Saudi Aramco intends to raise the official selling prices for Arab crude destined for Asia, during next May, after the decision of several OPEC + countries to voluntarily cut production.

A Reuters survey, seen by the specialized energy platform, indicated that the new increase comes amid expectations of an increase in Chinese demand in the second quarter, with refineries ending maintenance.

And in the event that Saudi Aramco approves the increase in the oil price, it will be the third in a row, following the rise in Arab crude prices, during last March and this April, after its decline to its lowest level in 15 months during last February.

Arab crude price

Saudi Aramco is heading to raise the official selling price of the main Arab Light crude, in May, by about 20 cents to $2.7 a barrel, in the third monthly increase.

The market was mostly expecting Aramco to lower its official selling price for May, which usually tracks Dubai’s market structure to reflect spreads for the first and third months, after the spread in March fell by about 30 cents.

The Saudi company raised the official selling prices for Arab Light crude to Asia during this April by $0.50 a barrel to $2.5 a barrel above Oman/Dubai levels.

Refining companies revised their estimates after countries from the Organization of the Petroleum Exporting Countries (OPEC) and its allies, including Russia, announced production cuts of about 1.16 million barrels per day from May to the end of the year.

Medium and heavy raw materials prices

Respondents in the Reuters poll expect additional cuts from OPEC+ to tighten supply and put upward pressure on crude oil prices from the Middle East, especially medium and sour grades which have already seen price differentials as light grades shrink due to increased demand.

Participants in the survey expected that the prices of Arab medium crude would rise by about 20 cents, and that the prices of heavy crudes would rise by up to 80 cents from the previous month.

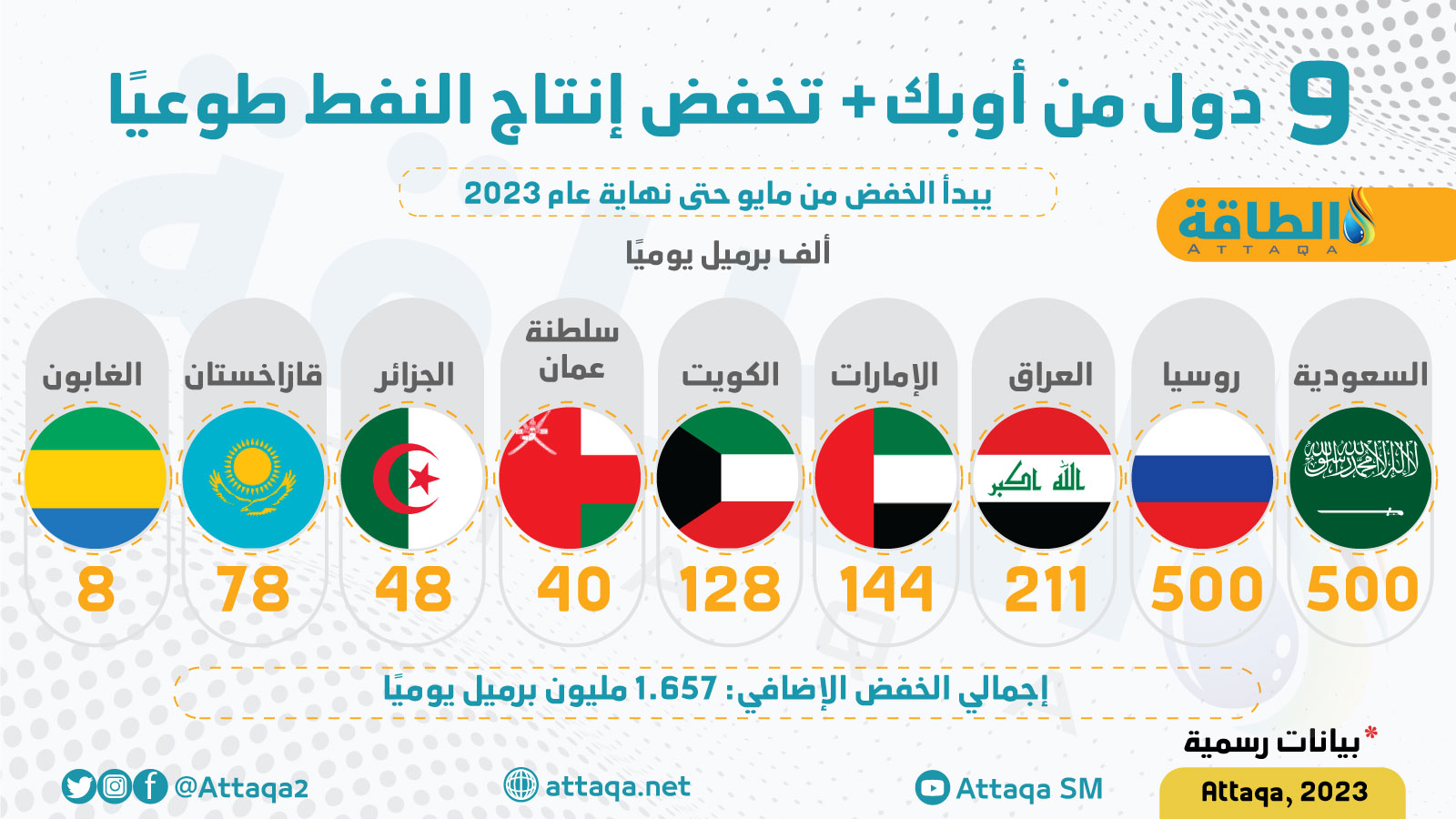

And 9 OPEC + countries, led by Saudi Arabia and Russia, announced voluntary cuts of more than 1.65 million barrels per day, starting next May, as a precautionary measure aimed at supporting the stability of oil markets.

The voluntary cut is in addition to the two-million-barrel production cut agreed upon by the OPEC+ countries at the 33rd Ministerial Meeting held on October 5, 2022, which will last until the end of December 2023.

The following infographic, prepared by the specialized energy platform, reviews the volumes of voluntary cuts announced by Saudi Arabia and 8 countries in OPEC:

Chinese demand

Chinese oil demand is expected to recover further in the coming months. Refineries complete scheduled maintenance.

PetroChina expects Chinese demand for refined fuels to rise by 3% this year from pre-corona levels in 2019.

A research center affiliated with the CNBC State Energy Group expects the Chinese oil refinery’s output this year to increase by 7.8%.

The respondents indicated that the production cut from OPEC + may prompt Chinese and Indian refiners to seek more barrels of crude from Russia; Which may limit the price hike in Saudi Arabia.

It is expected that the official selling prices for Saudi oil will be announced after the meeting of the OPEC + Ministerial Committee, which is scheduled to be held today, Monday, April 3, which may determine the direction of Iranian, Kuwaiti and Iraqi prices. This affects about 9 million barrels per day of crude destined for Asia.

Oil giant Saudi Aramco sets its crude prices based on customer recommendations and after calculating the change in the value of its oil over the past month, based on revenue and producer prices.

related topics..

Also read..

Leave a Reply