The debts of the Mexican oil company “Pemex” constitute a heavy burden after the Ministry of Finance stopped paying them, since the second half of (2022), but this year may witness a breakthrough, in light of its benefit from the gains in oil prices.

The company is studying the available options for how to pay, while the country’s Finance Minister expected the company’s ability to pay its debts during the current year (2023), showing some flexibility in the possibility of the ministry’s intervention and providing support to the company again, according to what was published by Reuters today, Saturday, March 18.

While the Mexican government company is struggling to overcome the debt stumbling block due as a result of bleeding losses incurred by refineries, calls have emerged to enact measures to prevent the company’s monopoly on the aviation fuel market, according to what was seen by the specialized energy platform.

Debt repayment

The debts of the Mexican company Pemex rose until the end of last year (2022) to 108 billion dollars. In addition, the company is obligated to pay an amount of 8.2 billion dollars due for repayment this year (2023), in addition to an additional 9 billion dollars for bonds and long-term bank loans.

These lump sum payments would increase the pressures and burdens on the company. This prompted its CEO, Octavio Romero, to hint at the possibility of offering guarantees to potential lenders backed by crude oil, in parallel with the company’s exploration of other options.

On the other hand, Finance Minister Rogelio Ramirez de la O carried a somewhat optimistic vision, as he expected the Mexican company Pemex to be able to pay off its debts during the current year (2023).

De la Or explained that the government of the North American country is ready to provide assistance if the company falters, according to what was seen by the specialized energy platform.

The Mexican company, Pemex, has received government support, during the past 4 years, amounting to $45 billion to boost capital and other items of expenditure.

Oil prices

Given that the government and the Mexican company Pemex did not include the debt payment due this year (2023), amounting to an average of $10 billion, in the annual budget, the company has been searching for financing sources for repayment by benefiting from the profits of oil prices, as it announced last January.

The company’s refineries suffer successive losses. This prompted the government to demand that it stop exporting oil and focus on refinery investments. This increases their financial burdens, especially since oil prices have become a source of revenue for them.

And the Ministry of Finance has already stopped supporting the company financially since the second half of last year (2022), whether in the form of capital-enhancing payments or tax exemptions, while investors wondered whether the international markets would become a haven for the company to save debt funds after the company’s oil production began in It has been declining since 2004, and has not added new fields or exploration to its assets.

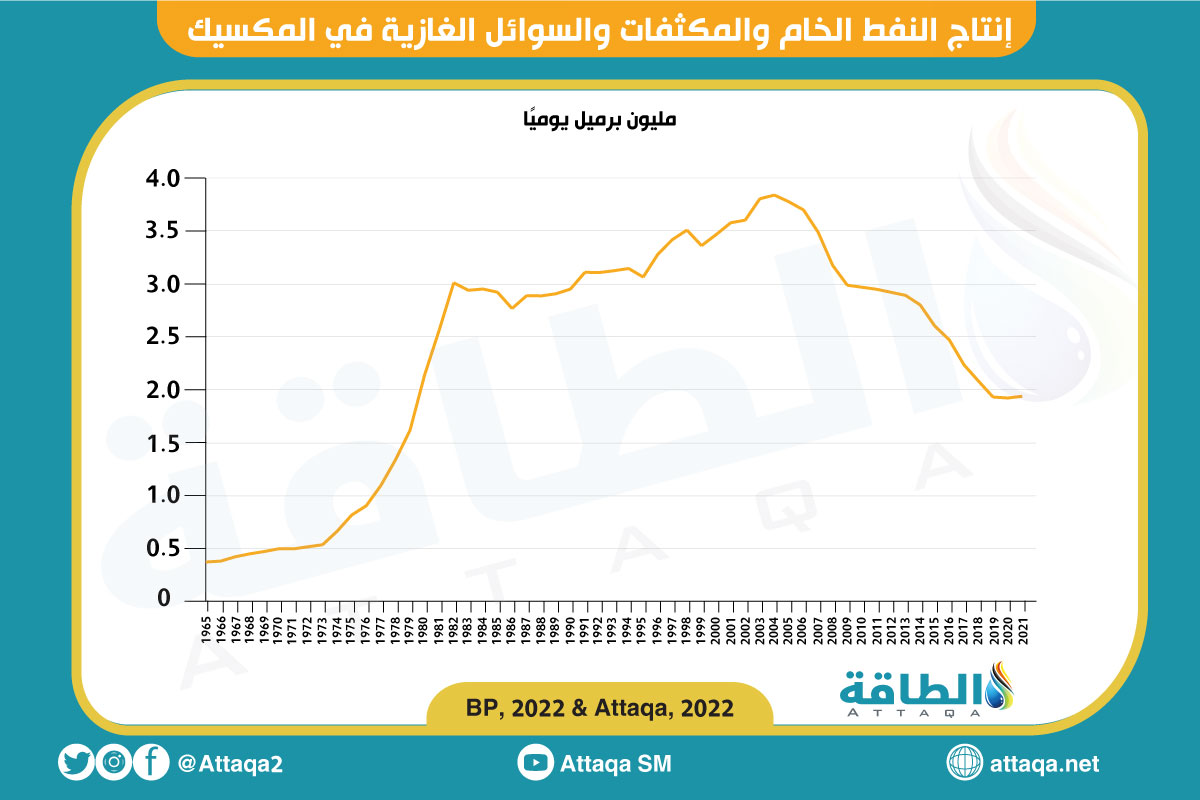

The chart below – prepared by the specialized energy platform – shows the evolution of crude oil and condensate production in Mexico from 1965 to 2021, according to data from the British oil company BP:

Aviation fuel monopoly

As Mexico’s Pemex struggles to pay off its debts, the competition watchdog has launched an attack on it, demanding that it limit its influence in the jet fuel market.

The authority called on the concerned authorities in the country to enact a regulatory rule that sets a ceiling and extent for the share of the state company, with the aim of reducing the government company’s control over the oil, gas and derivatives market – including the production and sale of aviation fuel – as the authority accused the company of hindering competition.

The proposed competition restrictions include limiting Pemex’s share in jet fuel imports – which constitutes a financial burden and a huge expense rate for airlines – and storage and supply in the retail market, according to Reuters.

The Competition Monitoring Authority confirmed that the approval of the restrictions on the Mexican company Pemex would give the consumer the best available price levels, according to information obtained by the specialized energy platform.

She said that the challenges facing the aviation fuel market in Mexico are in need of comprehensive reform, the first of which is the imposition of restrictions on the country’s national oil company.

Also read..

Leave a Reply