The increase in India’s imports of Russian oil prompted a reduction in the share of Middle East crudes to the lowest level in 22 years last April.

India’s purchases of Russian oil rose to new records in April, as New Delhi seeks to take advantage of deep discounts offered by Moscow on its crude.

In conjunction with India’s increased imports of Russian oil, the share of grades in the Middle East and Africa declined further, to its lowest level in at least 22 years, according to data seen by the specialized energy platform.

The data focused on the proportions of shares of India’s oil imports without focusing on the volumes of exports from Middle Eastern countries, especially Saudi Arabia, which the figures – seen by the specialized energy platform – reveal that they were not affected, and that the decline in the proportion came with the increase in the volume of imports.

Russian oil

Refineries in India, the third largest oil importer and consumer in the world, are witnessing a wave of purchases of Russian oil, after some countries avoided purchases from Moscow due to its invasion of Ukraine in February of last year.

The data showed that the third largest economy in Asia imported about 1.9 million barrels per day of Russian oil in April, an increase of 4.4% from the previous month, which represents about 20% of the country’s total purchases, according to Reuters.

India’s high imports of Russian oil raised the share of the CIS countries – Azerbaijan, Kazakhstan and Russia – to 43.6% of the total 4.81 million barrels per day that India imported last month.

Russia remained India’s largest supplier of oil for the sixth consecutive month in April, followed by Iraq and Saudi Arabia, according to data seen by the specialized energy platform.

India’s imports from the Middle East

The data showed that India’s imports of Russian oil led to a decline in the share of Middle Eastern grades, which traditionally represented the largest part of total oil imports, to about 44%, and African oil to 3.4%, last month.

The data indicated that India’s oil imports from Iraq in April fell 3.1% from the previous month to the lowest level in 4 months, at 928.4 thousand barrels per day.

Imports from Saudi Arabia also decreased by 11% to 723.8 thousand barrels per day, which is the lowest in 5 months, according to data reviewed by the specialized energy platform.

The data showed that the decline in oil purchases from the Middle East pushed OPEC’s share of Indian oil imports to a record low of 46%.

Data inconsistency

The data – published by Reuters – ignored the comparison on the basis of export volumes, especially from the Arab Gulf countries, led by Saudi Arabia, as the numbers show their stability to a large extent.

For example, last February, Saudi Arabia ranked third in the list of the largest oil exporters to India, with volumes of 647.8 thousand barrels per day of oil, and last April it rose to 723.8 thousand barrels per day.

The numbers of many charts and figures published by shipping companies confirm that the exports of the Gulf countries in general and the Kingdom in particular to India and China are stable at the same quantities, which contradicts what is published by the Western media, which always tries to focus on ratios only without indicating an increase in demand.

For example, if India imports 1,000 barrels (200 from Saudi Arabia, 200 from Russia, and 600 from other countries), this means that the share of Saudi Arabia in terms of the percentage is 20%, and if the total imports rise to 1100, and the 100 increase comes from Russia, This means that imports from Saudi Arabia did not change (as they are 200), but imports from Russia increased from 200 to 300.

With the increase in imports, only the proportions change, but the volumes of exports are the same, and these important details were ignored by the Reuters report. When looking at the graphics attached to the OPEC report, we find that it focused on the OPEC countries, and it also reduces the proportions, not the volumes of the Gulf countries.

Experts believe that it is not logical, in light of the decline in Russian oil prices, for India to import from North and West Africa, and these countries include Libya, Algeria and Nigeria – all of which are within OPEC – at prices that are more than $20 a barrel for Russian crude.

The figures for India’s oil imports confirm that Russia did not take from Saudi Arabia’s share, but the demand for oil is increasing in India, which decided to compensate for the increase in Russian oil.

