Participants in global markets seek to verify Moscow’s commitment to reducing Russian oil production to 9.5 million barrels per day, in the period from March 2023 until the end of the year, as part of a group of voluntary production cuts for several member states of the OPEC + alliance, with the aim of achieving balance. stability in the oil market.

A recent report – issued by the Swiss investment bank “UBS” – revealed a decline in Russia’s oil production by 300 thousand barrels per day, while confirming the continued monitoring of the incoming data.

The report – of which the energy platform obtained a copy – stated that the data on oil inventories, which witnessed a significant decline during the past week, is an accurate measure to ensure that production is cut, not the volumes of crude exports.

The report expected more withdrawals from inventories to compensate for the shortfall in supplies from OPEC + countries due to voluntary reduction measures and high demand in the summer.

Russian Deputy Prime Minister Alexander Novak pledged – in February 2023 – that Russia would reduce its crude production by 500,000 barrels per day in March.

This commitment was extended in late March until June, and again in early April until the end of this year (2023).

How does Russian oil production decrease as exports rise?

In its report, obtained by the energy platform, UBS cited market participants shifting to crude oil exports via tankers as another measure of the production cut, with Russia no longer publishing data on oil.

Russian seaborne oil exports have remained high in recent months, leading some market participants to believe that this is a result of Russia not cutting its production as promised.

With many companies using satellites to track tanker movements on a daily basis, it is a good but imperfect tool, according to the report.

The Swiss Investment Bank explained that shifts in pipeline exports, domestic oil demand, refinery utilization, refined product export, and storage changes; It could explain the mismatch between Russia’s alleged cut and seaborne crude oil exports.

“Without Russia publishing its data, we think one of the explanations for the mismatch is lower domestic oil demand and lower domestic oil stocks,” said Giovanni Stanovo, a commodities analyst at Swiss bank UBS – co-author of the report.

“If storage changes are the driver of the mismatch, then exports of crude and refined products should start to stabilize at some point,” he added.

Russia’s position in the OPEC + meeting

In a related context, it seems that Russia is inclined towards leaving oil production volumes unchanged before the meeting of the OPEC + alliance on June 4 to discuss production policy, because Moscow is satisfied with current prices and production, according to Reuters.

Russian President Vladimir Putin said – on May 17 – that energy prices are approaching “economically justifiable” levels.

Deputy Prime Minister Alexander Novak also said that he does not expect new steps from OPEC +, noting that Russia and its partners in OPEC + will make a decision on what is best for the oil market when they meet in Vienna.

By supporting current production levels, Moscow hopes it can maintain stable oil prices without exceeding the price ceiling imposed by the West, which is $60 a barrel for Urals blend, according to Reuters.

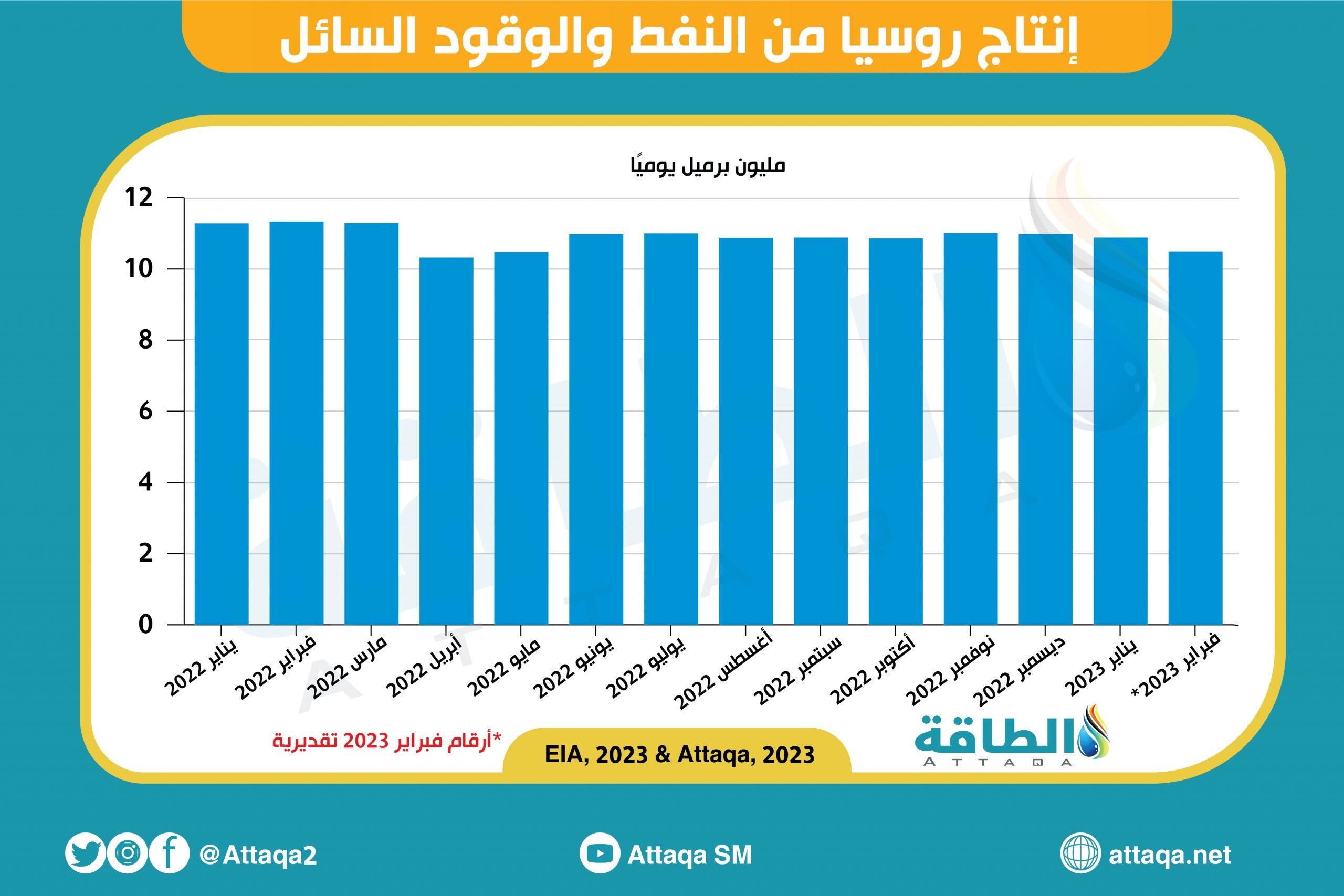

The following graph – prepared by the specialized energy platform – shows Russia’s production of oil and liquid fuels, in the period from January 2022 to February 2023:

Russian oil exports in 2023

Russian oil exports witnessed a significant increase in April 2023, to return to levels before the invasion of Ukraine, according to the monthly report issued by the International Energy Agency, on May 16, 2023.

The report – which was reviewed by the Energy Research Unit – indicated that Russia’s exports of crude oil and oil derivatives increased to 8.3 million barrels per day, during April 2023, with an increase in crude shipments.

This increase in Russian oil exports was driven by an increase in crude shipments to China and India, which accounted for nearly 80% of Russian exports, in exchange for a decrease in exports of petroleum products.

Russia’s exports of crude increased by about 250,000 barrels per day, to record 5.2 million barrels per day, the highest level since May 2022.

While shipments of oil derivatives reached 3 million barrels per day, down by 200 thousand barrels per day.

related topics..

Also read..

Leave a Reply