Goldman Sachs cut oil price expectations, whether during the next 12 months, or until the end of 2024, despite the recovery in Chinese demand for crude in the wake of the recovery from the repercussions of the Corona pandemic.

It seems that the increase in Chinese demand had less impact on the expectations of crude prices, compared to the momentum of the events that affected the energy markets during the past few weeks, including the closure of US banks with a wide impact, according to what was followed by the specialized energy platform.

The bank had indicated in previous forecasts that prices could reach $100 a barrel, but it modified these expectations to lower levels, and it also presented its vision on when to increase production from the OPEC + alliance, according to what was published by Bloomberg Agency today, Sunday, March 19.

Oil price forecasts until 2024

Goldman Sachs explained that in recent times there has been a jump in Chinese demand for oil, and despite that, oil prices have fallen.

The American bank attributed the decline in crude prices to 3 main reasons: the pressures experienced by banks and banks, as well as recession fears dominating the markets, along with the reduction in investments and cash flows.

The chart below – prepared by the specialized energy platform – monitors the daily gradation of crude prices over the months of the past year (2022):

As a result of these reasons, Goldman Sachs lowered its oil price forecasts, and its analysts expected Brent crude to reach $94 a barrel within a year from now (the next 12 months), rising to $97 a barrel by the second half of next year (2024).

The bank explained its recent expectations of a decline in price levels from $100 a barrel – which it had previously set in previous forecasts – that the events that afflicted the energy markets and the aforementioned influences require a gradual recovery.

He said in a note that the fears and uncertainty surrounding the banking and banking sector and recession fears had an impact on crude prices that outweighed the increase in Chinese demand.

Market variables

Energy platform editorial advisor, energy economics expert, Dr. Anas Al-Hajji, confirmed that the collapse of the “Silicon Valley” and “Signature” banks prompted oil prices to collapse, as they fell to the level of $75 a barrel, down $10 within 10 days.

He said that the collapse of the bank reinforced fears of a global financial crisis that would lead to an economic recession that would drop the demand for oil and prices, as he explained during an episode of the “Energy Anasiyat” program, broadcast on Twitter, last week.

Al-Hajji – during his speech in the episode titled “The Effects of the Saudi-Iranian Agreement on Energy Markets … and the Impact of the US SVB Bank’s Collapse on Renewable Energy Investments” – ruled out the possibility of the OPEC + coalition’s intervention to save oil markets and price levels.

He indicated that the coalition would not intervene – most likely – even if crude prices fell to $60 a barrel, given the appreciation of the dollar.

OPEC+ and oil prices

Goldman Sachs had previously estimated the possibility of oil prices rising to $107 a barrel by the end of this year (2023), up from $84, when it issued the forecast note on March 6, and prior to developments in banking events in the markets.

At that time, the bank mortgaged the jump in oil prices to the reaction of OPEC + to market variables, after the alliance responded in November last year to fears of recession, and announced a production cut at a rate of 2 million barrels per day.

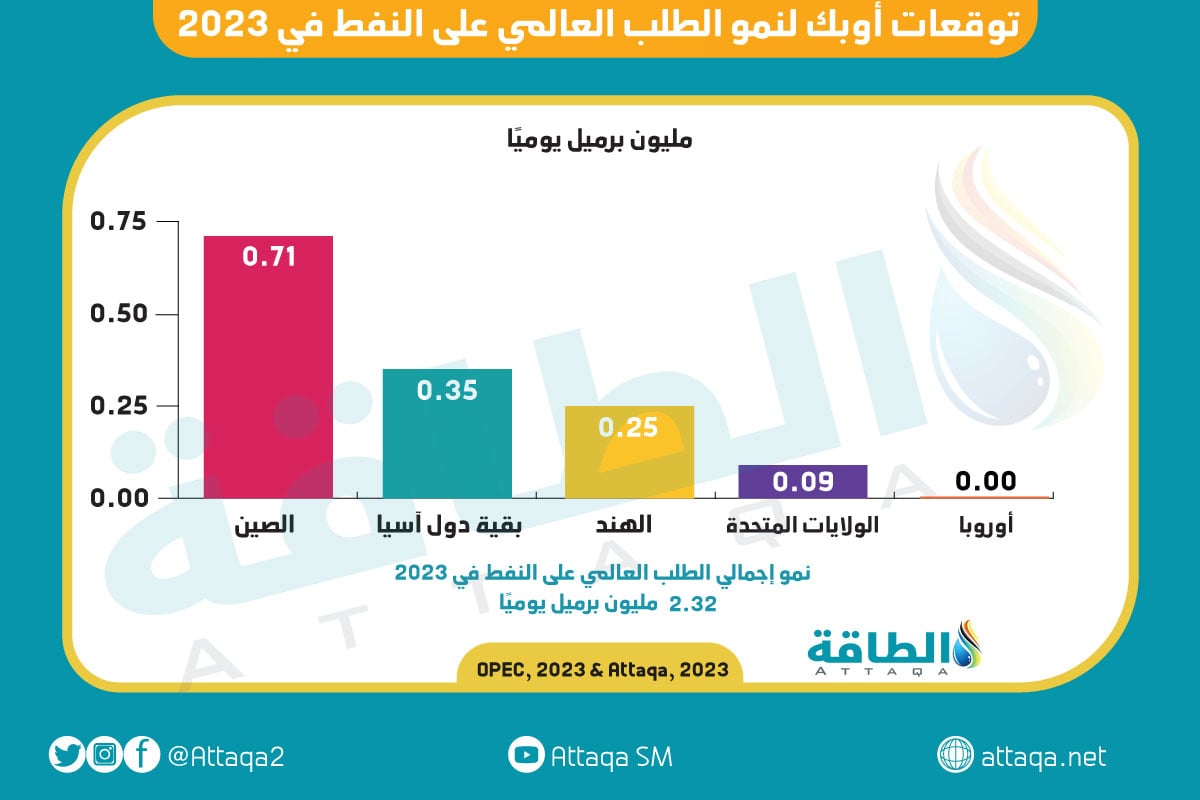

The chart below – prepared by the specialized energy platform – shows the expectations for the growth of global demand for crude during the current year (2023), according to the vision of OPEC:

Goldman Sachs said that if the alliance’s position changes, Brent crude prices may reach $90 per barrel during the second quarter of this year, reaching $100 until the end of 2023.

Analysts said that if OPEC production levels continue at their current pace after the next June meeting, prices may reach $107 a barrel in December.

And after what afflicted the Silicon Valley bank, Goldman Sachs issued a note published by Bloomberg today, Sunday, March 19, in which it not only lowered its forecast for oil prices, but also modified its vision for OPEC + production, indicating that it is likely that the alliance will tend to increase production by the third quarter of 2020. Next year (2024), instead of the second half of the current year (2023), according to the bank’s previous expectations.

Also read..

Leave a Reply