Moscow has devised a plan to impose maximum ceilings on Russian oil discounts, in an effort to control the fallout from Western sanctions following its invasion of Ukraine.

The Russian Council of Ministers submitted a bill to the State Duma that limits discounts on Urals crude in the international market, which the government will recognize when imposing taxes on oil producers, according to information seen by the specialized energy platform, quoting the Russian news agency TASS.

Under the bill, the rebate would be limited to $34 a barrel for Brent crude in April, dropping to $31 in May, $28 in June and $25 in July.

The government was debating how to calculate the price of taxable oil in Russia, following the EU import ban and the resulting lack of a reliable price-setting mechanism.

Russian oil revenues decline

Russia is currently using Urals price assessments at the ports of Rotterdam and Augusta in Europe, provided by the commodity price reporting agency Argos, to determine extractive tax, additional income tax, oil export duties and reverse taxes on oil.

Moscow relies on oil and gas income to finance its budget, but it was forced to start selling foreign exchange reserves to cover a deficit that widened to 1.76 trillion rubles ($24.08 billion) in January to secure the cost of the military operation in Ukraine.

And the Russian Ministry of Finance said – quoting preliminary data on February 6 – that oil and gas revenues declined by 46.4%, to reach 426 billion rubles ($ 5.83 billion) in January, compared to the same month last year (2022). , due to the decline in the prices of the Russian Urals blend and the decline in the volumes of natural gas exports.

The ministry also announced – on February 1 – that the average price of the Urals blend reached $49.48 per barrel in January 2023, lower than the $60 ceiling set by Western countries, and down 42% from January 2022.

Russia’s federal budget for 2023 is based on the average price of Urals crude for the year, of $70.10 per barrel.

The following graph – prepared by the Energy Research Unit – shows the volumes of Russian oil exports and oil derivatives during the year 2022:

Reduce Russian oil production

On Friday, February 10, Moscow announced a reduction in Russian oil production by 500,000 barrels per day, or about 5% of production, in March, after the West imposed ceilings on the prices of Russian oil and petroleum products.

Russian Deputy Prime Minister Alexander Novak said – in a statement -: “Starting today, we are selling the entire volume of oil produced, however, as mentioned earlier, we will not sell oil to those who directly or indirectly adhere to the principles of the price ceiling.”

Novak stressed that Russia believes that the price cap mechanism “in selling Russian oil and oil derivatives is an interference in market relations and a continuation of the destructive energy policy of Western countries.”

“In this regard, Russia will voluntarily reduce its production by 500,000 barrels per day in March. This will contribute to restoring market relations,” he added, according to statements seen by the specialized energy platform, quoting Reuters.

Novak’s spokesman said – at a later time – that the cuts will relate to crude oil only without gas condensate, which is a type of light oil.

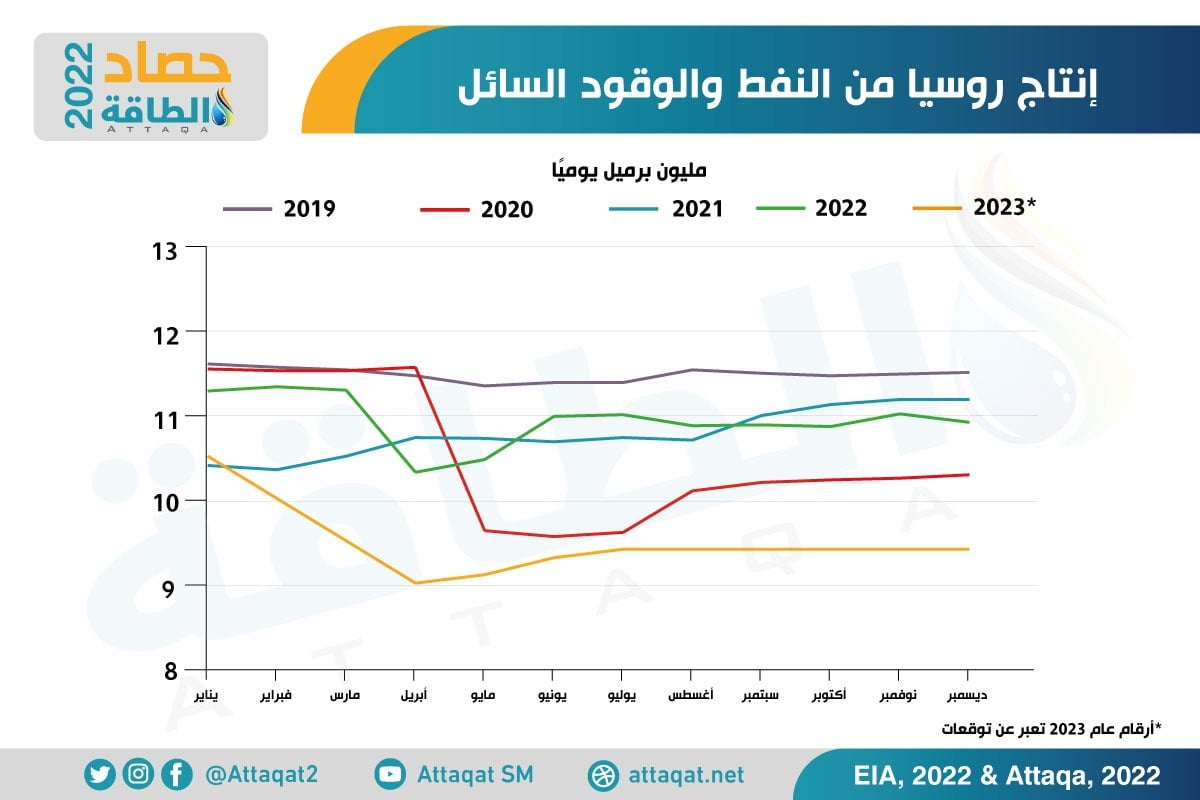

The following graph – prepared by the Energy Research Unit – shows Russia’s production of oil and liquid fuels from 2019 to 2022, with expectations for the current year (2023):

Western sanctions on Russian oil

The Group of 7, the European Union and Australia have agreed to ban the use of Western-provided marine insurance, financing and brokerage of seaborne Russian oil at a price of more than $60 a barrel starting December 5, 2022, as part of Western sanctions against Moscow for its invasion of Ukraine.

The European Union also imposed a ban on purchases of Russian oil derivatives, and set price ceilings, starting from February 5, 2023, at about $60 per barrel for crude oil, $100 for refined derivatives, and $45 for lower-quality products.

In contrast, Russia banned deals involving any application of price cap mechanisms.

In January 2023, Russian President Vladimir Putin signed a decree banning the supply of crude oil and petroleum products to countries that adhere to the cap, starting from February 1 for a period of 5 months.

related topics..

Also read..

Leave a Reply