus shares at the rate of one share for every 10 shares owned.

related issues..

Also read..

Leave a Reply