Nigerian oil sales fell in March, due to strikes at French refineries, as well as seasonal maintenance elsewhere in Europe.

Between 20 and 25 shipments of Nigerian oil for loading in April are still looking for buyers, and each shipment amounts to about 1 million barrels of crude oil, according to information seen by the specialized energy platform, according to Bloomberg.

This situation is much weaker than usual at this time of the month, as trade must move to barrels for loading in May, and the prices that shipments can reach are lower.

This comes at a time when Nigeria is already struggling with high production costs, continuous oil theft and sabotage of pipelines, as well as the country’s attempt to meet its quota under the OPEC+ alliance agreement.

Reasons for the decline in Nigerian oil sales

France is usually one of the largest importers of crude from Nigeria, taking an average of 110,000 barrels per day of Nigerian oil over the past year (2022), according to data compiled by Bloomberg.

However, that demand waned in March, with France’s total imports of crude oil halving this month as a nationwide row over pension reforms escalated, according to research firm Wood Mackenzie.

The data showed that more than 80% of France’s processing capacity, amounting to 1.1 million barrels per day, has stopped or is in the process of being closed due to strikes, according to Bloomberg.

In addition to the impact of the strikes, other stations in Europe are also buying less crude due to seasonal maintenance, traders said, citing Bloomberg.

There are out of commission sites in some typical destinations for Nigerian oil, such as Spain’s San Roque refinery and Italy’s Sarroc refinery.

Among the facilities that have stopped capacity, Shell’s Bernice refinery near Rotterdam, the largest refinery in Europe.

Alternatives are available

“The backlog of cargoes in Nigeria is a combination of higher freight costs, lower tanker availability – particularly in Europe – as well as lower overall demand for West African Light crude, as oil is from other regions,” said Victor Katona, crude oil analyst at Kepler. flooding the markets.

The decrease in buying in northwest Europe is important for West Africa, because alternative outlets are limited, according to information monitored by the specialized energy platform, quoting Bloomberg.

Mediterranean refiners could choose to skip Nigerian supplies in favor of cheaper North African barrels that are shipped more quickly to the region, or they could process some of the large volumes of US WTI that have reached Europe in recent months.

While long-term buyers – such as Indian Oil and Indonesia’s Pertamina – chose larger quantities of discounted Russian oil during the current year (2023), which reduces their need for Nigerian supplies.

China’s Unipec also favors processing oil from Angola, as there are still only about five shipments available for April loading.

Another driver of the glut of unsold cargoes has been Nigeria’s revival of crude oil production that has been halted in recent months due to theft and technical problems, such as the country’s Bonny Light crude.

Nigeria’s export capacity may now exceed what the market needs in April and May, according to Kpler crude oil analyst Victor Katona.

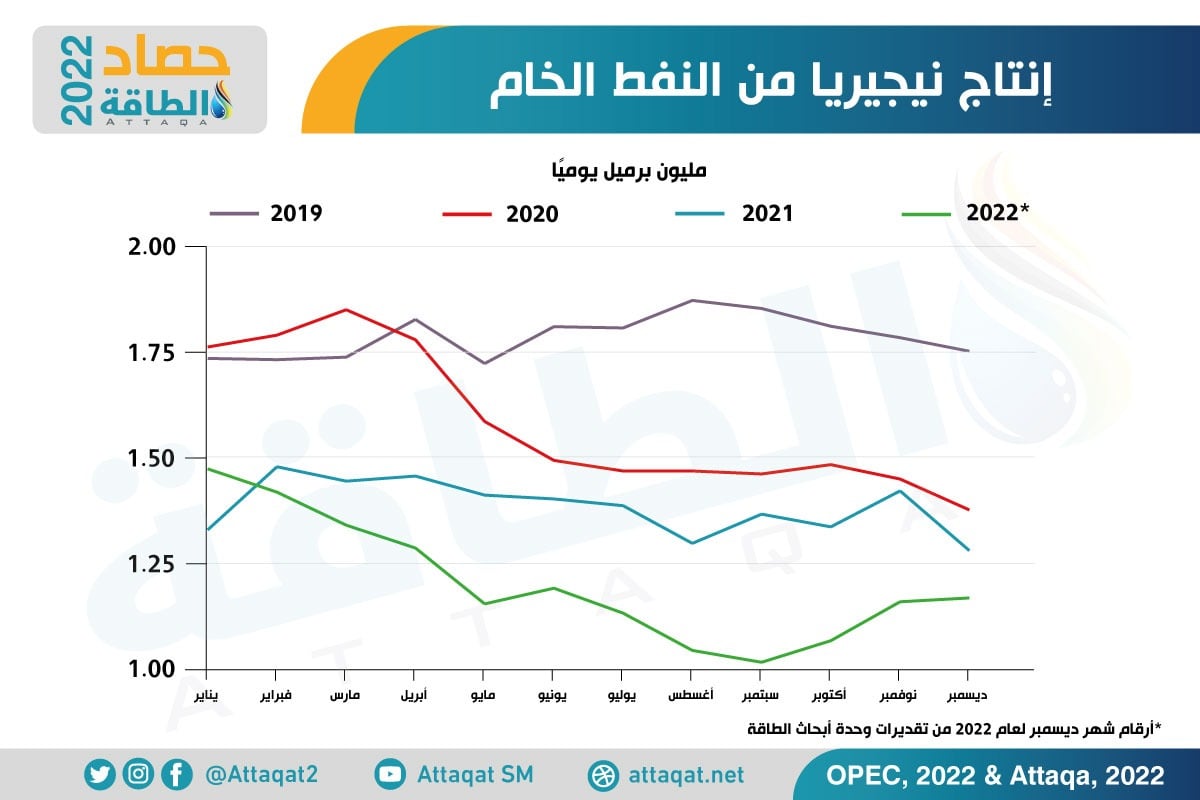

The following graph – prepared by the specialized energy platform – shows Nigerian oil production from 2019 to 2022:

Nigerian oil exports

In another context, Nigerian oil export revenues rose to 26.79 trillion Nigerian naira ($58.4 billion) in 2022, recording a record jump of 46.41%.

Total crude oil sales alone in 2022 amounted to about 21.09 trillion naira ($45.97 billion), compared to 14.41 trillion naira ($31.44 billion) in 2021.

Last year, crude oil exports accounted for about 78.74% of Nigeria’s total exports, according to information seen by the specialized energy platform, quoting local newspaper Punch.

Observers expected that Nigerian oil production may suffer a significant loss of up to 180,000 barrels per day during March 2023, if one of the main lines in the Niger Delta region is not repaired.

These estimates mean that Nigeria’s crude exports may lose more than 4 million barrels this month, according to the specialized energy platform.

On Thursday evening, March 2, 2023, a major export pipeline in the Niger Delta region exploded, killing 12 people and injuring others.

related topics..

Also read..

Leave a Reply