Read in this article

- Positive results regarding oil production from the Mafraq field in the Sultanate of Oman

- High world oil prices support Oman’s oil revenues

- Maha Energy of Sweden announces the results of oil field tests in Block 70 in the Sultanate of Oman

- Maha Energy reduced its share in Block 70, after its participation in the Omani Energy Junction

- Omani oil and gas investments achieve a huge leap in 2022

The Sultanate of Oman plans to start oil production near the Mafraq field located in Block 70, following data from the field’s operator regarding production tests, which appeared to be very positive.

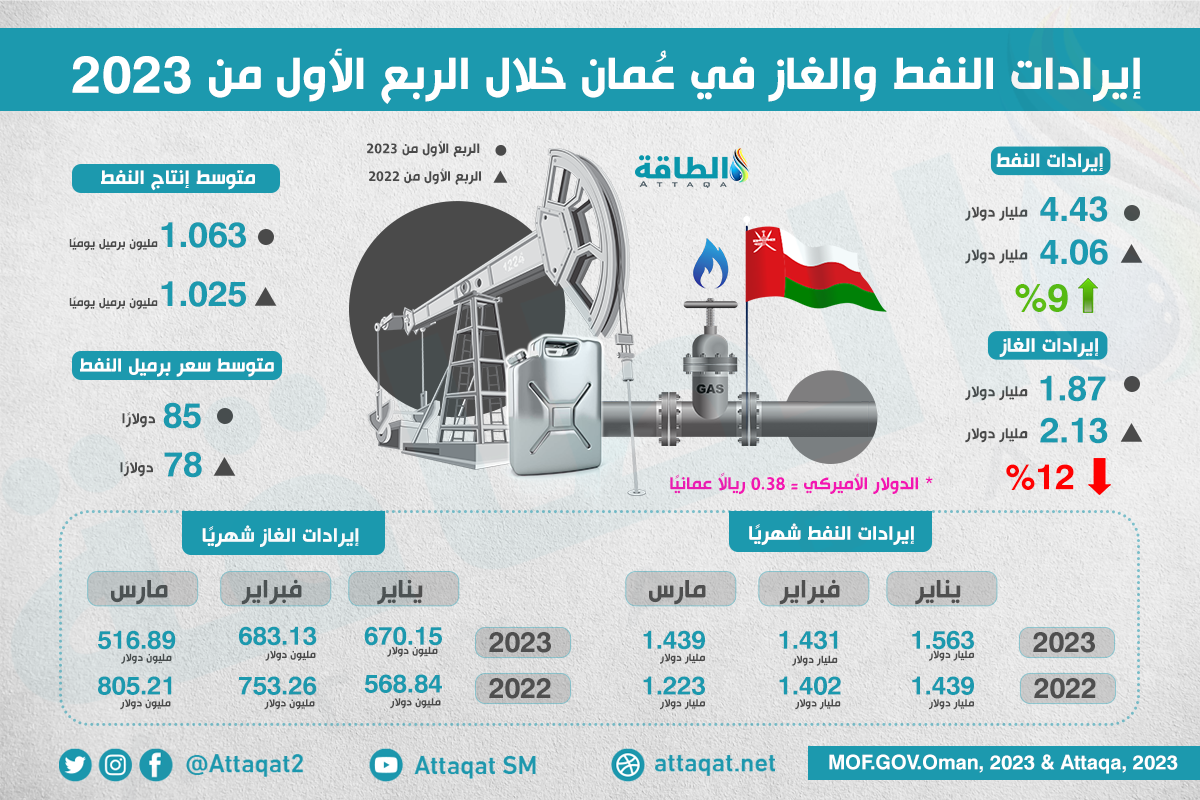

Despite the decline in oil prices in the global market since the second half of last year (2022), to continue the noticeable decline in the first 3 months of this year, the price of a barrel of Omani oil was high during the same period on an annual basis, which contributed to an increase in oil revenues by 9 percent. % during the first 3 months of 2023, to record $4.433 billion, compared to $4.064 billion during the same period of 2022.

In light of the optimistic scenario, the Swedish company Maha Energy unveiled the preliminary results of the production test of the Mafraq oil field in the Sultanate of Oman, according to the company in a statement published on its website.