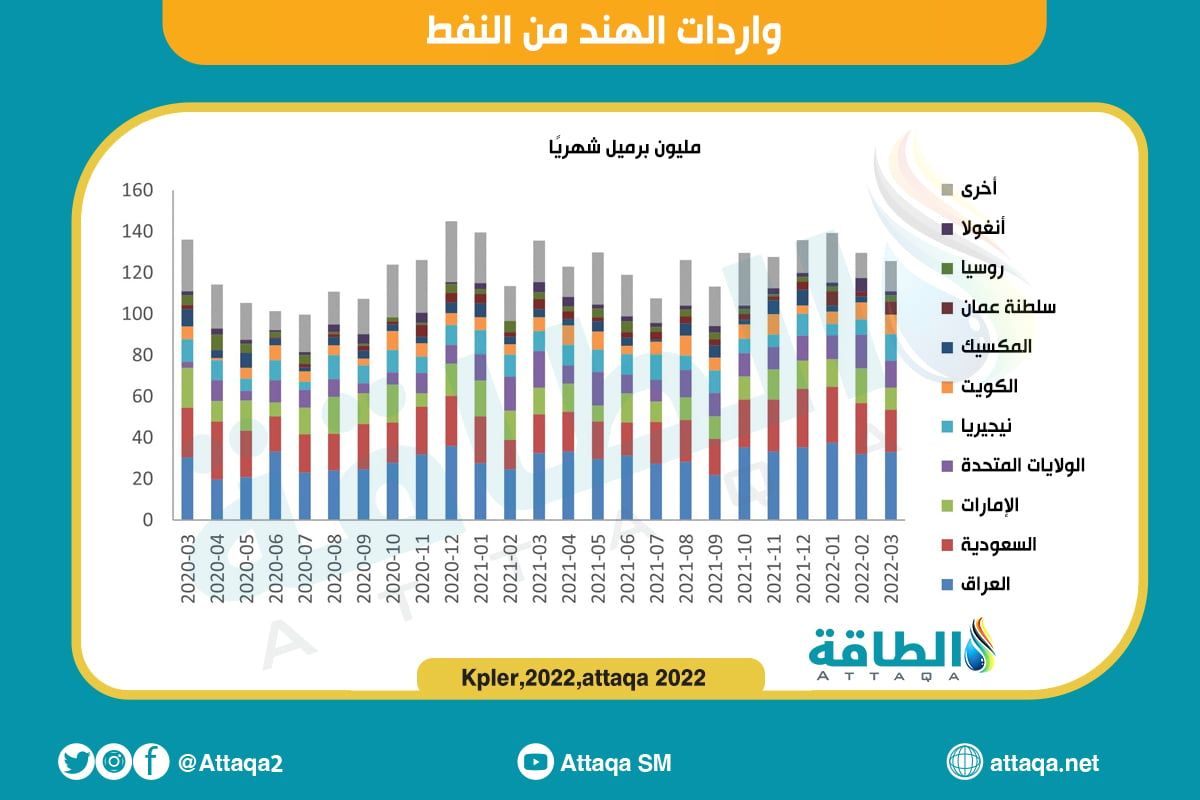

The following infographic, prepared by the Energy Platform, reviews countries’ shares in India’s total oil imports (March 2020-March 2022)

India and Russia deals

“Indian refineries have cut off spot purchases of Middle East and West African crudes because they are getting Russian oil supplies at low prices,” said an Indian refiner at an Indian refinery.

Supporting the rise in India’s imports of Russian oil, the Indian Oil Company, the country’s largest refiner, raised the volume of the annual import deal with Rosneft.

India’s increased imports of Russian oil prompted Western countries to criticize New Delhi and accuse it of violating sanctions imposed on Moscow’s energy exports.

Western countries see India’s behavior as an explicit challenge to the sanctions imposed on Russia, to dry up the sources of funding for its war on Ukraine.

The Energy and Clean Air Research Center (CERA) had put India on the list of countries that Moscow uses to “wash” its crude and sell it on the American and European markets, after refining it, despite the sanctions.

India has rejected the accusations, citing the increasing purchases as the size of its huge domestic consumption and its vast refining capabilities.

related topics..

Also read..

Leave a Reply