Shipments of Russian oil pushed Asia’s crude imports to a record high in May 2023, in light of the continued growth of purchases by China and India, which are benefiting from attractive discounts offered by Moscow following Western sanctions imposed on it over its war in Ukraine.

Asia’s oil imports are expected to rise to the highest level in 2023, as 27.73 million barrels per day of crude oil will be unloaded at Asian ports this month, according to Refinitiv Oil Research data.

This represents an increase of 8.6% from 26.39 million barrels per day in April 2023, according to information seen by the specialized energy platform, according to Reuters.

China’s imports of Russian oil

Asia’s oil imports rose thanks to China, which is expected to receive 11.96 million bpd in May, up from 10.96 million bpd in April and just below a 34-month high of 12.37 million bpd in March. .

The strong imports from China come as conventional refinery maintenance runs out and refineries ramp up production to build up stocks ahead of the summer peak demand season.

Chinese refiners benefit from discounts on Russian oil, which Europe and the Group of Seven have embargoed under a series of sanctions in response to Moscow’s invasion of Ukraine.

China’s imports of Russian oil delivered by sea and pipelines are expected to reach 2 million bpd in May, up from 1.74 million bpd in April, according to Refinitiv data.

This means that Russia is once again displacing Saudi Arabia as China’s largest supplier, with imports from the kingdom expected to reach 1.95 million bpd in May, down from 2.07 million bpd in April.

The following graph – prepared by the specialized energy platform – shows Russian oil exports from January 2022 to January 2023:

India’s imports of Russian oil

In a related context, India’s imports of Russian oil rose to 1.97 million barrels per day in May, from 1.68 million barrels per day in April.

This gives Russia a market share of 38.6% of India’s total oil imports of 5.10 million barrels per day in May, which is also the second highest monthly import volume on record after April 2022.

India’s shift to Russian oil, like China’s, has been driven by its cheaper cost and New Delhi’s traditional suppliers in the Middle East sacrificing market share.

India’s imports from Saudi Arabia are expected to reach 570,000 bpd in May, down from 690,000 bpd in April and 850,000 bpd in March.

While imports from Iraq are likely to drop to 890,000 bpd in May, from 900,000 bpd in April and 1.02 million bpd in March.

Asian oil product exports

India’s appetite for crude has been driven by strong domestic fuel consumption, and rising exports of refined fuels such as diesel and petrol.

However, some exports could be at risk in the coming months, as European buyers are said to be wary about buying fuel from India that may have been refined from Russian crude, or partly from Russian oil, according to information seen by the specialist energy platform.

This could lead to some slowdown in demand for refined products in India, which in turn is likely to force another round of realignment of product flows as the oil industry struggles to continue using Russian crude and products.

China’s exports of refined fuels were also strong, rising by 44.3% in the first four months of 2023, compared to the same period last year (2022).

However, these volumes are expected to decline in May 2023, as refineries exhaust export quotas and domestic demand recovers significantly.

Refinitiv expects diesel shipments to decline for the fifth month in a row, falling to less than 200,000 tons (1.46 million barrels), much lower than 2.41 million tons (17.6 million barrels) in December 2022.

However, China’s gasoline exports are expected to rise slightly to between 900,000 tons (6.6 million barrels) and 1.2 million tons (8.8 million barrels) in May, from 820 thousand tons (2.04 million barrels) in April. Nissan, as high refinery utilization leads to motor fuel production outpacing domestic demand growth.

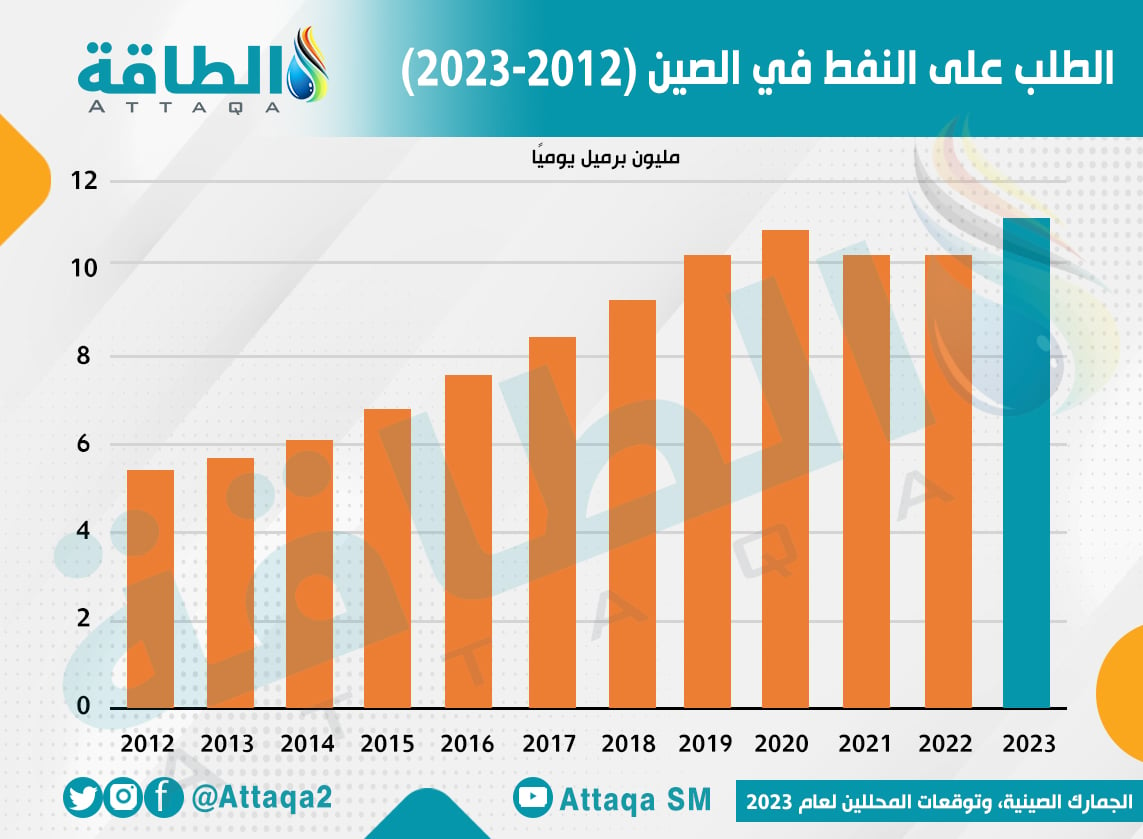

The following graph – prepared by the specialized energy platform – shows the demand for oil in China, in the period from 2012 to 2023:

Russian energy exports to Asia

Russian energy exports have attracted Asian buyers, due to severe heat waves on the continent in recent weeks. Countries scramble to make sure they have enough coal, gas and fuel oil to keep the electricity going.

Russian exports to Asia of thermal coal and natural gas – the two most used fuels for electricity generation – have grown significantly during the current year (2023), according to figures issued by data analysis company Kepler.

Russian coal export volumes jumped sharply to 7.46 million tons in April 2023, about a third higher year on year.

Russian LNG shipments to Asia have also seen a similar growth in recent months, after prices retreated from record highs that poor countries could not afford.

Asian imports of Russian fuel oil – the dirtiest and cheapest alternative for electricity generation – hit the highest two months on record in March and April, according to Kpler data.

related topics..

Also read..

Leave a Reply