Shares of major oil companies jumped during trading today, Monday, April 3, with the support of the voluntary production cuts announced by 9 OPEC+ countries, led by Saudi Arabia.

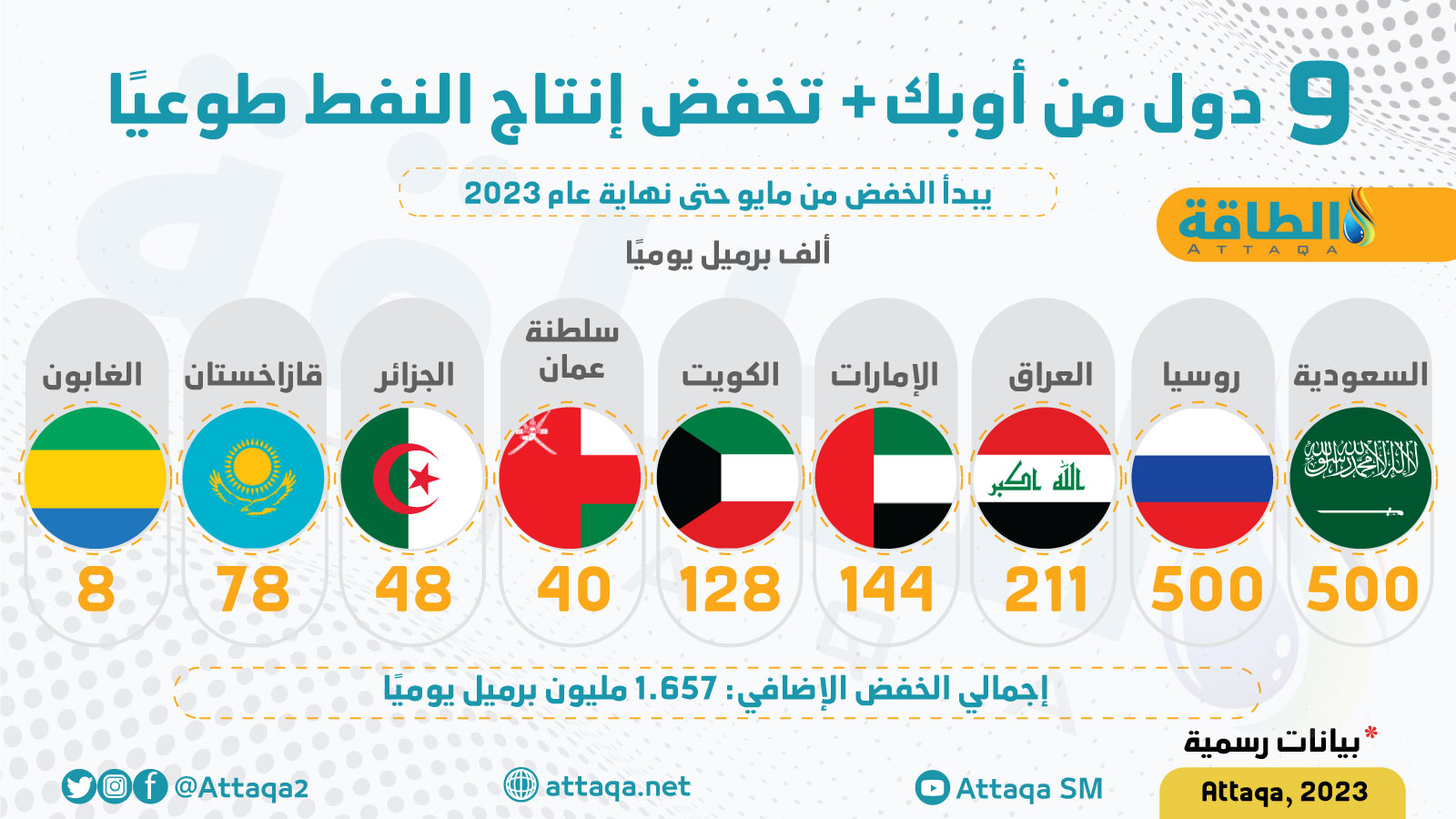

The 9 countries announced voluntary cuts of more than 1.66 million barrels per day, starting next May, as a precautionary measure aimed at supporting the stability of oil markets, according to official data, copies of which were obtained by the energy platform.

Shares of oil companies rebounded in Asia, Europe and America, after oil prices rose against the backdrop of the OPEC + decision, as the voluntary cut is added to the two million barrel production cut agreed upon by the coalition countries at the 33rd ministerial meeting held on October 5, 2022, which It runs until the end of December 2023.

Aramco share price

Aramco’s share price rose on the Saudi Stock Exchange, “Tadawul”, with OPEC + moves aimed at maintaining the stability of oil markets.

Aramco’s stock ended Monday’s trading, up by 0.62%, at 32.55 Saudi riyals ($8.68).

