There is no doubt that the recovery of the Chinese economy from the repercussions of the Corona epidemic will provide a strong impetus to global oil and mineral prices in 2023, after the turmoil left by the Russian invasion of Ukraine last year (2022).

Research firm Wood Mackenzie believes – in a report issued Thursday, March 23, 2023 – that China is the largest importer of almost every commodity in the global markets, which means that the pace of growth of the Chinese economy and, accordingly, the demand for commodities mainly determines the trends of oil and commodity prices.

In the research company’s basic case, China’s economy is expected to grow by about 5.5% and 5.1% in 2023 and 2024, respectively, with recovery from the repercussions of the Corona epidemic after nearly 3 years of closure restrictions, compared to 3% last year.

While the high growth scenario indicates an increase in China’s GDP by about 7% and 5.5% in 2023 and 2024, respectively, which is not difficult to achieve, especially since Beijing has a successful record in exceeding growth expectations, according to what was monitored by the Energy Research Unit.

Base case vs elevated scenario

Wood Mackenzie believes that the growth of the Chinese economy by about 5.5% this year (2023), according to the base case scenario, means that the impact of the recovery will be more local, with minor repercussions at the global level.

On the other hand, the growth of China’s economy by about 7% during 2023, according to the high scenario, means significant positive effects in the global economy, with the increasing Chinese demand for materials and capital equipment, which strengthens the energy and mineral markets.

Wood Mackenzie LNG Markets Analyst Massimo D’Odoardo believes that faster-than-expected Chinese growth will reshape commodity prices and supplies in the short term.

In this case, the global economic growth forecast rises to 2.6% in 2023, compared to the base case forecast of 2.2%.

Oil price forecast

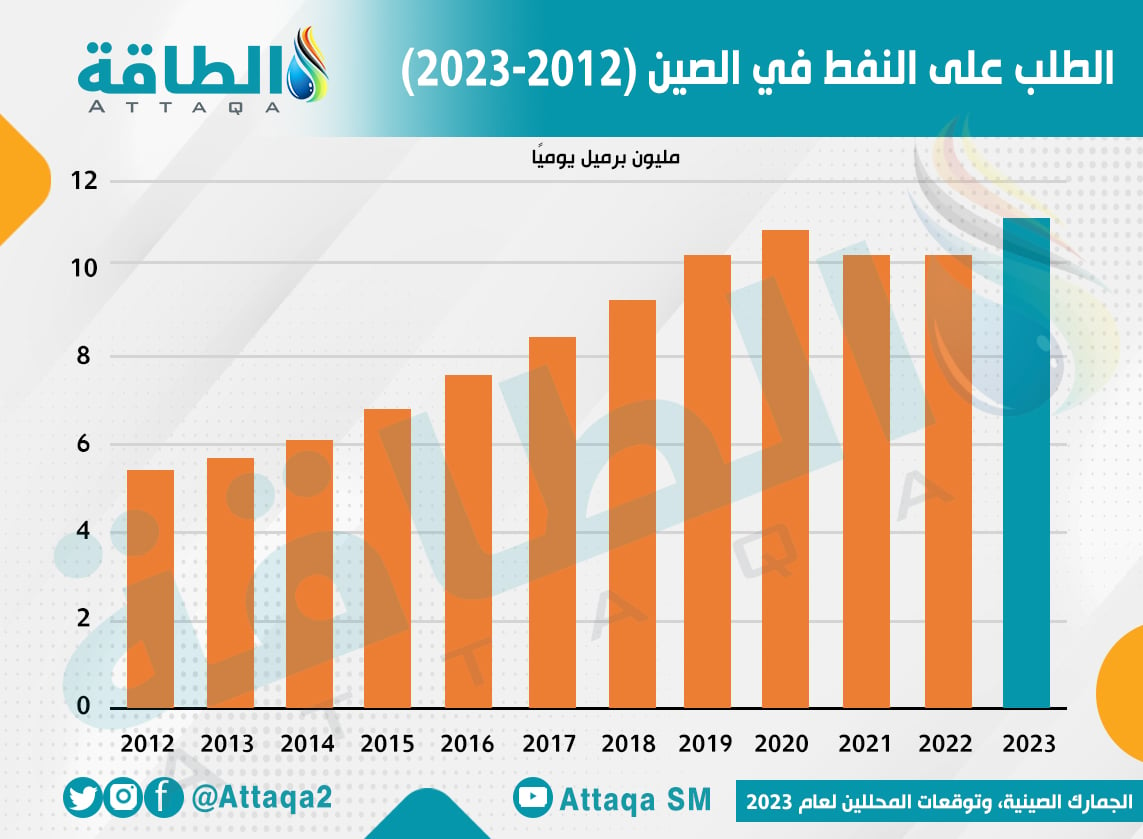

Oil prices are expected to receive support as Chinese economic activity returns to normal, which will drive up demand for oil in 2023, both in the base and high condition.

Wood Mackenzie believes that China may account for one million barrels per day of the total global oil demand growth expected at 2.6 million barrels per day in 2023, according to the report seen by the Energy Research Unit.

This would raise oil prices (Brent crude) to an average of $89.40 per barrel for 2023, compared to less than $80 currently, in the base case scenario.

As for the high growth scenario, the growth in demand for crude in China may reach 1.4 million barrels per day this year, which may push oil prices to rise by 3 to 5 dollars per barrel above the base case estimates.