The tests took place on the “Alpha” platform, and included the “Munraq-9”, “Munraq-7”, “Munraq-10” and “Munraq-8” oil fields.

tests results

The results of the tests for the aforementioned fields were as follows:

- Junction 9 emerged as the first oil field to be connected to production test facilities, with a flow rate of between 300-350 barrels of oil per day, and a decrease in water of about 5%.

- This was followed by testing of the Junction 7 field, which had start-up issues, before it was closed for re-evaluation.

- The production capacity of the “Mafraq-10” oil field is estimated at 430 barrels per day, with a decrease in water not exceeding 10% before the end of the test.

- The production capacity of the “Mafraq-8” field was about 600 barrels per day, with a water decrease of less than 5%.

heavy oil

The quality of the oil produced during the testing phase falls under the quality of heavy crude, which ranges from 11-13 according to the American Petroleum Institute scale, and a viscosity degree that exceeds the pre-test estimates.

To get the oil that meets the specifications for processing and trucking by third party facilities, different thermal and chemical treatment options are implemented by Maha Energy with different service providers having the expertise and capabilities in heavy oil processing.

Encouraging results

Initial flow rates and water drop rates are very encouraging, and once specifications are met, the oil produced during the testing phase will be trucked to third-party facilities for further processing, before being transported through the Oman National Pipeline System.

The process of testing the oil wells will continue until they are all completed, and the data collected will be submitted, before connecting each field to a decentralized screw pumping system.

The drilling program in Block 7 will continue according to a plan in the second quarter of this year (2023), with the drilling of production, exploration and evaluation wells.

Maha Energy is the operator of block 70, which covers an area of 639 square kilometers in the middle of the prolific Ghabat al-Salah basin, in which it owns a 65% stake, while Mafraq Energy owns the remaining 35%.

joint operating agreement

Maha Energy decided to reduce its operating stake in Block 70, by seeking the help of a strategic Omani partner, according to a press release issued by the company.

In August 2022, Maha Energy entered into an agreement with Mafraq Energy to reduce the shareholding in the EPA for Block 70 from 100% to 65%.

The deal concluded by Maha Energy with Junction Energy in Block 70 received the blessing of the Omani authorities in December (2022).

The agreements concluded in this regard stipulate that Mafraq Energy shall compensate its Swedish partner for its proportional share of all previous costs, including the signature grant required under the relevant agreement with the government.

The agreement also obligates Energy Junction to pay its share of all future expenses in Block 70, according to information followed by the specialized energy platform.

field reserves

Maha Energy snatched the contract to operate Block 70 during a government bidding round in the Sultanate of Oman, which took place during the years 2019-2020.

It is noteworthy that the Mafraq field had undergone extensive tests by the Petroleum Development Oman Company in 1988 and 1991, according to what was announced by “Maha Energy” in a statement viewed by the specialized energy platform.

It is not yet clear why PDO did not undertake field development work at that time, but it is likely that oil prices at the time (US$18-20 per barrel) and access to other low-cost opportunities prevented Mafraq from being selected as a development option. the time.

The Mafraq field likely contains approximately 35 million barrels of recoverable oil, according to estimates from Chapman Petroleum Engineering, a Canadian reserves audit.

The following infographic – prepared by the specialized energy platform – reviews the most prominent figures for the oil and gas sector in the Sultanate of Oman during the first quarter of this year (2023):

A leap in oil and gas investments

The oil and gas sector in the Sultanate of Oman accounted for the lion’s share of foreign direct investment during the past year (2022).

Foreign direct investments in the oil and gas sector in the Gulf country recorded a significant increase by the end of the last quarter of 2022.

Foreign investment revenues in oil and gas extraction activities touched approximately 14 billion 166 million 300 thousand Omani riyals ($36.79 billion) by the end of the last quarter of 2022, up from 12 billion 177 million 700 thousand Omani riyals ($31.63 billion) by the end of the same period. From the previous year (2021).

(Omani Rial = 2.60 USD)

During the first quarter of this year (2023), total oil and gas revenues in the Sultanate of Oman jumped by 1.8%, to $6.3 billion, compared to $6.191 billion during the comparison period of 2022, according to official data, verified by the specialized energy platform.

related topics..

Also read..

Leave a Reply