Aramco shares recorded today, trading amounted to 9 million million shares, through 13.979 thousand transactions, with a value of 293 million riyals ($ 78.12).

* The dollar is equivalent to 3.75 Saudi riyals.

Financial market analyst in Egypt, Hanan Ramses, says in exclusive statements to the specialized energy platform, that the rise in oil prices will enhance the performance of the energy sector in the Saudi market indices.

She pointed out to Aramco share, that despite the positive news that surrounded the performance of the share since the beginning of the year, including the rise in profits to the highest levels since 2017, the entry into international companies, the localization of the oil industry, and the opening of new markets in China, the fluctuation of oil prices negatively affected the share and the expectations of its rises.

And she explained that the OPEC + cuts cast a shadow on the stock’s performance, which rose by more than 1% at the beginning of today’s session, to reach the level of 32.7 riyals, before reducing its morning gains, and closing the trading up by 0.62%.

The financial market expert stressed that the stock is expected to rise again due to the positive news and the improvement in trading values in the market, against the background of the expectation of profits and the budget surplus from oil investments, to return to the level of 36 riyals in the medium term.

Shares of Total Energy

French Total Energy shares rose about 5.46%, in trading today, Monday, supported by the rise in oil prices.

And the share price of Total, by 01:30 pm GMT (3.30 pm Mecca time), was about 57.33 euros (62.40 US dollars).

Crude oil prices rose about 5.7%, today, Monday, April 3 (2023), recording the largest daily rise in about a year, after countries from OPEC + announced voluntary cuts.

BP share

In the footsteps of the shares of the major oil companies themselves, the share of the British Oil Company “BP” followed, which rose by 5.27% during trading, supported by expectations of a rise in oil prices during the coming period.

BP’s share price recorded about 537.70 pence sterling, equivalent to 6.65 US dollars, after achieving huge gains over the past year, supported by the rise in energy prices.

By 01.32 pm GMT (04:32 pm Mecca time), the price of Brent crude futures – for May 2023 delivery – increased by 5.72%, to record $ 84.46 a barrel.

Shell share price

Shell’s share followed the same trend, as it rose 5.31% in today’s trading, to record about 24.31 pounds (30.14 US dollars), supported by the rise in oil prices.

Goldman Sachs raised its forecasts for the price of Brent crude to $95 and $100 per barrel for the years 2023 and 2024, respectively.

The OPEC+ pledges will bring the total volume of cuts by the alliance since November to 3.66 million barrels per day, equivalent to 3.7% of global demand.

Eni share

The Italian Eni was not isolated from the stocks of the major oil companies, which rose with the breakthrough in the rise in oil prices, supported by the decisions of the OPEC + countries to reduce production.

Eni’s share rose about 4.73% in today’s trading, to record about 13.53 euros (14.73 US dollars), supported by the moves of OPEC + countries led by Saudi Arabia.

Rystad Energy said it believes the cuts will oversupply the oil market and lift prices above $100 a barrel for the rest of the year, with Brent possibly rising to $110 this summer.

Exxon Mobil

The American Exxon Mobil stock jumped about 5.69% in today’s trading, and scored about $115.78, according to the data seen by the specialized energy platform.

The OPEC+ alliance was expected to keep production unchanged this year, after cutting production by 2 million barrels per day in November 2022.

The Joint Ministerial Monitoring Committee of the OPEC + coalition confirmed that the voluntary cuts in oil production by Saudi Arabia and 8 other countries are a precautionary measure aimed at supporting the stability of the oil market.

The Joint Ministerial Monitoring Committee indicated that Saudi Arabia announced – on April 2, 2023 – a voluntary cut of 500,000 barrels per day, the UAE 144,000 barrels per day, Kuwait 128,000 barrels per day, Kazakhstan 78,000 barrels per day, Algeria 48,000 barrels per day, and the Sultanate of Oman 40 thousand barrels per day, and Gabon 8 thousand barrels per day.

The following infographic, prepared by the specialized energy platform, reviews the numbers of OPEC+ voluntary cuts:

Chevron stock price

American Chevron’s stock rose by 4.73% in today’s trading, to record about $170.93, reaping the gains from the rise in oil prices.

UBS also expects Brent to reach $100 by June and Goldman Sachs raised its December forecast by $5 to $95.

The OPEC+ Ministerial Monitoring Committee indicated that the cut would be in addition to the optional adjustment announced by Russia, of 500,000 barrels per day until the end of 2023, which would be from average production levels as estimated by secondary sources for February 2023.

Russian Deputy Prime Minister Alexander Novak said on Monday that interference in market dynamics was one of the reasons behind the cuts, Reuters reported.

And the Russian presidency stressed that America’s objection to the voluntary reduction in Saudi and Russian oil production is “a matter of its own,” explaining that the existence of oil prices at certain levels “preserves investments.”

related topics..

Also read..

Leave a Reply