Oil prices witnessed another decline over the past weeks, as they are currently trading below $75 per barrel.

This came in the wake of the recent rise that pushed Brent crude prices above $85 a barrel, following the sudden voluntary production cuts announced by members of the OPEC+ alliance in early April 2023, which will continue until the end of this year.

Despite this, the Swiss investment bank “UBS” maintained its positive outlook for oil prices, in light of a possible tight supply with the implementation of OPEC + cuts and an increase in oil demand in the coming months.

Factors of the current decline in oil prices

The UBS report – a copy of which was obtained by the energy platform – stated that weaker Chinese indices are one of the factors affecting oil prices.

It is also possible that stagnant Chinese seaborne oil imports – which fell by about 1 million barrels per day compared to March – and the increase in OPEC + oil exports in April – by about 200 thousand barrels per day compared to March – are not supportive of prices. According to Swiss bank analysts.

Analysts added that the decline in prices may increase due to the forced sale of futures contracts by financial institutions looking to protect against the downside risks of the options they sold to oil producers, similar to what happened in March.

“We are likely to add other factors, such as the lack of buyers willing to increase exposure to volatile fundamentals, and the sideways trend of oil inventories in recent weeks,” they wrote in their report.

Oil price forecast

Despite this, UBS maintained a positive outlook for oil prices, as air traffic has rebounded strongly this year, with activity close to 2019 levels.

And the Swiss Bank expected – in its report issued today, Thursday (May 4, 2023), that oil prices would reach $100 a barrel in the middle of the year, then rise to $105 a barrel, starting from September 2023 until the end of the year.

“Overall, we see that demand for oil remains strong, and we look forward to higher demand over the coming months,” said Giovanni Stanovo, a commodities analyst at Swiss bank UBS, who co-authored the report.

On the supply side, additional voluntary production cuts were implemented by the OPEC + alliance at the beginning of May, by 1.66 million barrels per day.

Giovanni added, “The possible decline in OPEC + oil production and exports should help tighten supplies in the oil market, which supports our view that oil inventories will start to decline and will support prices.”

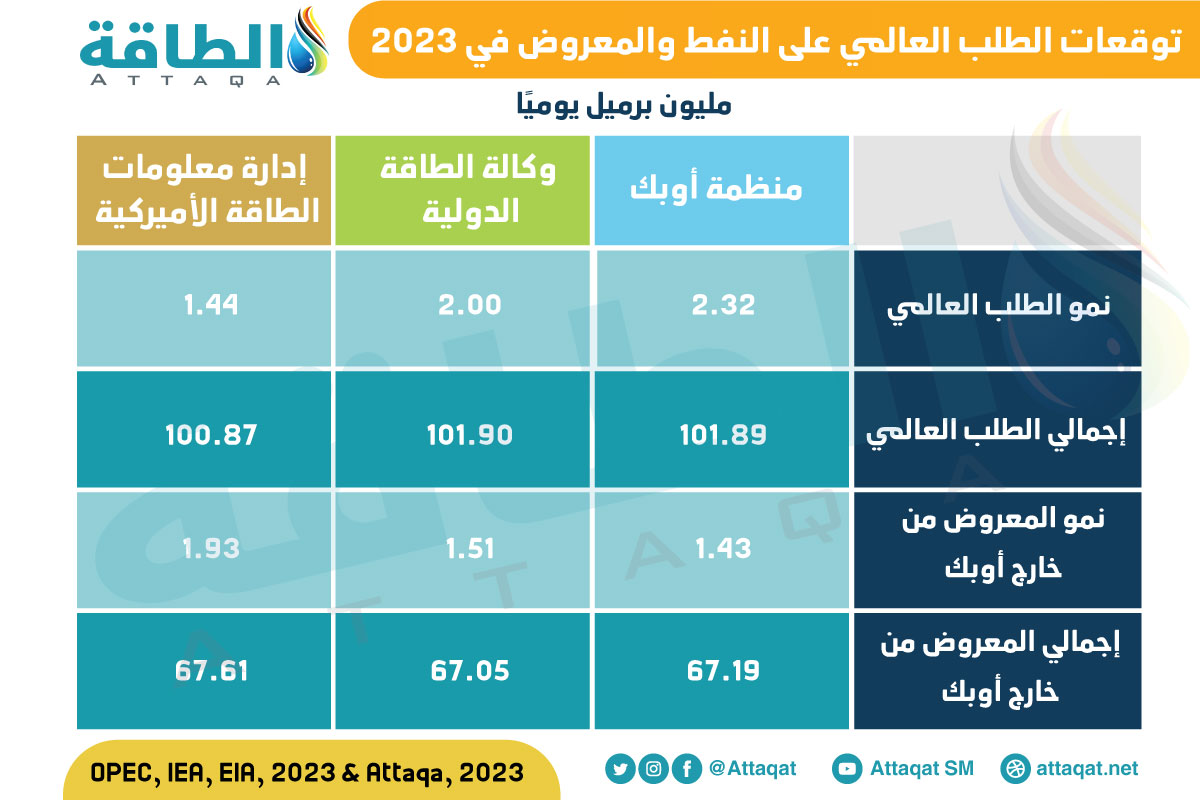

The following table – prepared by the specialized energy platform – shows the expectations of oil demand and supply in 2023:

A slight increase in trading today

In a related context, oil prices rose slightly, during today’s trading, Thursday (May 4, 2023), after the previous 3 sessions witnessed losses amounting to more than 9%, according to the data seen by the specialized energy platform.

And futures contracts for Brent crude oil – delivery in July 2023 – were recorded at $ 72.92 a barrel, an increase of 0.82% by 06:34 am GMT (09:34 am Mecca).

US West Texas Intermediate crude futures – for June 2023 delivery – also rose by 0.52%, to reach $68.96 a barrel.

Crude prices fell this week amid signs of weak manufacturing growth in China, and the United States raised interest rates to their highest levels since 2007; This poses a threat to the country’s future economic growth, according to Reuters.

The role of OPEC in stabilizing the oil market

The Secretary-General of the Organization of Petroleum Exporting Countries, Haitham Al-Ghais, had confirmed that OPEC and OPEC + do not target oil prices, but rather focus on market fundamentals.

Al-Ghais stressed that pointing fingers and distorting the actions of oil exporters and their allies had “counterproductive results.”

He also noted that blaming oil for inflation was “technically incorrect” and that repeated calls from the International Energy Agency to stop investing in oil could lead to market volatility.

He said the International Energy Agency should “exercise extreme caution about further attempts to undermine investments in the oil industry,” according to a statement seen by the specialized energy platform.

Al-Ghais added that other energy markets were much more volatile, with oil markets declining, mainly due to OPEC’s stabilizing role.

related topics..

Also read..

Leave a Reply