Energy platform editorial advisor, energy economist Dr. Anas Al-Hajji, revealed that US oil may be sold at 30 or 40 dollars a barrel, while global oil prices recently reached the level of 80 dollars, but that is in a specific case.

Al-Hajji explained – during a new episode of the program “Energy humanitiesEntitled “Oil Quality… Between Shale Oil, Gulf Oil, and Sanctions Against Russia” – that US President Joe Biden’s administration will soon realize that there is a problem related to oil quality.

He added: “The results of these developments are very important, and they have great repercussions on the Gulf countries, Russia and the countries of Latin America, as the US government has ended the withdrawal from the strategic oil reserve, and there are no new quantities to withdraw from it, and therefore any US economic growth will lead to an increase in demand for oil.” oil.”

He continued, “Since American refineries need medium, sour and heavy quality, America will increase its oil imports, and then there will be competition between Europe, China and the United States for this type of oil, which in turn will lead to price differences between them and an increase in these differences.”

American oil and Venezuelan support

Anas Al-Hajji, an adviser to the energy platform editor, said that there is some evidence that the government of Joe Biden is aware of the crisis that US oil is currently going through, so it resorted to Venezuela, and allowed a company – which granted it a work permit for a period of 6 months – to expand continuously, as Venezuelan shipments arrived to America now.

Dr. Anas Al-Hajji explained that Venezuelan oil is heavy and sour, which is what American refineries need, pointing out that the issue of going to Venezuela is nothing but compensation for the Russian oil that the United States used to import.

He pointed out that after the recent developments, the Biden government will focus more on Venezuela, and will allow additional investments to import more oil, and temporarily there will be an increase in imports, which will most likely come from Iraq, and perhaps Saudi Arabia, but Iraq is the main candidate.

Al-Hajji added, “All the recent increase in US oil production was condensate, not oil, which will lead to an increase in US imports of medium sour oil, and perhaps the heaviest thing that we do not know yet is the issue of export.”

He revealed that the matter affected the export, because when these condensates are broken into provene, butene and other products, they will appear as liquid gas exports and not as oil exports, but if left as they are, they will appear as oil exports.

Al-Hajji indicated that America is likely to crack these condensates, and then increase its exports of liquid gases. However, he stressed that US oil exports will decrease, and then the demand for oil will rise, which will affect the global markets.

offsetting US oil exports

Energy economist Dr. Anas Al-Hajji said that with the decline in US oil exports, global demand will rise, explaining that compensation – especially for condensate – will come from Iran and Malaysia, especially since Tehran is constantly increasing its production.

Al-Hajji explained that there is a green light from US President Joe Biden’s administration regarding these increases, as it is quite clear that the floating condensate stock has been disposed of, or at least a large part of it has been disposed of, and more of it will be brought in and compensated for.

He added, “The other point related to quality is that the Urals crude is a heavy and sour mixture, and it goes to Europe from the Asian markets through oil laundering operations, as the Russian oil goes to China, which works to refine it and then export it in the form of oil products to Europe.”

He pointed out that there is evidence that Russian oil also reaches the United States, especially in the form of diesel, explaining that in the event of a decrease in Russian oil production, there is a crisis related to the alternative, which is expected in all cases.

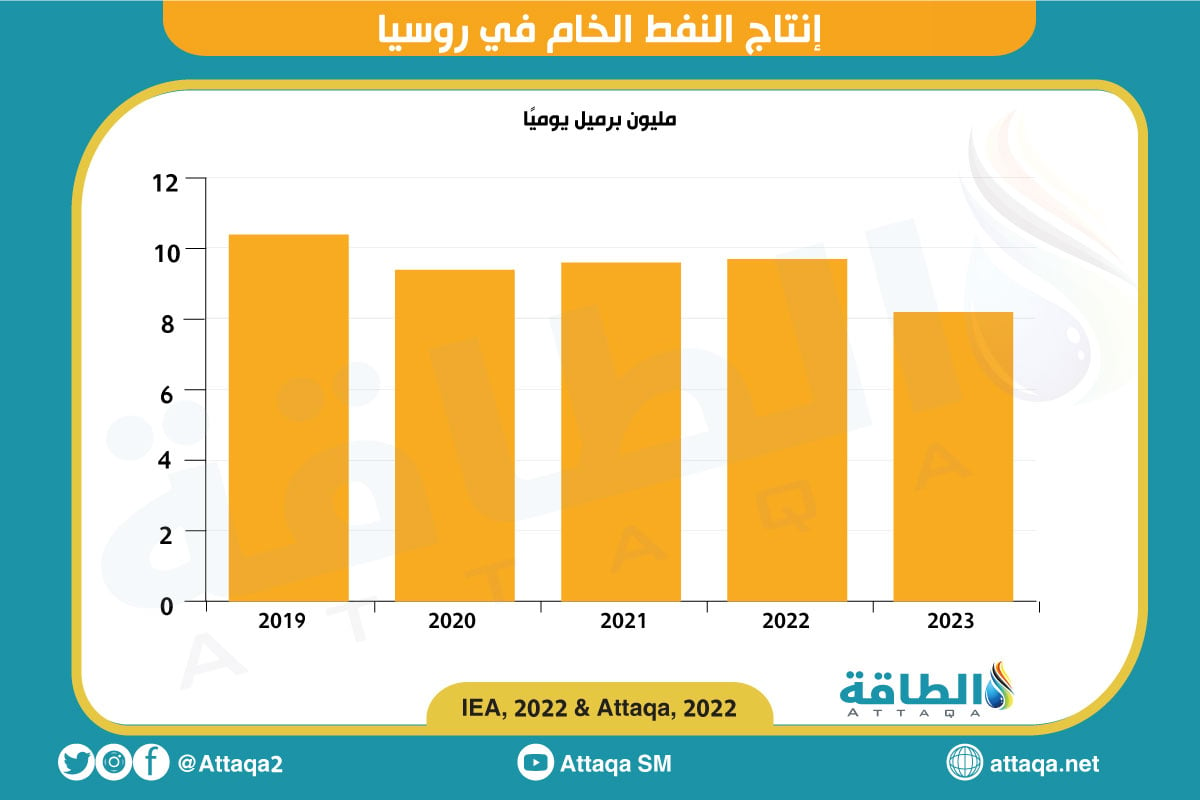

The following chart – prepared by the specialized energy platform – shows the volume of Russian oil production until the current year 2023:

Regarding the reasons for the decline in Russian oil production, Al-Hajji said that it will be due to weak investments, as there are rates of depletion in the wells, and there is a constant need to compensate for this depletion, so if investments stop or weaken, production will decrease.

Will US oil reach $40?

Anas Al-Hajji, an advisor to the Energy Platform Editorial, said that US oil prices may drop to 30 or 40 dollars – while international prices are within the range of 80 dollars per barrel – if shale oil production continues as it was between 2015 and 2018.

Al-Hajji explained that the increase in production to this degree will lead to a stage of global saturation, and then there will be no market for this oil, and if it continues to grow, there will be very large price differences.

He continued, “In other words, we assume that the global price of Brent crude oil is $80. If things reach saturation with regard to the prices of very light crudes and condensates, American oil may be sold at $30 or $40 a barrel, while the global price is $80.” .

related topics..

Also read..

Leave a Reply