Growing demand for refined products in China, especially transportation fuels, coupled with higher crude oil prices should support global refinery margins by about $0.5 per barrel, according to Wood Mackenzie.

The following chart monitors oil demand trends in China between 2012 and 2023:

LNG imports

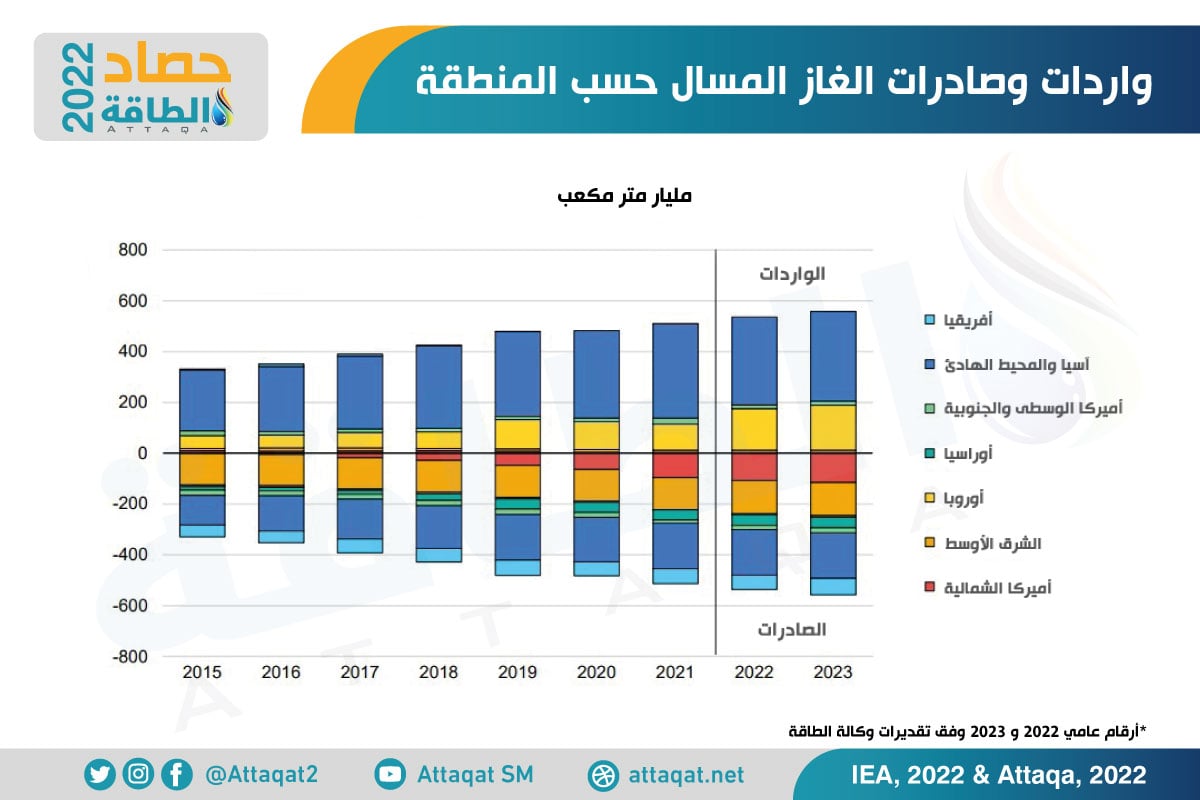

The International Energy Agency has warned that the recovery in Chinese demand will negatively affect European LNG imports, but Wood Mackenzie believes that European supplies are safe for now.

China’s imports of liquefied gas fell by an exceptional 20%, equivalent to 22 billion cubic meters in 2022, which allowed Europe to secure more supplies, to compensate for the decline in Russian pipeline exports.

The gas market continues to suffer from supply shortages and price volatility, but with demand subdued by higher prices and mild weather, the market has proven somewhat resilient in the absence of Russian pipeline exports to Europe.

Wood Mackenzie believes that the rise in Chinese demand for LNG is unlikely to lead to a repeat of the market turmoil in 2022, from higher prices and supply shortages.

Demand for LNG in China is expected to grow by more than 30 billion cubic meters in 2023, as the economy recovers and prices fall, according to the report.

However, an increase in domestic gas production by 14 billion cubic meters, and a rise in Russian pipeline imports by about 7 billion cubic meters will lead to a restriction of Chinese LNG imports at 97 billion cubic meters this year, which represents an increase of only 10 billion cubic meters from last year. 2022, and less than the level recorded in 2021, at approximately 109 billion cubic meters.

The following chart shows LNG imports and exports by region:

Metals markets in 2023

In addition to the impact of the Chinese economy on oil and gas prices, the mineral markets also depend heavily on the growth of activity in China, especially from the industrial and real estate sectors.

In the high growth scenario, it is likely that the main metals markets such as steel, aluminum and copper will be affected, with the increase in Chinese consumption, and this would keep prices high for a longer period, especially steel, with insufficient supplies to meet the high demand.

In the base case, additional supplies over time of the main raw materials for steel – iron ore and coking coal – moderate the price hike.

As for copper and aluminum, demand for them is expected to grow by about 1.6% and 1.3% – in the high scenario – during 2023 and 2024, which reinforces the rise in prices.

related topics..

Also read..

Leave a Reply